From the initial purchase order to vendor and supplier payment, it’s important that AP is managed properly from the start. Implementing the proper AP system will mean fewer errors to correct, fewer penalties that you’ll have to pay, and a strong, healthy relationship with your vendors and suppliers.

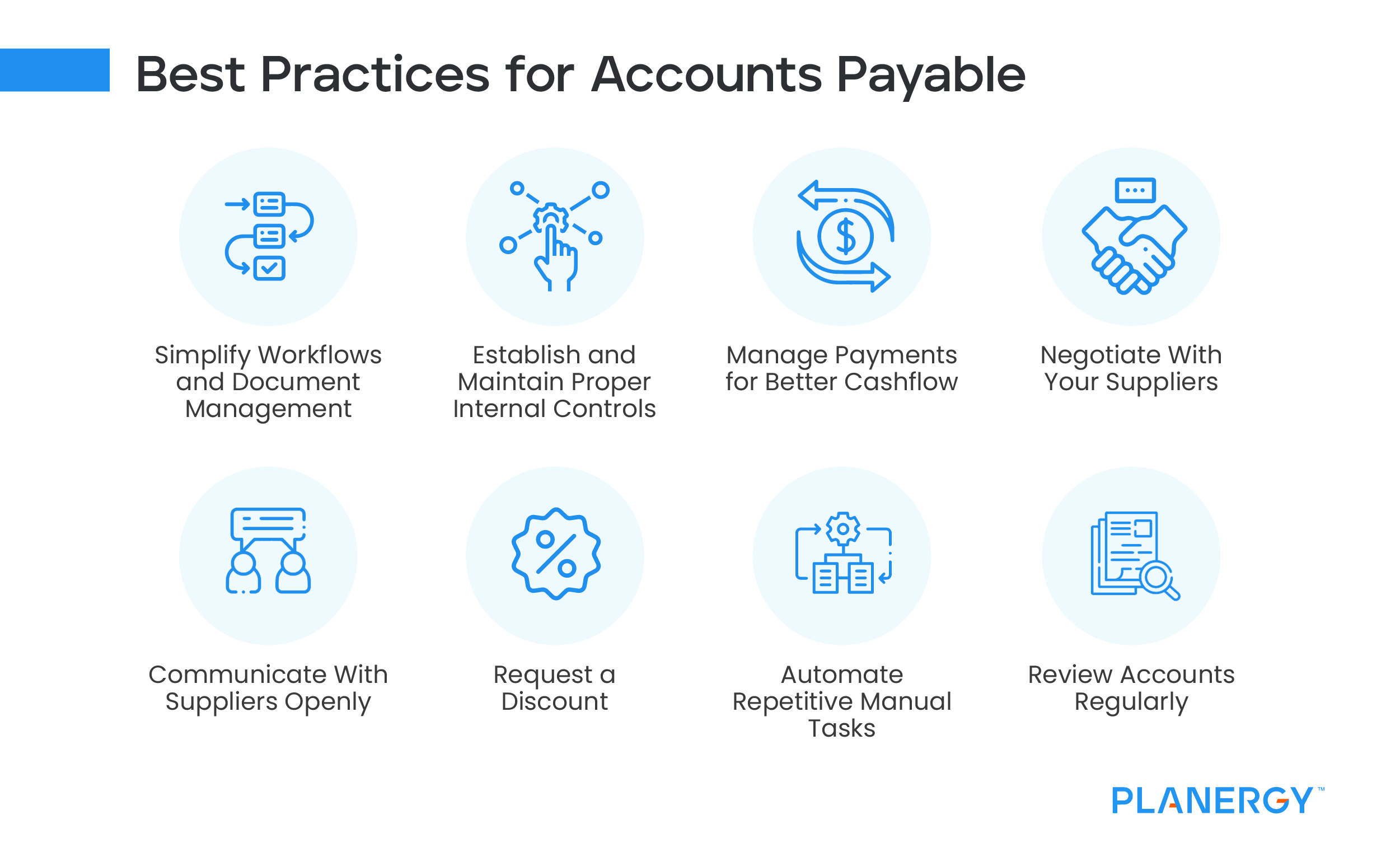

Simplify Workflows and Document Management

Accounts payable best practices should always include having the proper systems in place, starting with AP automation software .

If you have a growing business and a busy AP department, you should also consider implementing Procure to Pay software that can be used in conjunction with your accounting software to provide a seamless AP solution.

Establish and Maintain the Proper Internal Controls

The proper internal controls for accounts payable include everything from reviewing reports for duplicate invoices to restricting system access to certain individuals.

These controls should begin with a clear separation of duties so that AP tasks are not exclusively handled by a single employee. A three-way match for all invoices should also be required.

It’s also important a manager or supervisor approve all new vendors added to the system, and multiple staff members should be available to handle the payment process, with one person processing invoices and a second staff member approving payment.

Manage Payments for Better Cashflow

Immediate payment isn’t always the best. Instead of paying a bill immediately upon receipt, take advantage of the thirty to sixty-day window you have at your disposal and pay invoices when they’re due.

While the idea of having no bills may be appealing, the reality is that once you’re in business, you’re always going to have bills. Paying them when they’re due makes good sense and helps you preserve your cash flow.

Negotiate With Your Suppliers

Chances are your vendors and suppliers value your business more than they value a specific due date. If your current payment terms aren’t working for you, don’t hesitate to pick up the phone or drop your vendor rep an email requesting different terms.

If you always pay your bills on time and have a good vendor relationship, chances are good that they will meet you halfway.

Communicate With Suppliers Openly

Part of maintaining a good relationship with your vendors is to keep the lines of communication open. That means that if you run into financial difficulties and know you’ll be a few days late getting their payment out, let them know.

Letting them know in advance instead of silently ignoring the invoice due date goes a long way towards making sure you don’t damage a relationship that you worked so hard to create.

Request a Discount

Again, if you have a good relationship with your vendors and suppliers, why not ask them for a discount? This can be particularly useful if you order a lot of products from one particular vendor or supplier. It certainly doesn’t hurt to ask, and if they refuse, it may give you the impetus to look at other vendors.

Automate Repetitive Manual Tasks

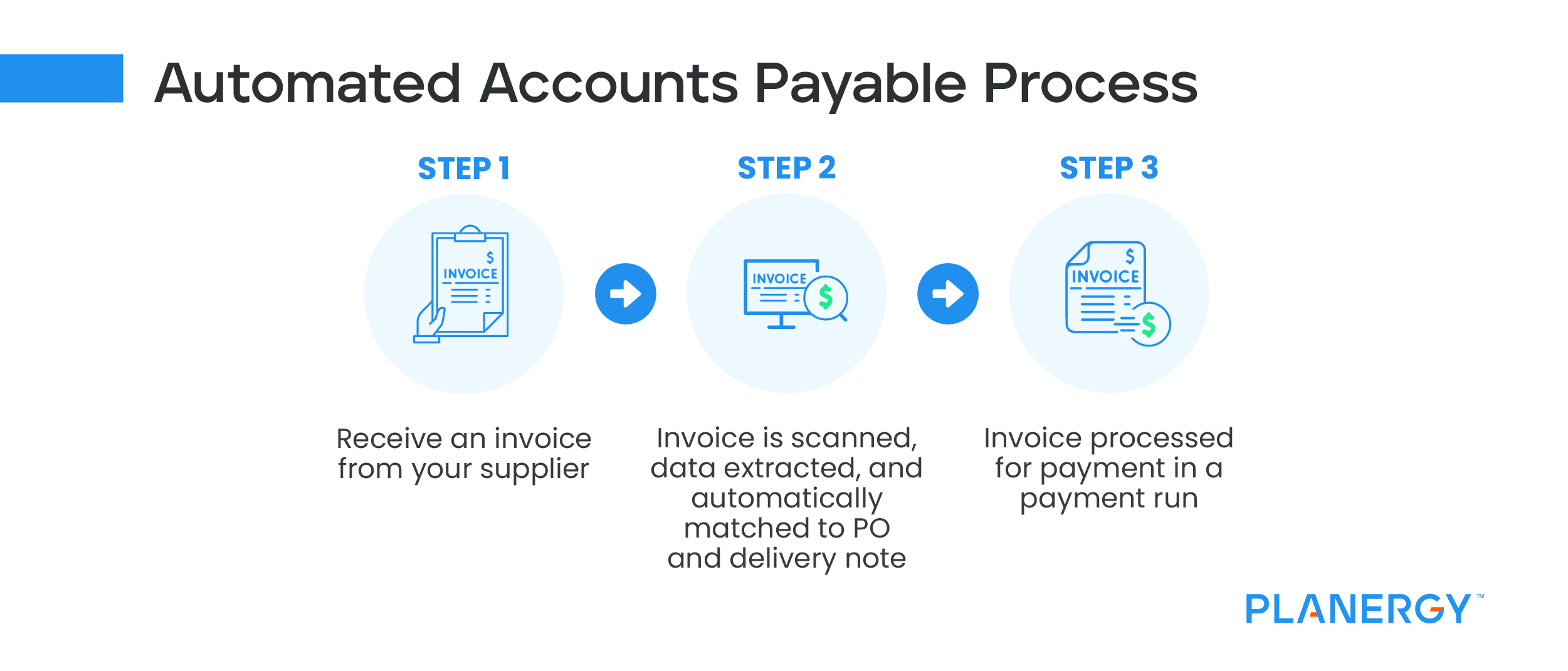

There are a lot of products out there designed to simplify the AP process. From OCR readers to AI automation applications that reduce bottlenecks and cut manual processes in half, making the move to a more automated system can save you both time and money.

These systems may sound intimidating, but with a little time spent upfront learning the ins and outs, they will save you a tremendous amount of time. PLANERGY uses OCR and AI to automate 3-way matching.

Continue To Review Accounts Regularly

Automation does not mean that you shouldn’t take the time to review and reconcile accounts regularly. Mistakes can still happen and the quicker those mistakes are caught, the less harm they’ll do to your business.

Regularly reviewing accounts can also cut down on fraud and can help you stay up to date on current cash flow. Regular accounts payable audits will ensure that things are running smoothly.