What Is Paperless Invoicing?

Paperless invoice processing is a streamlined accounts payable process designed to replace manual invoice approvals and check runs.

In a manual AP environment, staff members spend much of their time making copies of invoices, matching invoices to purchase orders and shipping receipts, and verifying the invoice, and that’s only the first step.

Once the first step is completed, you then have to route the matched, authenticated documents to other staff members for approval, where the invoice is frequently misplaced or lost altogether. Even if the invoice isn’t lost, it can remain on an approvers desk for days, creating the very real likelihood of a late payment, and a very unhappy vendor or supplier.

Once the invoice is finally returned, the AP team needs to code the invoice to the appropriate GL account, and enter it into the system. But you’re not done yet, since payment isn’t always immediate, meaning that a supervisor again will need to determine what invoices to pay.

Once that’s done, AP will process the checks in a check run, attach the check stub to the invoice and purchase order and then file the document.

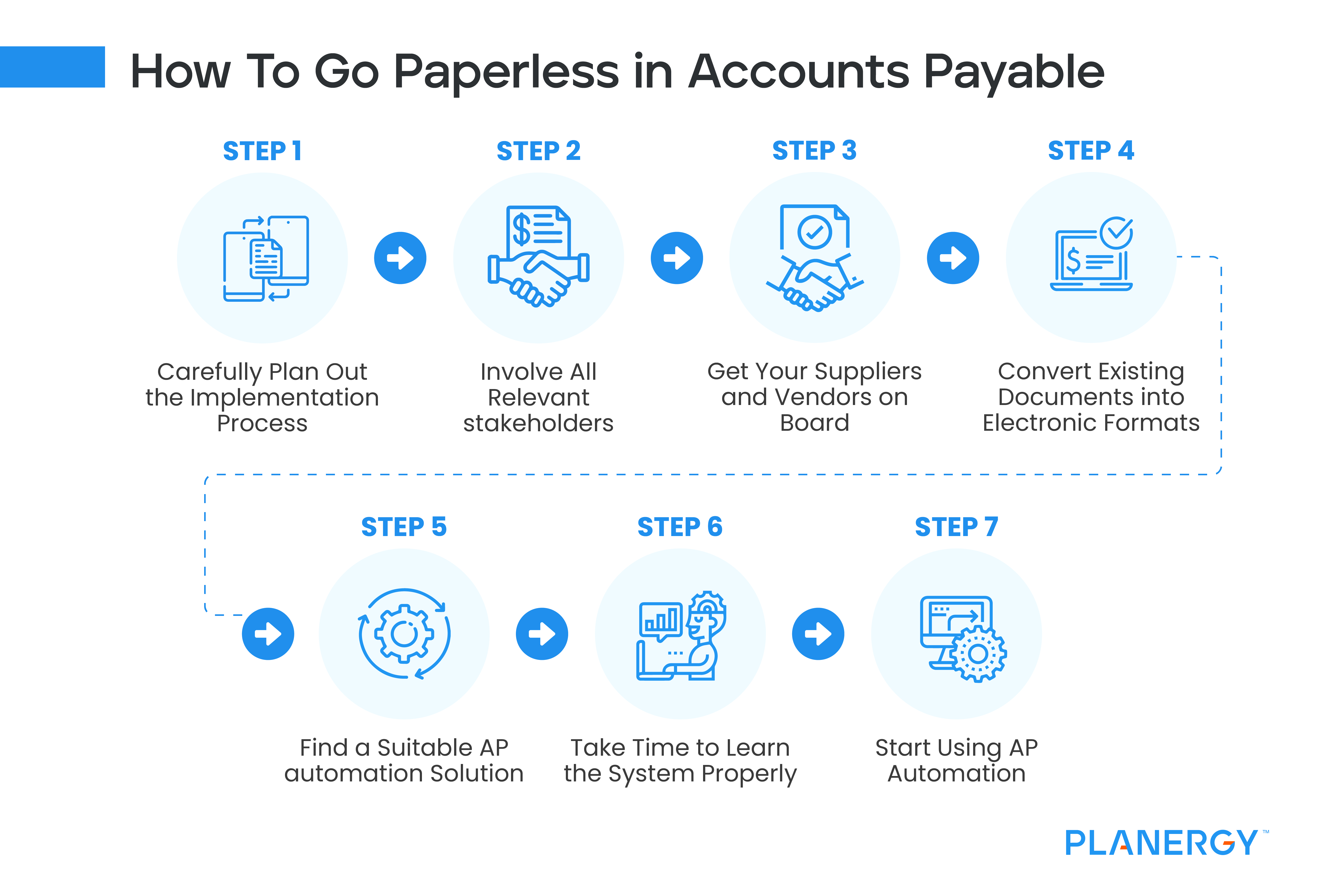

Paperless invoicing eliminates much of that process by using specialty software to capture invoices as they are electronically received via email or fax.

The software then uses optical character recognition, or OCR, and AI to read the information in the invoice, where it will be checked for accuracy.

The next step is three-way matching, where a purchase order if there is one, is matched with the invoice and the shipping document. The invoice is then sent electronically to the approvers. If more than one approver is needed, it will be automatically routed to the appropriate approvers in the order you specify.

Once approved, the invoice is ready to be paid via your accounting software application, where a check can be processed, or better yet, the invoice can be paid electronically.

Finally, all documents are digitized and stored electronically, for easy access.