An Example of How To Use the Accounting Equation

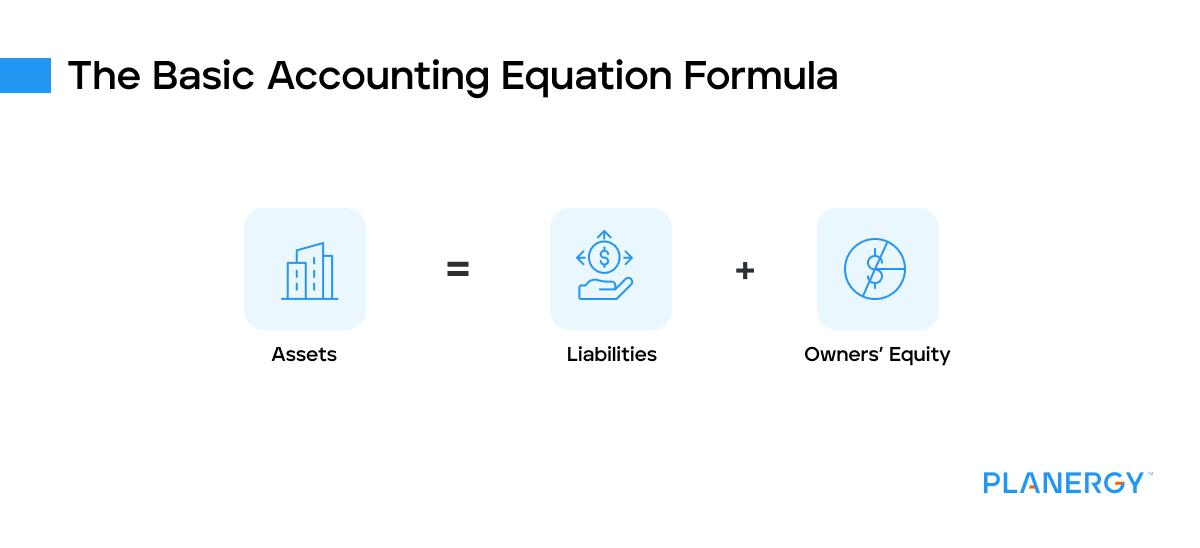

The accounting equation is used by businesses to ensure that their balance sheet remains in balance.

Debits are always posted on the left side of the account, while credits are posted to the right side of the account.

Remember when you debit an asset account, you’re increasing the balance of the account.

Likewise, when you credit a liability or equity account, you’re increasing the balance.

A credit to an asset account would decrease the balance, while a debit to a liability or equity account would decrease the balance.

Any transaction you post into your general ledger will directly impact your balance sheet in some fashion. For example, Robert recently opened a hardware store.

When preparing to open the business, Robert made the following transactions:

- Contributed cash of $50,000 to start the business

- Purchased bins and shelves for the store on credit totaling $2,000

- Purchased hardware items for the store on credit totaling $21,000

- Obtained a small business loan for $10,000

Each transaction that Robert made directly impacted his initial balance sheet and the accounting equation.

For his first transaction, Robert deposited $50,000 to initially fund the business.

This initial transaction impacted the cash account under assets and the owners’ equity account.

To record the journal entry into the general ledger, Robert would debit or increase his cash account, which is an asset account, and credit or increase his owners’ equity account, which is an equity account.

The impact on Robert’s balance sheet would be:

$50,000 (assets) = $0 (liabilities) + $50,000 (owners’ equity).

Robert then purchased $2,000 worth of bins and shelves for the store on credit.

This transaction impacted the furniture and fixtures account, which is a fixed asset, and his accounts payable account, which is a liability.

To record this transaction, Robert would debit or increase his furniture and fixtures account which is an asset account, and credit or increase his accounts payable account, which is a liability account.

The impact on Robert’s balance sheet would be:

$2,000 (assets) = $2,000 (liabilities) + $0 (owners’ equity)

Next, Robert purchased inventory for $21,000 to stock his store. He purchased the inventory on credit.

This transaction impacted his inventory account, which is an asset, and increased his accounts payable account, which is a liability.

To record this transaction, Robert would debit or increase his inventory account which is an asset account, and credit or increase his accounts payable account, which is a liability account.

The impact on the balance sheet is:

$21,000 (assets) = $21,000 (liabilities) + $0 (owners’ equity)

Finally, Robert realized that he needed additional funds to open the store, so he obtained a business loan for $10,000, which would need to be paid off in six months.

To record the transaction, Robert would debit or increase his cash account which is an asset, and credit or increase his short-term loan account, which is a liability account.

The balance sheet equation would be reflected as follows:

$10,000 (assets)= $10,000 (liabilities) + $0 (owners’ equity)

| Assets |

|---|

| Current Assets | |

| Cash | $60,000 |

| Inventory | $21,000 |

| Total Current Assets | $81,000 |

| Fixed Assets | |

| Furniture and Fixtures | $2,000 |

| Total Fixed Assets | $2,000 |

| Total Assets | $83,000 |

| Liabilities and Equity | |

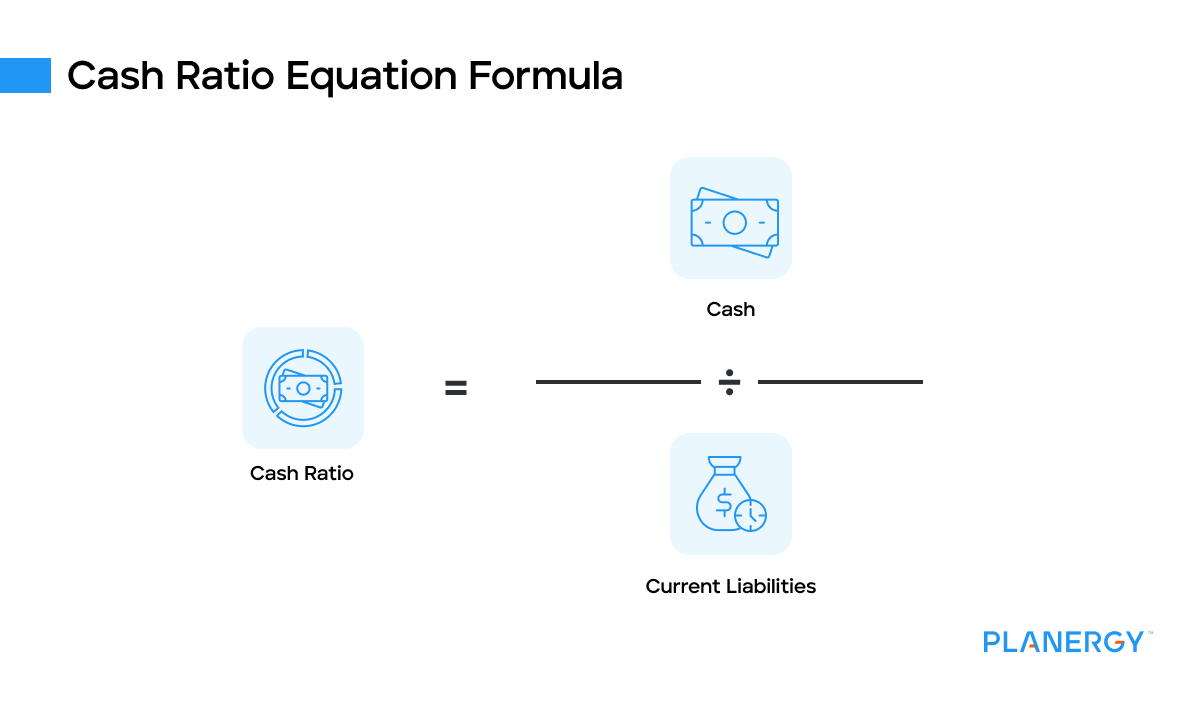

| Current Liabilities | |

| Accounts Payable | $23,000 |

| Short-Term Loan | $10,000 |

| Total Current Liabilities | $33,000 |

| Total Liabilities | $33,000 |

| Equity | |

| Owners’ Deposits | $50,000 |

| Total Equity | $50,000 |

| Total Liabilities and Equity | $83,000 |

After Robert has entered all of his initial business transactions into the general ledger, he runs a balance sheet which that all accounts are in balance.

$83,000 (Total Assets) = $33,000 (Total Liabilities) + $50,000 (Owners’ Equity)

What will happen if the accounting equation is not balanced?

If Robert had posted any of the above transactions incorrectly, his balance sheet would not have been balanced.

For instance, if he had posted his $50,000 into his cash account but had not completed the transaction by posting the $50,000 in the owners’ equity account, the balance sheet would not be in balance.

Posting only half of a transaction is more likely if you’re using a spreadsheet application to record your accounting transactions.

If you’re using an accounting software application, the program will send a warning if there is not a debit and credit included in the transaction.

However, even accounting software will not prevent other common issues such as posting transactions to the wrong account or for the wrong amount.