Budgeting is a vital aspect of financial management that helps businesses allocate resources effectively, control costs, and achieve their financial goals.

In this article, we will discuss the typical steps involved in the budgeting process, the challenges of forecasting, best practices for effective business budgeting.

We will also look at how spend management software, like PLANERGY, can help keep track of expenses and control spending within budget limits.

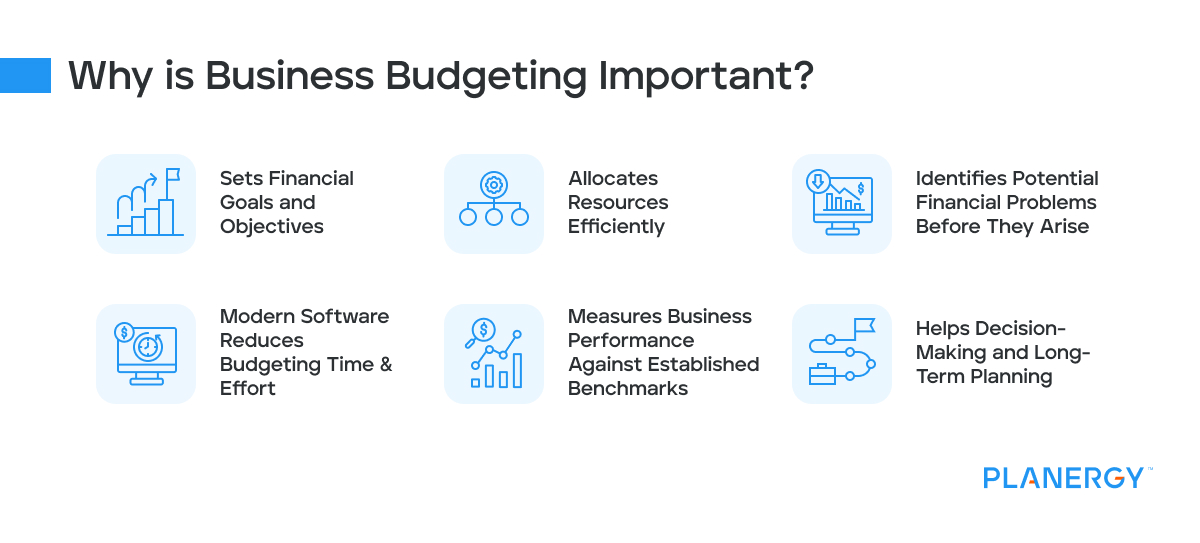

Why is Business Budgeting Important?

Business budgeting plays a crucial role in the financial success of a company. Regardless of size, all companies must have an annual budget for every fiscal year.

Larger companies may have a budget committee in charge of creating multiple types of budgets, including operating budgets and departmental budgets.

The end goal should be a detailed budget that covers everything you expect to spend, plus some excess for discretionary spending.

Budgeting should be part of regular financial planning. As you make budget decisions, consider:

- Available funds

- Capital expenditures and operating expenses, including variable and fixed costs

- Plans for the next fiscal year

Use documents such as your:

- Income statement

- Cash flow statement

- Utility bills

- Payroll documents

These documents will help you develop your master budget. Use your business plan as a guide if it’s your first year in business.

If you’ve been in business for a while, you can use information from the prior year to help you set up the budget.

This is the case unless you are using a zero based budgeting approach.

Sets Financial Goals and Objectives

A well-prepared budget serves as a roadmap for your business’s financial growth. By setting clear financial targets, you can align your business strategies with your desired outcomes, such as increased revenue, reduced expenses, or higher profitability.

Budgeting also helps you prioritize investments and allocate resources to achieve these objectives effectively.

Allocates Resources Efficiently

Business budgeting lets you analyze your company’s financial needs and distribute resources accordingly.

This ensures that each department or project receives adequate funding, vital for smooth operations and achieving your business goals.

Efficient resource allocation also helps you avoid overspending and maintain a healthy cash flow.

Identifies Potential Financial Problems Before They Arise

Regular budgeting lets you spot financial issues early on, such as declining sales, rising costs, or cash flow shortages.

By identifying these problems in advance, you can take proactive measures to address them, such as cutting unnecessary expenses, renegotiating contracts, or seeking additional funding.

This ensures that your business remains financially healthy and avoids costly issues down the line.

Modern Software Reduces Budgeting Time & Effort

Many businesses still rely on outdated, manual budgeting methods, such as spreadsheets or pen and paper.

This can be time-consuming and error-prone, leading to inaccuracies in financial forecasting. By using modern budgeting software, businesses can dramatically reduce the time and effort required to generate accurate budgets.

Accurate real-time tracking and reporting on budget vs actual expenditure can avoid overspends and gives visibility of underspends so budgets can be adjusted or reallocated as needed.

Business budgeting software automates many of the manual processes, allowing you to quickly develop comprehensive financial plans without sacrificing accuracy or detail.

This can provide peace of mind that your business’ finances are well-managed and help enable more informed decision making, and easier financial reporting.

Measures Business Performance Against Established Benchmarks

A budget is a benchmark against which you can compare your financial performance. This enables you to evaluate your company’s progress toward its financial goals and identify areas that need improvement.

Regularly reviewing your budget and adjusting it based on your business’s performance helps you stay on track and make informed decisions.

Helps Decision-Making and Long-Term Planning

Budgeting provides valuable insights into your business’s financial health and future prospects. These insights are essential for making strategic decisions, such as expanding into new markets, launching new products, or acquiring other businesses.

Additionally, a well-structured budget can help you plan for long-term growth by identifying opportunities for cost reduction, revenue generation, and investment.

No matter what your budget looks like, set aside some funds to account for unexpected expenses or overages.

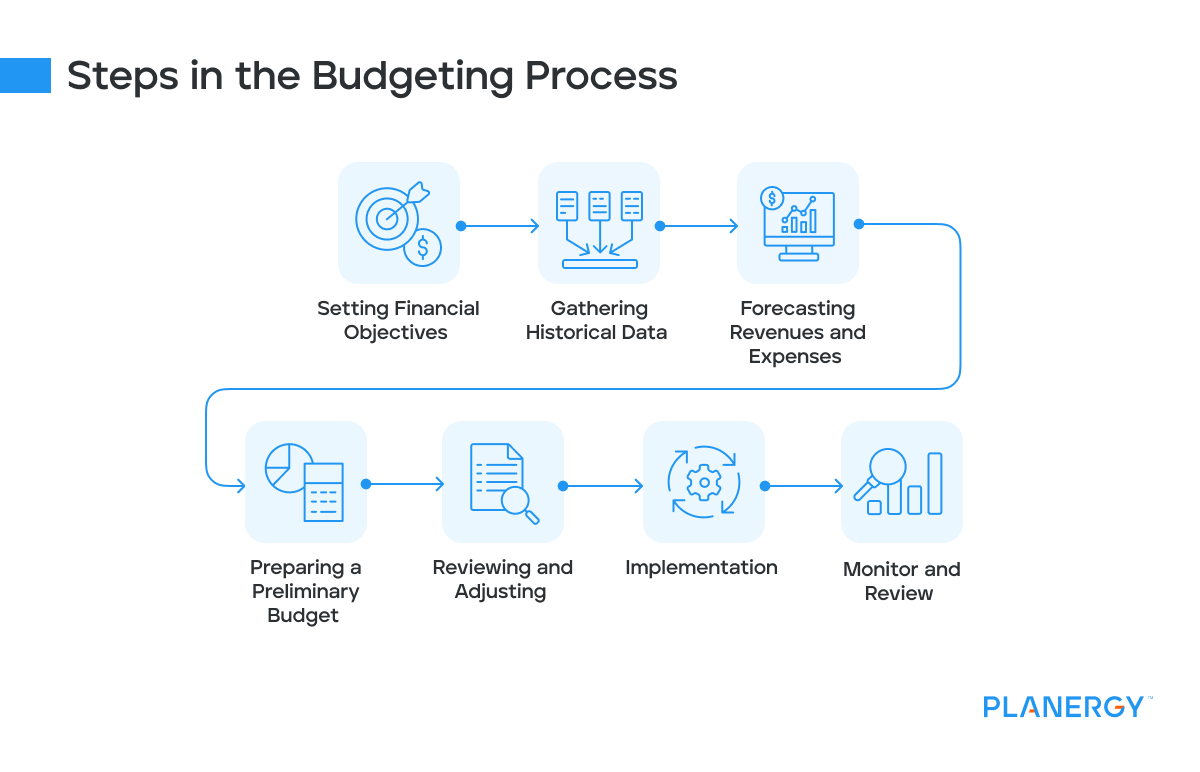

Steps in the Budgeting Process

Budgeting is a crucial aspect of financial management that helps businesses plan and allocate resources effectively.

It typically involves the following steps:

Setting Financial Objectives

Start by determining your short-term and long-term financial goals, such as increasing revenue, reducing costs, or improving profitability.

Gathering Historical Data

Review past financial statements, records, and reports to gain insights into your business’s financial performance and trends. This can include a budget analysis report and budget variance analysis.

This information will help you identify areas of strength and weakness and opportunities for improvement and growth.

Using spend management software, like PLANERGY, will allow you to gain real-time spend visibility and make better decisions.

Forecasting Revenues and Expenses

Based on historical data, market research, and industry trends, estimate future sales, costs, and other financial variables. Variable expenses can be difficult to budget for, so they need to be considered carefully.

Consider factors such as seasonality, economic conditions, and changes in your business operations when making these projections.

Preparing a Preliminary Budget

Create a draft budget that outlines your projected revenues, expenses, and cash flow.

This should include line items for each category of income and expenditure, as well as a summary of your overall financial position.

Reviewing and Adjusting

Analyze the preliminary budget to ensure it aligns with your financial objectives and accurately reflects your business’s anticipated financial performance.

Make any necessary adjustments, such as reallocating resources or revising revenue projections, to create a more accurate and realistic budget.

Implementation

Once your budget is finalized, communicate it to relevant stakeholders, such as department heads, employees, and investors.

Ensure that everyone understands the budget’s objectives and their role in achieving them. Integrate the budget into your business operations, using it as a guide for decision-making and resource allocation.

Monitor and Review

Regularly track your actual financial performance against the budget to identify any discrepancies or areas that require attention.

Review your budget periodically and adjust as needed to account for changes in your business environment or financial performance.

This ongoing monitoring and review process will help you stay on track and ensure that your budget remains an effective tool for managing your business’s finances.

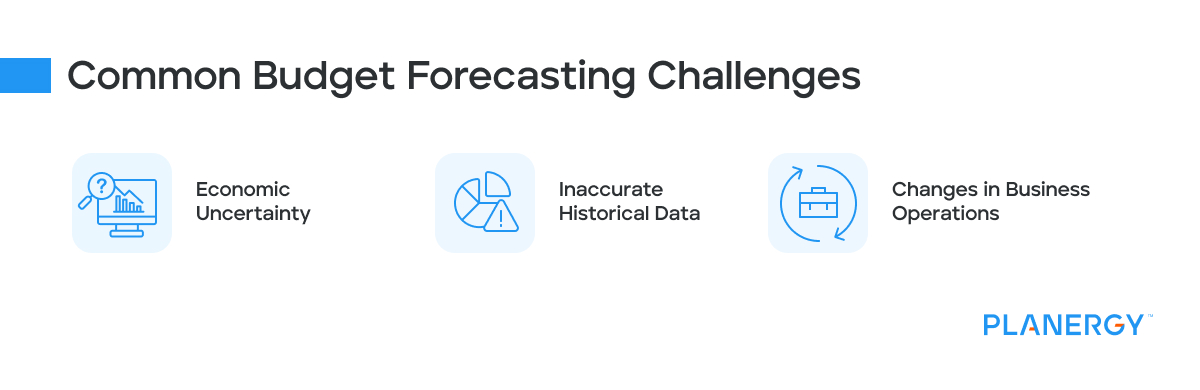

Budget Forecasting Challenges

Economic Uncertainty

Unpredictable market conditions, such as consumer demand fluctuations, interest rate changes, or shifts in global economic trends, can impact your revenue projections and expense estimates.

Economic uncertainty makes it difficult to accurately predict your business’s financial performance, which can lead to over- or underestimating your budgetary needs.

To address this challenge, consider using multiple scenarios (optimistic, realistic, and pessimistic) in your budget forecasting process to account for potential variations in market conditions.

Inaccurate Historical Data

Your budget forecasts rely heavily on historical reporting data to project future revenues and expenses. Incomplete or incorrect historical data can lead to flawed forecasts, resulting in unrealistic budget expectations and poor decision-making.

To overcome this challenge, maintain accurate and up-to-date financial records, and review them regularly for errors or inconsistencies.

Use industry benchmarks and market research to supplement your historical data and provide a more comprehensive view of your business’s financial outlook.

Changes in Business Operations

Significant changes in your business operations, such as new product launches, acquisitions, or changes in your supply chain, can impact your budget projections.

These changes may introduce new revenue streams or alter your cost structure, making it challenging to forecast your business’s financial performance accurately. For example, a significant increase in operations can result in a decrease in cash flow.

To address this challenge, closely monitor any changes in your business operations and incorporate them into your budget forecasts.

This may involve updating your revenue projections, adjusting your expense estimates, or reallocating resources to accommodate the changes.

Benefits of Business Budgeting

Improved Financial Control

Budgeting helps you monitor and manage your business’s finances more effectively. By setting financial targets and allocating resources accordingly, you can track your company’s performance and ensure it stays on track to achieve its goals.

A well-prepared budget also enables you to identify areas where cost savings can be made, or resources can be reallocated to maximize efficiency.

Enhanced Decision-Making

A well-prepared budget provides valuable insights for strategic planning and decision-making.

By analyzing your projected revenues and expenses, you can identify growth opportunities, prioritize investments, and make informed decisions about your business’s operations.

Budgets also serve as a reference point for evaluating the financial impact of various alternatives, helping you choose the most cost-effective and beneficial options for your company.

Better Risk Management

By identifying potential financial issues early on, budgeting allows you to mitigate business risks and implement contingency plans.

Regularly monitoring your budget helps you spot potential problems, such as cash flow shortages or declining revenues, before they become critical.

This proactive approach to risk management allows you to address issues in a timely manner and minimize their impact on your business’s financial health.

Increased Profitability

Effective budgeting helps optimize resource allocation and control costs, increasing profits.

By carefully planning your expenses and analyzing your procurement spend you can identify areas where cost savings can be achieved, you can reduce unnecessary spending and improve your company’s bottom line.

A well-structured budget can help you identify new revenue opportunities and invest in initiatives to drive growth and profitability.

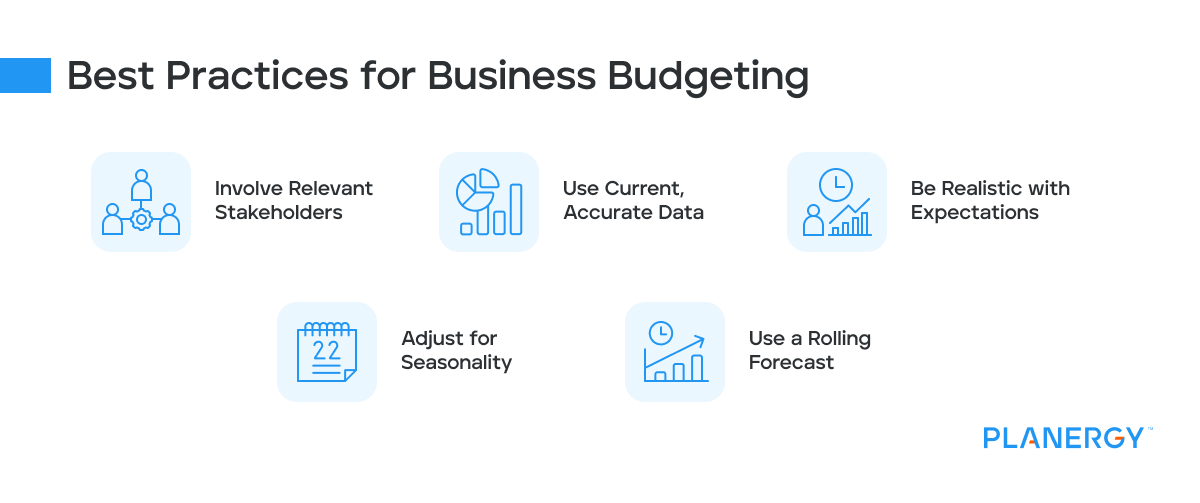

Best Practices for Business Budgeting

To ensure effective business budgeting you should consider following these best practices:

Involve Relevant Stakeholders

Include employees from different departments to gather diverse perspectives and insights.

Involving key stakeholders in the budgeting process ensures a more comprehensive understanding of the company’s financial needs and promotes buy-in and commitment to achieving budget goals.

Use Current, Accurate Data

Base your revenue and expense projections on accurate, up-to-date information. If the information is not accurate or not up to date you can be sure your budget will have the same problem.

Be Realistic with Expectations

Avoid overly optimistic or pessimistic assumptions that could lead to unrealistic expectations and poor decision-making. Use historical data and industry benchmarks to create a more reliable and achievable budget.

Adjust for Seasonality

Consider seasonal fluctuations in sales and expenses when creating your budget. Many businesses experience variations in demand and costs throughout the year due to factors like holidays, weather, and consumer behavior.

Incorporating these fluctuations into your budget can help you better plan for and manage resources during peak and off-peak periods.

Use a Rolling Forecast

Update your budget regularly to account for market conditions and business operations changes. A rolling forecast is an approach where you continually update your projections for a set period (e.g., 12 months) as new data becomes available.

This enables you to maintain a more accurate and up-to-date financial outlook, allowing for quicker strategy and resource allocation adjustments as needed.

How Can Software Help You Manage Your Budget?

Spend management software like PLANERGY can help you manage your budget by:

Streamlining Data Collection

Spend management software like PLANERGY can help you manage your budget by automatically importing financial data from various sources.

This saves time and reduces errors by eliminating manual data entry and ensuring your budget is based on accurate, up-to-date information.

Facilitating Better Collaboration

Enable team members to work together on business budget planning and review processes using spend management software.

This fosters better communication and collaboration among stakeholders, allowing for a more comprehensive understanding of the company’s financial needs and promoting commitment to achieving budget goals.

Providing Real-Time Insights

Generate reports and dashboards with spend management software that allows you to monitor your financial performance in real-time.

This enables you to quickly identify trends, discrepancies, and areas of concern, allowing for more informed decision-making and timely adjustments to your budget and strategy.

Improving Expense Tracking

Track expenses against your budget with ease using spend management software, and identify areas where spending can be controlled.

This helps ensure your business stays within budget, allowing for more effective resource allocation and improved financial performance.

Simplify Business Budgeting with PLANERGY

Effective business budgeting is crucial for managing your company’s finances, making informed decisions, and achieving financial goals.

By following best practices and leveraging spend management software like PLANERGY, you can create an accurate and comprehensive budget that supports your business’s long-term success.