One of the most important elements in crafting a successful and financially healthy business is developing and implementing an effective cash flow management strategy.

From sole-proprietor startups to small business owners to financial professionals working at major corporations, anyone who has to manage cash flow knows cash is the lifeblood of their organization—and a positive cash flow, maintained at the proper cost and with the proper timing, is key to financial health.

By following some basic best practices and investing in the right software solutions, you can craft a cash flow management strategy that helps you optimize your working capital for performance, growth, profitability, and competitive advantage.

Why Having an Effective Cash Flow Management Strategy Matters

Cash flow management challenges are the number-one killer of small businesses. Maintaining or improving your cash flow is crucial to keeping things running while waiting for accounts receivable to obtain and process the payments from your customers.

Cash management is, at its core, about putting your company’s working capital to optimal use by:

- Minimizing excess cash on hand;

- Balancing cash inflows and cash outflows accurately and completely;

- Ensuring all cash is spent with an eye toward maximum return on investment (ROI) and value creation (i.e., optimizing the working capital turnover ratio); and

- Maintaining sufficient working capital to cover the company’s financial obligations with enough left over to manage unexpected expenses and take advantage of investment opportunities. This requires balancing business liquidity against opportunity cost.

- In determining an optimal cash balance, companies need to identify, track, and mitigate the risks associated with their target cash balance.

- They also need to chart the expected ROI and opportunity cost for various options, e.g. paying vendor invoices early to capture discounts versus having more cash on hand and making payments when they’re due.

- A simple formula businesses can use to calculate opportunity cost is:

Transaction costs + Potential Risk Exposure Created By Maintaining a Minimal Cash Balance = Opportunity Cost for that balance.

In order to perform these business-critical tasks, you need both a clear understanding of your cash flow’s importance and a realistic, detailed, and data-driven approach.

Without a formalized strategy for managing working capital, a system for evaluating and improving performance using metrics, or complete buy-in from your organization at all levels, cash flow problems may prove frequent and frustrating.

Tying disciplined cash flow management to the company’s larger goals for growth, innovation, profit margins, and competitive strength will go a long way toward encouraging team members at all levels to get on the same page.

Best Practices for Effective Cash Flow Management

Invest in a Software Solution

From optimizing your cash conversion cycle to calculating and optimizing accounts payable days (i.e., accounts payable turnover), every part of improving your cash flow is easier and more effective with help from a best-in-class procure-to-pay solution like PLANERGY.

Artificial intelligence (AI), process automation, and advanced data management and analytics are all core components of modern procurement software. Armed with these tools, you can:

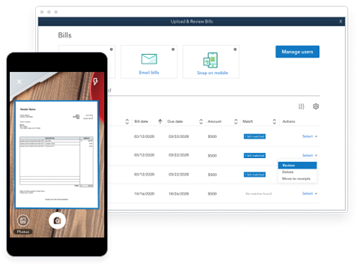

- Capture, organize, and analyze all your spend data for maximum transparency, accuracy, and completeness. Spend visibility is essential for optimizing all your business processes, but it’s particularly important to cash flow management, since having the wrong data can leave you with an inaccurate cash flow forecast—and without enough cash to cover your operating costs, pay salaries, or pay vendors, let alone making strategic investments or covering emergencies.

- Provide a single, cloud-based repository for data, with secure, role-appropriate access. Everyone can access the data they need, when they need it, so it’s easier to make smart business decisions for both short-term and long-term cash flow management.

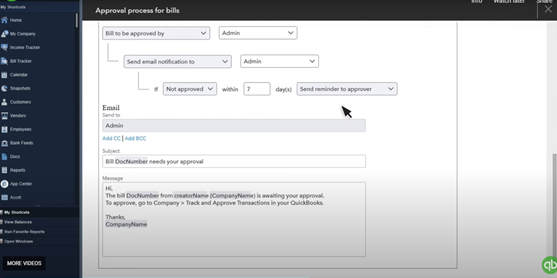

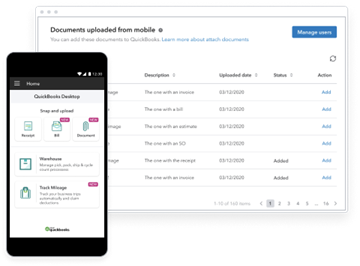

- Integrate your accounting software, procurement solution, and other applications into a cohesive software environment with better communication and collaboration.

- Create and enforce policies that encourage responsible, cash-savvy spending and smart, strategic decisions for improving cash flow over time.

- Create accurate and complete budgets, forecasts, and cash flow projections, as well as core financial documents such as income and cash flow statements.

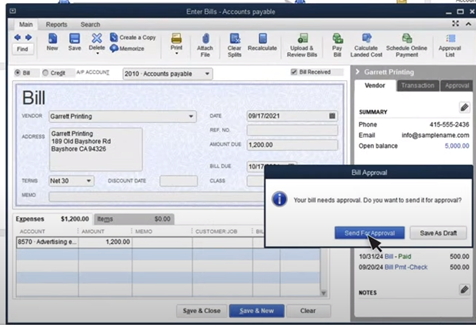

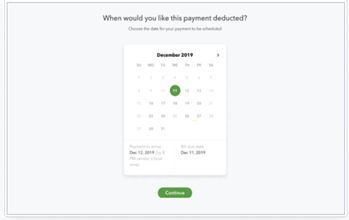

- Automate and optimize core accounts payable processes, integrate with vendor systems, and facilitate collaboration with accounts receivable to ensure you have full visibility into and control over your cash outflows and cash inflows. This is particularly important to shortening the cash conversion cycle.

- Create and track metrics used to monitor and streamline processes related to managing cash inflows and outflows, including:

- Days Sales Outstanding (DSO)

- Days Inventory On-Hand (DIO)

- Days Payable Outstanding (DPO)

Create a Cash-Savvy Culture

To be truly successful in making optimal use of their working capital, companies need to ensure everyone from the CEO to the bookkeepers in accounts payable and receivable understand the importance of effective cash flow management.

The C-Suite can kickstart the process by providing not just instruction, but leadership and guidance in prioritizing a strategic approach to positive cash flow.

Tying disciplined cash flow management to the company’s larger goals for growth, innovation, profit margins, and competitive strength will go a long way toward encouraging team members at all levels to get on the same page.

In the accounting and procurement departments, developing and implementing policies that promote both financial discipline and value-centered, strategic spending can make it easier to achieve compliance, monitor performance, and identify problem areas in need of improvement.

Other departments and business units can be incentivized to support financial discipline (and manage cash outlays attentively) by connecting departmental bonuses, budgets, or even salaries to cash flow targets.

Introducing software tools that simplify the cash flow projections, budgeting, and forecasts required to pursue this strategy will make things simpler still.

Ensuring everyone is trained on the software tools, understands and agrees to comply with financial and cash flow management policies, and knows their roles and responsibilities in supporting the company’s pursuit of financial health will provide a final layer of reinforcement necessary to get everyone working together toward shared success and better cash management.

Take a Proactive Approach to Invoicing

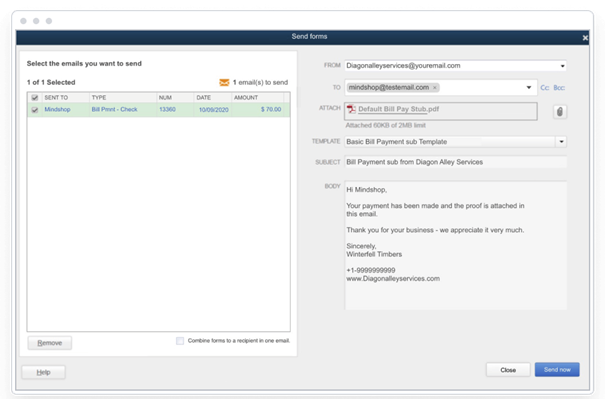

Even a profitable business needs cash in hand to go with the healthy numbers on the balance sheet. Streamlining your invoicing workflows for accuracy and speed gets your invoices into your clients’ hands as soon as possible—and money into your bank account sooner.

Automate your invoicing workflows. Collaborate closely with clients to ensure each invoice has a corresponding purchase order to minimize exceptions, chargebacks, and delays.

Rather than tying invoice dispersal to a specific day, consider sending them out whenever you hit a preset target such as a certain number of projects completed.

Streamline Your Inventory Management

Inventory that’s languishing in your storerooms or warehouses isn’t generating revenue for your business. Prioritize stocking for strong sellers and have systems in place to liquidate dead stock and minimize or eliminate reorders as required.

Prioritize Agility, Continuous Improvement, and Business Resilience

While the global economy is definitely a fiercely competitive place, your toughest competitor when it comes to achieving optimal performance will always be your own business.

Companies who turn the microscope on themselves to evaluate and improve business practices (including business operations, financial activities, strategic sourcing, etc.) can trim the fat while finding new ways to wring value from their workflows.

Practicing agile procurement and prioritizing supply chain resilience will not only make it easier to track financial data and streamline your workflows, but will also eliminate waste, human error, and costly delays while ensuring your company has a flexible footing that promotes profitability while guarding against disruptors (further insulating your cash balance from unexpected turmoil).

The net result is a leaner, more focused organization that can more readily implement financial discipline into its business processes and leverage working capital much more effectively.

Don’t Shy Away from Financing

Both short-term and long-term financing can be extremely helpful in providing an infusion of cash when you need it most or want to take advantage of an exceptional investment opportunity.

Short-term financing, such as a line of credit, can help you close the gap when you need working capital fast.

Better still, you can set up a line of credit with your lender before you need it. This not only provides you with additional peace of mind but can potentially yield a more favorable interest rate since you’re negotiating when you’re flush rather than coming to your financial institution with your hat in hand (so to speak).

Small business owners and startups can definitely take advantage of other short-term financing options such as credit cards, provided they draw a clear, heavy line between the personal and the professional by establishing a separate bank account and credit cards for the business.

Keeping things separate also allows you to more easily integrate your business credit card purchases with your overall spend management system, providing valuable insights you can use to refine your cash flow management and reduce your reliance on plastic in future cash flow forecasts.

Long-term financing is a better option than working capital when you’re investing in major purchases such as manufacturing equipment, real estate, etc. You can space payments and depreciation over the life of the asset, and while you’ll need to keep an eye on interest rates, your cash position will be much stronger.

Balance the Carrot with the Stick

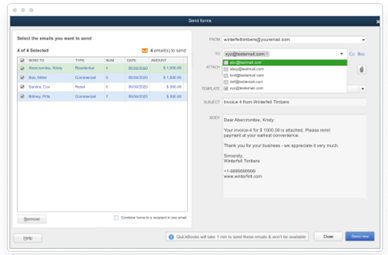

Creating a clear and comprehensive collection policy is crucial to keeping your cash flow under control.

Formalize your payment terms, make penalties for late payments clear, and make sure you distribute the latest version of your policy to all your clients as well as your staff at regular intervals.

You can integrate your collections process with your accounts receivable workflows to monitor due dates and amounts and automatically issue collection reminders, too.

This will encourage swift payment while keeping things friendly (or at least professional) with clients.

That’s the stick. The carrot comes in the form of discounts for early payment. Discounts can help you reap more cash, more quickly, even though you’re receiving a little less from each client taking advantage of the discount.

Sacrificing 5% or 10% of an invoice to get the cash in hand within 10 days is well worth it if it prevents you from having to take out a short-term loan and pay hefty interest fees.

Make Sure Your Working Capital is Doing Its Job

To survive in today’s competitive marketplace, you need to keep your company’s financial heart beating with a steady flow of well-managed cash.

Create a culture of cash-flow mindfulness, invest in a reliable and comprehensive software solution, and develop and implement effective cash flow forecasting and management strategies today, and you’ll have the resources you need when it’s time to pay the bills, make strategic investments, and cover the emergencies that pose a risk to your company’s financial health.