Why Do We Do a Bank Reconciliation?

The purpose of the bank reconciliation is to account for the differences in your financial records.

Every active checking account or other business account your business currently has should be reconciled at the end of the month.

For a variety of reasons, the balance on your bank statement will rarely match your book balance or general ledger balance.

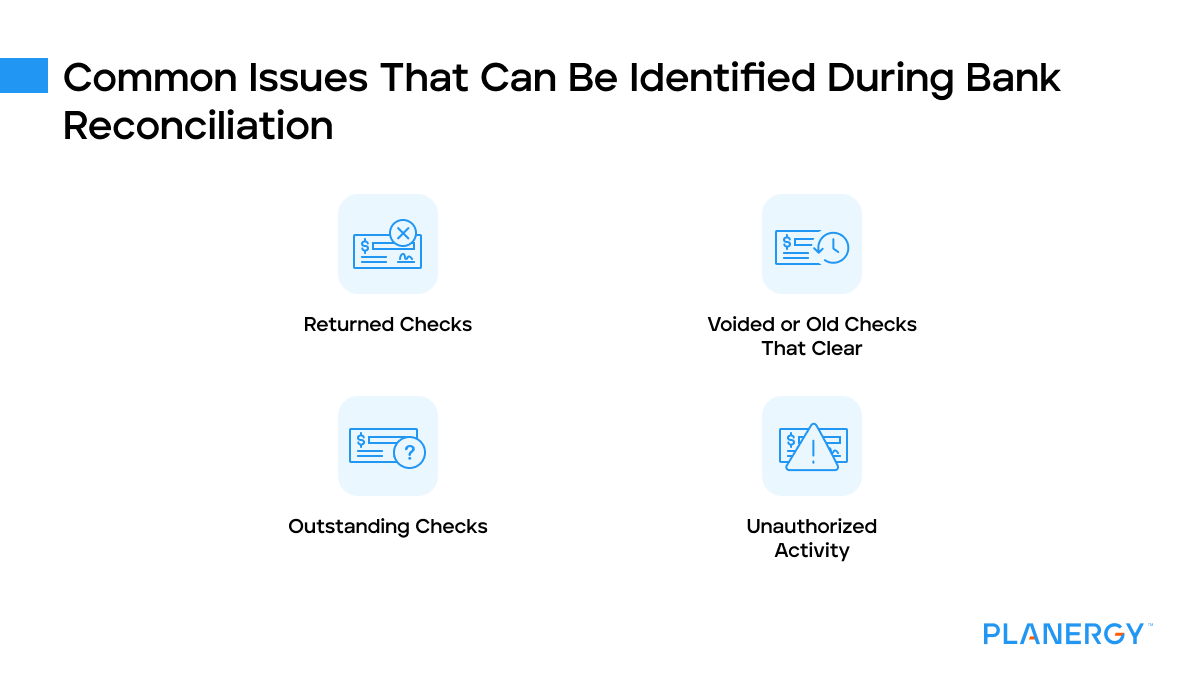

Your bank statement balance may be overstated since it doesn’t include any outstanding checks that have not yet been cashed.

On the other hand, your general ledger account will not reflect bank fees or other administrative charges, or any returned checks.

It may also not reflect deposits made into your account electronically that have not yet been accounted for.

Aside from having your bank account and general ledger account balance match, there are other reasons why a bank reconciliation should be completed regularly.

The reconciliation process also helps spot potential fraud or bank errors.

Let’s say that you wrote a check for $50 to a vendor, but the check was later altered and cleared by the bank for $500.

The only way you may even know about the fraud is by completing a bank reconciliation.

Completing a bank reconciliation also helps you keep track of any bank service fees or interest income that appears on the statement, allowing you to address them if they’ve been applied in error.

A reconciliation can also assist with spotting possible errors reflected in the general ledger or on the bank statement.

For instance, you may have written a check to the plumber who was in last week to fix a leaky faucet and failed to record it in your accounting software application. Or your bank may have posted a check to your account in error.

Again, the only way to find out about the error or omission is to complete a bank reconciliation.

Finally, completing a bank reconciliation regularly can help make audits an easier process, since all banking and general ledger activity has already been reviewed for accuracy.