Maintaining good cash flow is necessary for business success.

Having a steady stream of incoming cash allows you to pay your bills and your employees while allowing you to invest in the future business growth.

Without a steady stream of incoming cash, you could quickly see your entrepreneurial dreams disappear.

But maintaining good cash flow doesn’t just happen. It requires a good understanding of your current cash flow including any potential risks that may hamper cash flow levels, leaving you with a stack of unpaid bills and a shortage of cash on hand.

Understanding Cash Flow and Cash Flow Risk

Business owners sometimes make the mistake of confusing cash flow with profit.

While both are necessary for long-term financial success, cash flow isn’t just a number reported after all expenses have been covered.

Cash flow is concerned with nothing other than the amount of cash flowing into and out of your business.

In very simple terms, cash flow is the difference between having a customer pay you for services rendered and having the customer owe you the money for those same services.

While both show up as cash received on a profit and loss statement, you’ve only received cash from the customer that has paid you.

The other customer is still just an outstanding bill.

For example, if you offer your customers extended payment terms beyond 30 days, you can run into cash flow problems in the short term until those customers pay.

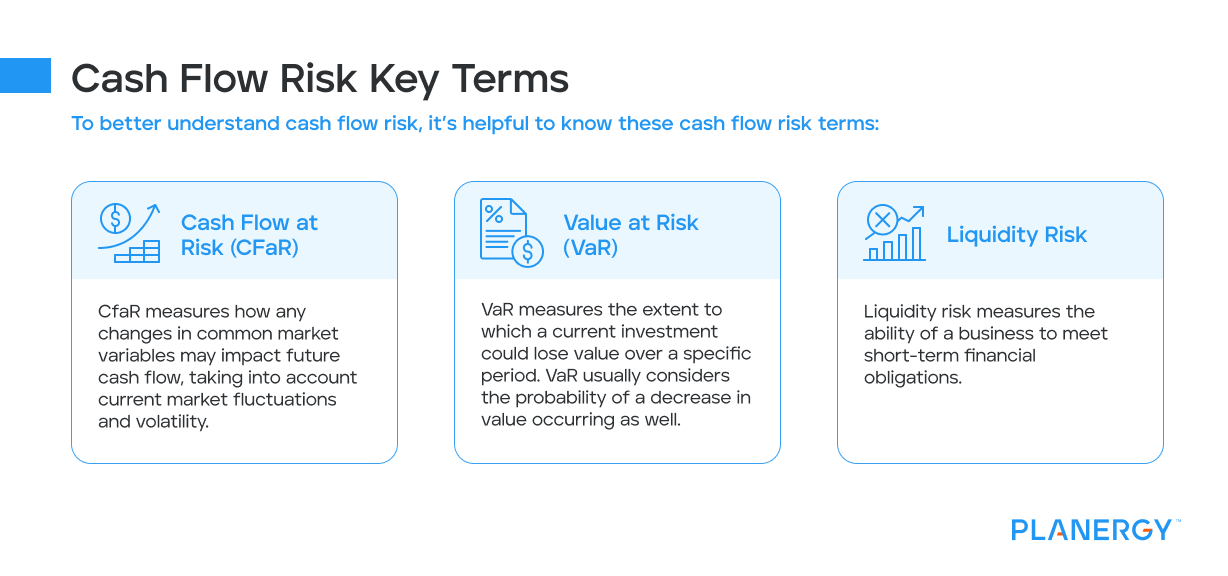

Cash Flow Risk Key Terms

To better understand cash flow risk, it’s helpful to know these cash flow risk terms:

Cash Flow at Risk (CFaR) – Cash Flow at Risk measures how any changes in common market variables may impact future cash flow, taking into account current market fluctuations and volatility.

Value at Risk (VaR) – Value at Risk measures the extent to which a current investment could lose value over a specific period. VaR usually considers the probability of a decrease in value occurring as well.

Liquidity Risk – Liquidity risk measures the ability of a business to meet short-term financial obligations.

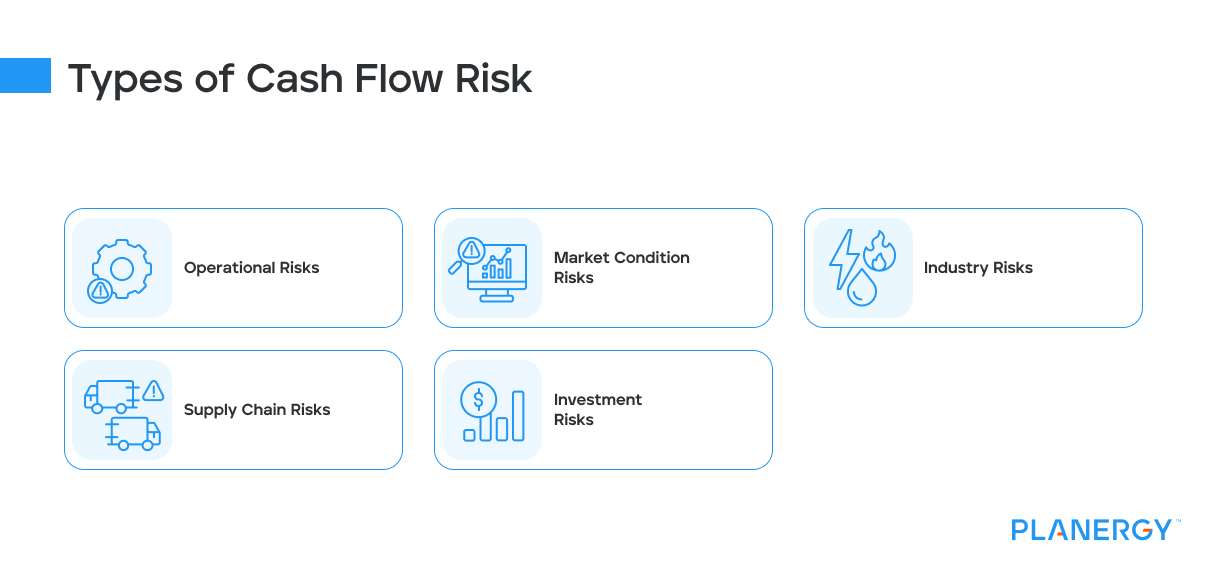

Types of Cash Flow Risk

Business owners, CFOs, and corporate finance professionals need to be aware of the potential financial risks that businesses commonly face.

While some cash flow issues can be addressed internally by changing processes and procedures, other risk factors may be largely out of the control of a business.

When conducting a risk assessment for your business, always consider these common cash flow risks:

Operational Risks

Operational risks are risks that a business has control over. But to do so, the risk has to be identified and corrected.

This can involve reviewing and updating the policies of multiple departments that have a direct impact on cash flow such as procurement, accounts payable, and accounts receivable.

Because each of these departments is directly responsible for managing company money in some manner, mitigating departmental issues such as overly generous payment terms, tax collection activities, rogue spending, and delayed accounts payable processing can all directly impact company cash flow.

Market Condition Risks

Even though businesses have no direct influence on market risk or an economic downturn, such as during the pandemic, they can control how they respond to those conditions.

For example, during a recession, a business may need to rethink credit terms for customers or consider adding an interest rate to all late payments.

In some cases, it may be wise to request an initial down payment on certain orders that come with large out-of-pocket expenses.

Industry Risks

Your risk may be increased, depending on the industry your business is in.

This is particularly true in the manufacturing world, where a recession or sudden increase in the cost of raw materials can directly impact business operations.

This can also happen when a market suddenly becomes saturated with a particular product or service, reducing its demand.

Supply Chain Risks

If your business relies on a complex supply chain, any type of interruption can directly impact your business.

All it takes is a single supplier to go out of business, or a vendor unable to source a needed product for your cash flow to suffer.

Investment Risks

Most major investments are considered long-term and are managed as such.

But they can still impact day-to-day cash flow, eating up available cash flow for the near term.

Other investments such as equipment or real estate can also be beneficial for company growth, but can negatively impact cash in the near future.

In addition, reducing the amount of short-term debt your company carries reduces the possibility of a debt being called in for payment, while too much long-term debt can result in investment-rich/cash-poor status, directly impacting your business financially making lenders leery of investing in your business.

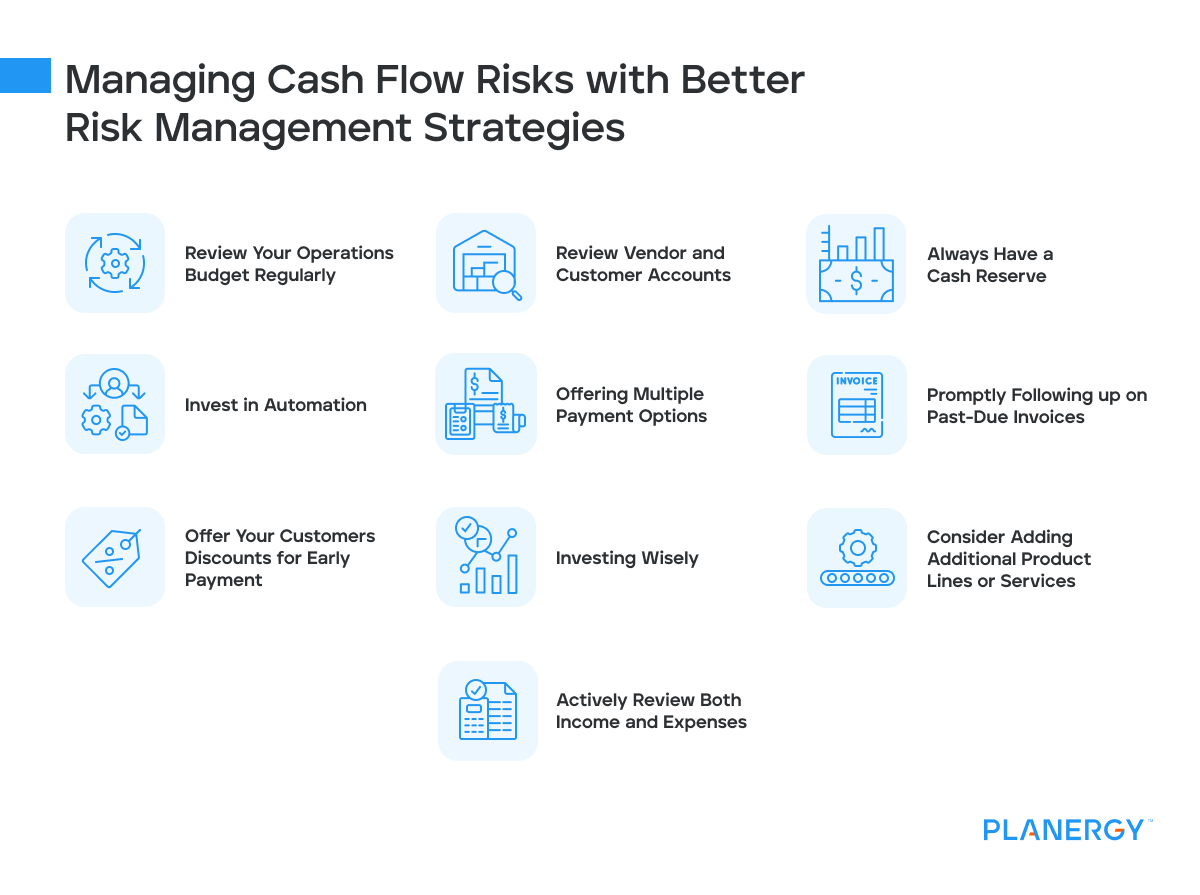

Managing Cash Flow Risks with Better Risk Management Strategies

There are a variety of best practices you can implement to improve your cash flow risk management strategies.

Here are some of the top ones to consider implementing.

Review Your Operations Budget Regularly

The best way to keep cash flowing in is to stop it from unnecessarily flowing out.

By regularly examining your budget and your cash flow statements, you can adjust income and expenses when necessary, perhaps increasing marketing efforts or cutting expenses.

When creating a budget, it’s also helpful to factor in an emergency expense somewhere in your budget, should you need to deal with an unexpected issue.

In addition, regular reviews help prevent negative cash flow.

Review Vendor and Customer Accounts

Regularly reviewing both vendor and customer accounts allows you to see if any areas need improvement.

Perhaps you can negotiate better terms from your vendors that will allow you to keep cash in the business longer.

Looking at customer accounts, including who you’re giving credit to can also help improve cash flow.

Consider changing payment terms for chronically late payers, or rescind their credit altogether if necessary.

You can also examine existing credit policies to see if they need updating or if terms need to be changed to encourage earlier or prompt payment.

Always Have a Cash Reserve

Operating on a shoestring budget is often the reality for new businesses struggling to get established, meaning there’s likely to be nothing left to put into a contingency plan for emergencies.

One way around that is to apply for a business credit card or line of credit that should only be used for emergencies.

That way you won’t be impacting your available cash.

Invest in Automation

One of the best ways to keep a handle on your cash flow is to start using an automated system that utilizes automated workflows.

An application like PLANERGY provides the transparency needed to better manage cash flow while using AI tools that optimize the entire procure-to-pay process.

PLANERGY also offers seamless integration with popular accounting software applications ensuring that all the information you need to properly manage cash flow risk is at your fingertips.

Automation also allows you to centralize reporting and forecasting capabilities, with total spend reports available in real-time that lets you see exactly what has been spent.

Offering Multiple Payment Options

If the majority of your customers are still paying you by check, is it because they prefer that method or you haven’t provided them with any other options?

Making it easier for your customers to pay electronically often means earlier payment.

For a very small investment, it’s worth it.

Promptly Following Up on Past-Due Invoices

No matter what you do, there will always be a few customers who pay their invoices late; sometimes very late. Start your follow-up process before they’re late, sending email reminders with a link to payment options.

And be sure to follow up by phone with any customer who is more than a few days late with their payment.

If the same customers are repeatedly late, consider changing their payment terms or requiring a deposit for any future orders.

Offer Your Customers Discounts for Early Payment

If you have a decent markup on your products and services, you may want to consider offering a small discount for customers who pay early.

A 2% discount on a $500 bill is only $10, but it may provide just enough incentive for your customers to pay you early.

Investing Wisely

Investments can play a large role in the success of your business.

But be careful to balance short-term and long-term investments to make sure that they’re not leaving you wealthy on paper but cash-poor.

Consider Adding Additional Product Lines or Services

Growing your business doesn’t always mean just adding customers. It also means that you increase the products or services you sell.

For example, if you sell earrings exclusively, consider adding bracelets or necklaces to increase your cash flow.

Actively Review Both Income and Expenses

Regularly reviewing both income and expenses provides the information you need to make key decisions including:

- Raising prices to adjust for rising costs

- Creating additional incentives for customers to purchase products

- Eliminating an unprofitable product or service from your offerings

- Streamlining operations to reduce labor costs

- Reducing or eliminating any unnecessary expenditures

- Taking advantage of early payment discounts when possible

- Regularly negotiating payment terms with vendors and suppliers

- Implementing automation to eliminate time-consuming, costly manual tasks

What is a Cash Flow Analysis?

Cash flow analysis takes a look at the cash that flows into and out of a business, looking at a variety of information including:

- Where cash inflows come from

- Where you’re spending most of your cash

- How much cash you regularly receive

- How much cash you regularly spend

To complete a cash flow analysis, you must first create a cash flow statement that displays all sources of cash received from operating activities as well as from investments.

The cash flow statement also examines cash outflow and where it’s going.

The cash flow statement or cash flow forecast has three areas that cover the following:

Operating Cash Flow from operations which includes accounts payable, accounts receivable, and taxes.

Cash flow From Investing which includes cash from sales from fixed assets such as land or buildings along with any purchases of investment securities.

Cash flow From Financing which includes dividends paid to investors, the sales of stocks and bonds, and any cash received from a loan.

Dividing the cash flow statement into these three sections allows business owners to see exactly where cash flows in from and where it’s going, allowing adjustments if necessary.

For example, if you see that the majority of your cash flow is coming from investments and not operations, you may want to consider strategies for boosting sales or creating an additional product line to increase cash from operations.

What is the Difference Between Cash Flow Risk and Liquidity Risk?

Cash flow risk and liquidity risk are two necessary aspects when dealing with your business’s financial health.

Cash flow risk addresses the possibility that a business will not be able to generate a sufficient amount of cash due to internal or external issues.

Liquidity risk looks at a company’s ability to quickly convert assets to cash.

This risk happens when the majority of a business’s assets such as land and buildings cannot be quickly converted to cash.

Maintaining Cash Flow Keeps Your Business Thriving

Maintaining good cash flow is necessary for the financial health of your business.

By managing risk properly and making adjustments as needed, you can keep cash flowing into your business instead of watching it flow out.

To better manage cash flow for your small business, consider investing in the tools and technology you need to effectively manage cash risk, including better expense management tools and more accurate forecasting capability.

By investing in this technology, you’ll have the necessary information at your fingertips resulting in better decision-making when managing working capital and cash inflows and outflows, including real-time cash flow statements.