Two of the most commonly used documents in the small business world are invoices and statements.

Though both of these documents are used to notify a customer about how much money they owe, they are used for different purposes, which we’ll explain shortly.

What Is an Invoice?

An invoice, also known as a sales invoice, is a document sent to a buyer that provides details about a specific transaction.

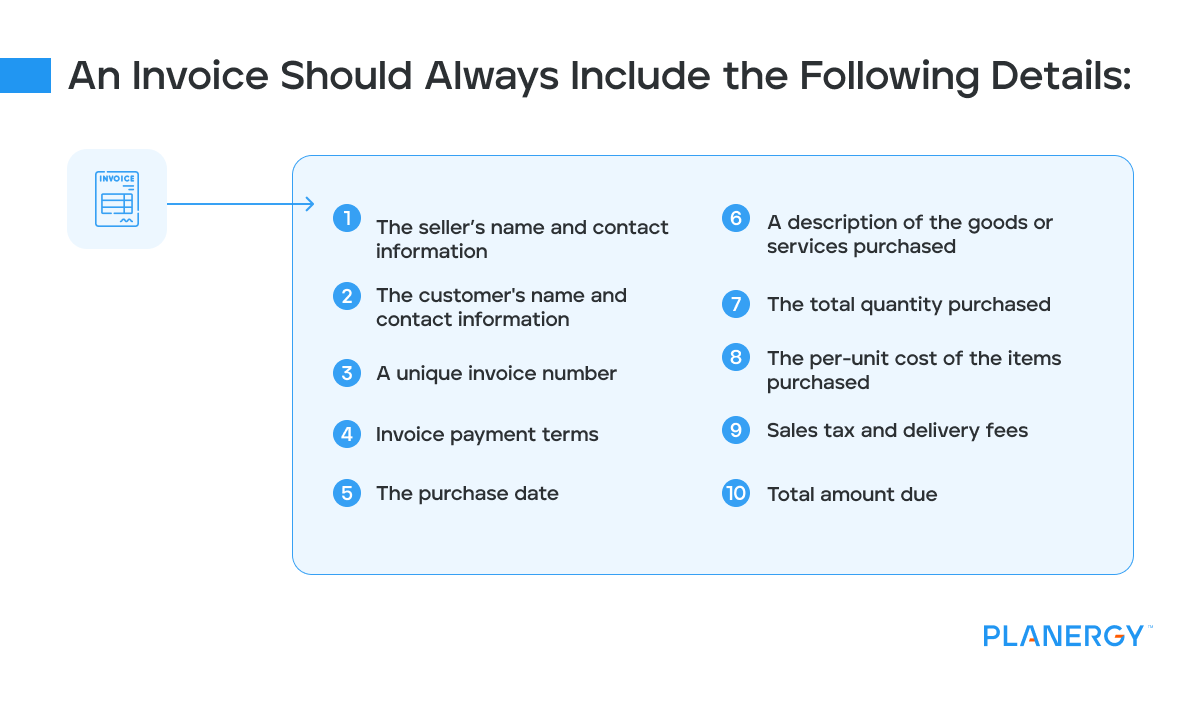

An invoice should always include the following details:

The Seller’s Name and Contact Information

To ensure legitimacy, an invoice should always include the seller’s complete name, address, phone number, and email address.

This is a way to verify that the invoice is legitimate.

The Customer’s Name and Contact Information

An invoice should always include the buyer’s contact information.

In many cases, a specific customer contact will be included on the invoice.

A Unique Invoice Number

Every invoice that is created must include a unique invoice number.

Having a unique invoice number benefits both the buyer and the seller, preventing both duplicate invoice creation and duplicate payments.

Invoice Payment Terms

One of the more important items on an invoice is the payment terms, which serve as an informal contract between the buyer and the seller and should include the payment due date.

The Purchase Date

The purchase date is an important part of an invoice, working as an acknowledgment of when the product or service was purchased.

The purchase date is not the same as the invoice date.

A Description of the Goods or Services Purchased

An invoice always provides detailed information on exactly what was purchased.

The Total Quantity Purchased

If a customer purchases multiple items or multiple quantities of an item, it must be listed as such on the invoice.

The Per-Unit Cost of the Items Purchased

The per-unit cost is an important component of an invoice since it provides the seller with details on exactly how much each unit costs.

Sales Tax and Delivery Fees

If the purchase includes sales tax or a delivery fee, it should be at the bottom of the invoice after the subtotal.

Total Amount Due

The final total of the invoice includes the product or service total along with tax and delivery fees.

It may be helpful to include accepted payment methods on the invoice as well.

To avoid payment delays, an invoice should always be sent promptly once a purchase has been made.

Once an invoice has been created, the total due is posted in the seller’s accounts receivable account until payment has been made.

For buyers, the invoice is recorded in their accounts payable account, where it will remain until it’s paid.

What Is a Statement?

A statement provides a customer or client with their balance due and is typically sent at regular intervals, usually at the end of the month.

A billing statement provides customers with an itemized list of outstanding invoices and other account activity including any payments that have been made on the account.

Statements usually include activity for a specific month, though the statement period can display activity for more than one month if necessary.

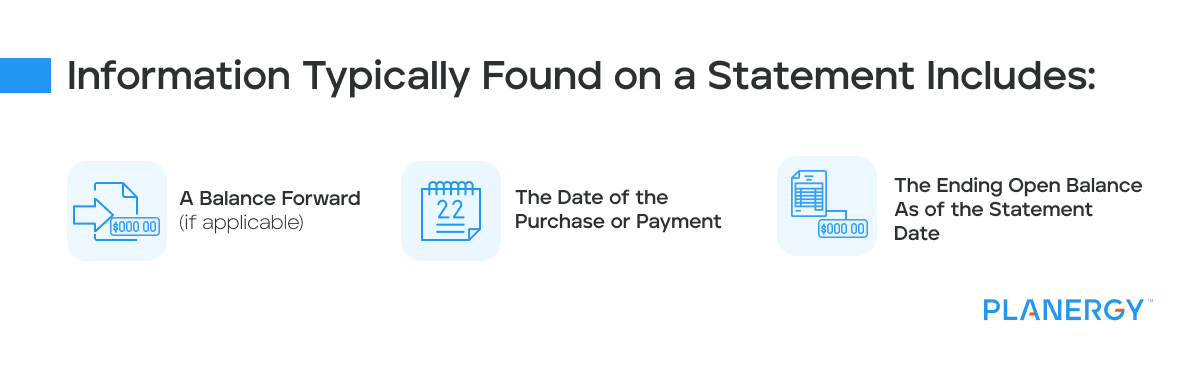

Information typically found on a statement includes:

A Balance Forward (if applicable) – If you’re running a statement for June, and your customer still has an open balance from May, that will need to be included on the statement.

The Date of the Purchase or Payment – Instead of providing a detailed view of each purchase, the invoice summarizes the purchase by providing the date the products or services were purchased, along with the balance due.

If a payment is included on the statement, the date the payment was received and the amount of the payment will be included on the invoice.

The Ending Open Balance As of the Statement Date – A statement reflects a customer’s total amount due by factoring in any open balances from the previous month, along with any payments and charges incurred for the current month.

Statements are helpful for customers that make multiple purchases and payments throughout the month.

But unlike an invoice, which is routed to the accounts payable department for payment, a statement merely provides a customer’s current account status for informational purposes and should never be recorded in your general ledger.

What are the Similarities Between an Invoice and a Statement?

Both invoices and statements provide details on how much a customer or client owes a business for goods and services purchased.

While an invoice provides details on one specific purchase, a statement provides details on all purchases that have been made.

Key Differences Between an Invoice and a Statement

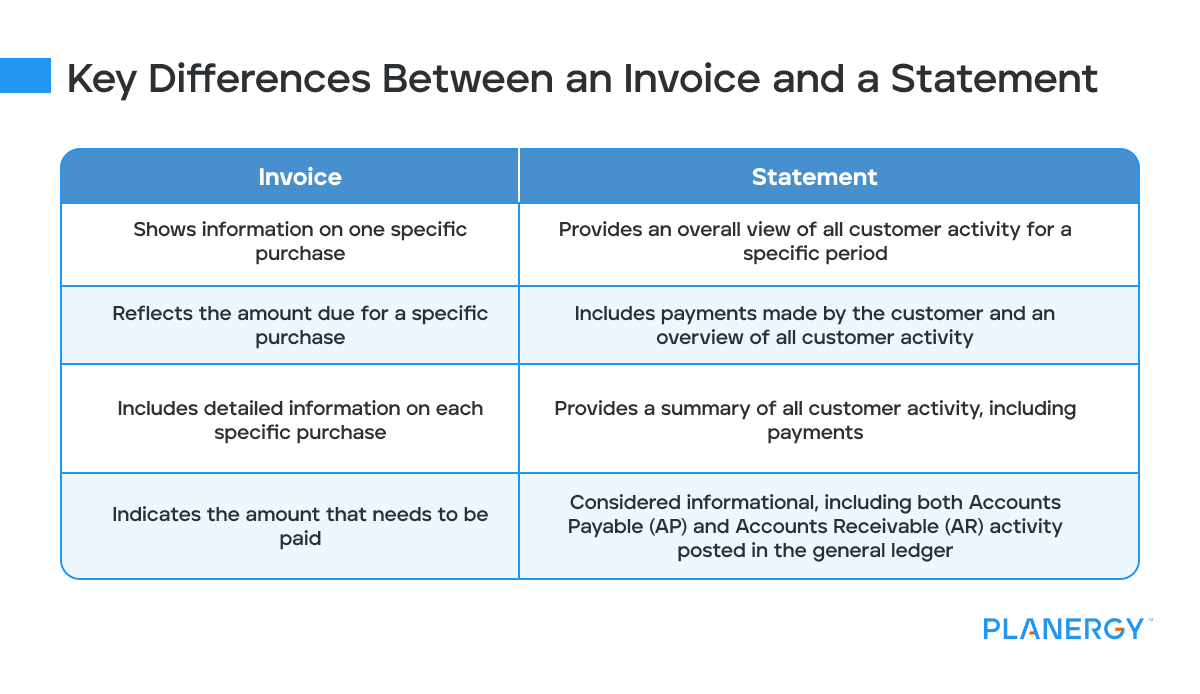

Though both invoices and statements provide customers and clients with the total amount they owe, there are key differences between the two.

Invoices only show information on one specific purchase while a statement provides an overall view of all customer activity for a specific period.

A statement includes payments made by the customer or client while an invoice typically shows only reflects the amount that is due.

Invoices include more detail on each specific purchase than a statement, which provides an overview of all customer activity including payments as of the statement date.

Statements are considered informational and include both AP and AR activity that has been posted in the general ledger.

How to Decide Whether to Send an Invoice or a Statement

Many businesses routinely send their customers both invoices and statements.

An invoice should be sent to a customer or client immediately upon the purchase of goods and/or services.

In turn, a statement is sent at month end to provide a customer or client with a detailed record of all of their transactions.

If your customers typically make a single purchase, there’s no need to send a statement.

However, for customers that have multiple transactions in a single month, a statement is a good idea.

Let’s look at a few situations to determine if you should send an invoice, a statement, or both.

When To Send an Invoice

Jeff owns a computer store. A customer recently purchased 10 laptops for a total of $10,000.

His customer has Net 30 credit terms, which means that they will have to pay the $10,000 within 30 days of the invoice date.

Jeff’s order department ships the laptops and the accounting team creates and sends an invoice for the laptops immediately after the laptops have been shipped.

There is no need to send a statement, as the customer has only purchased the 10 laptops and nothing else.

When To Send a Statement

Another one of Jeff’s customers has an outstanding balance of $900 on a purchase that was made May 4 and is due on June 3.

The same customer than purchases a printer on May 25 for $500, with that payment due on June 24.

Because there are now two unpaid invoices open as of May 31, Jeff’s customer would benefit from having a statement sent to them so they could view the total amount due.

When To Send Both an Invoice and a Statement

Jeff has a third customer who had an opening balance on June 1 of $1,100. The customer purchased a computer from Jeff for $750 on June 10th, with payment due on July 9.

Jeff sent an invoice to the customer immediately upon purchase.

On June 21, the customer paid their $1,100 balance.

It would be a good idea to send the customer an invoice at the end of June that includes their opening balance, the new purchase that was made on June 10th, and the payment that was made on June 21.

This allows the customer to see that their payment has been applied properly and also serves as a reminder that the $750 invoice will be due soon.

Does a Customer Make a Payment from a Statement?

A statement serves as an informational document only.

Businesses should never request payment from a statement since its primary purpose is to provide customers and clients with a summary of their purchasing and payment activity as of a certain date.

To avoid the possibility of a duplicate payment, buyers should only pay from an invoice, not from a statement.

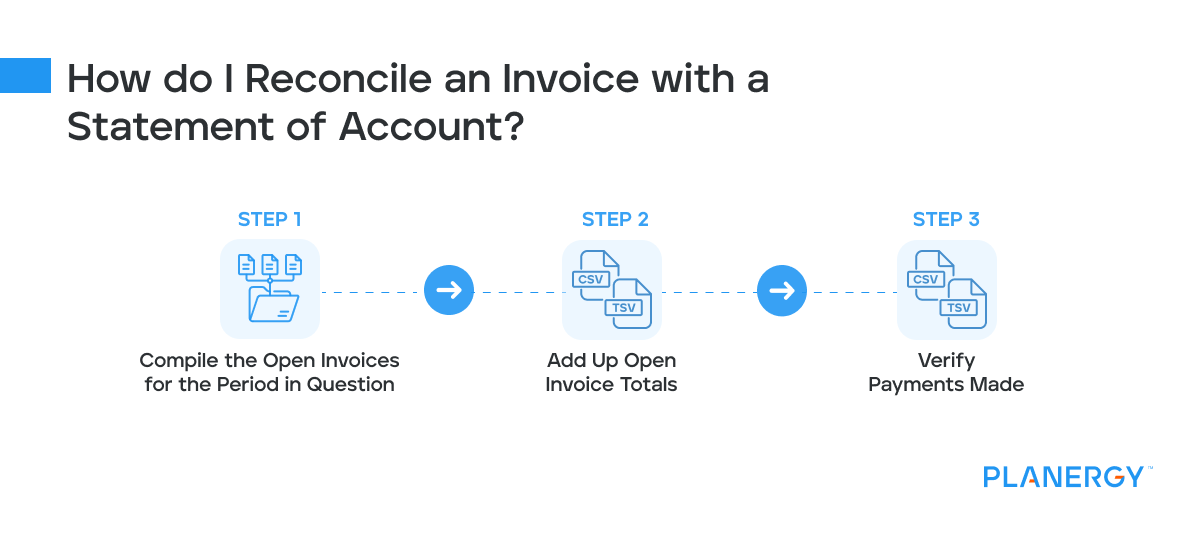

How do I Reconcile an Invoice with a Statement of Account?

If your business routinely receives both invoices and statements from your vendors and suppliers, it’s helpful to reconcile them regularly to ensure that ending balances on the statement are in line with your invoices.

To reconcile invoices to a statement, use the following steps:

Compile the Open Invoices for the Period in Question

For example, if you just received the June statement that includes two open invoices, you’ll need to have those invoices handy.

Add Up Open Invoice Totals

If you receive a statement from a seller, you’ll want to add up open invoice totals to make sure that they coincide with the open invoices shown on the statement.

If they don’t match, check to see if a payment was sent after the statement was issued.

Verify Payments Made

Both buyers and sellers will need to verify that any payments issued or received are included on the statement.

For buyers, if a payment was made after the statement was issued or mailed, it’s likely that it just hasn’t been posted yet.

A quick call or email can verify that the payment was received.

On the seller’s side, all payments received must be posted before statements are issued to avoid phone calls and emails from customers asking if payment was received.

Final Thoughts on Invoices and Statements

For business owners new to accounting, it’s easy to confuse invoices and statements. Keeping the following in mind can help clear up some of the confusion.

- An invoice is sent immediately after a purchase

- A statement is for informational purposes only

- An invoice provides detailed information for a single purchase

- A statement provides a summary of transactions for a specific period of time

An important part of the bookkeeping process is understanding the differences and similarities between invoices and statements.

If you’re looking for an easier way to invoice, consider using automation on an invoicing software application that simplifies the entire process.