In a business climate radically altered by both digital transformation and major disruptors such as the COVID-19 novel coronavirus pandemic, companies who want to compete, grow, and innovate effectively need both flexibility and resilience.

Securing competitive advantage means mastering emerging technologies and developing strategies that incorporate risk management, data-driven decision making, and a collaborative, agile approach.

For chief financial officers (CFOs), this need is even more urgent. As procurement and financial departments take center stage in crafting the strategic business models necessary to compete in today’s economy, today’s CFOs are tasked with finding ways to minimize risk, maximize performance, and protect business continuity while maintaining sufficient flexibility to take full advantage of emerging opportunities.

Today’s CFO Challenges Are Bigger Than Ever

In the past, the CFO served largely as a finance chief. They were a liaison between the finance team (along with procurement) and upper management in the C-suite.

They focused the lion’s share of their time and skill set on dealing with regulatory issues, guiding their teams in cutting costs, managing cash flow, and enforcing budgeting initiatives, and then reporting the results.

But in the age of digital transformation, the role of the CFO is rapidly evolving. They don’t just lead the finance team or spearhead initiatives to reduce costs.

Instead, more and more companies are elevating the CFO to a primary strategic role within the C-suite, and relying on the finance function to create value, secure and enhance competitive advantage, and improve overall business performance—all while reducing risk and continuing to perform their traditional roles.

Doing business in the new normal has underscored the importance of accurate and strategic financial planning paired with strategic flexibility, both aligned tightly with organizational goals for business performance.

From optimizing internal processes to meet stakeholder expectations to forging strong bonds with vendors to ensure supply chain resilience, finance leaders are tasked with finding immediate and lasting solutions to unprecedented challenges.

Consequently, today’s CFOs need new skill sets and talents. They need to understand emerging technologies such as artificial intelligence, data analytics, and robotic process automation.

They need to understand and know how to effectively leverage financial business intelligence, risk management systems, and new business models built on collaboration, innovation, communication, and both resilience and flexibility.

Doing business in the new normal has underscored the importance of accurate and strategic financial planning paired with strategic flexibility, both aligned tightly with organizational goals for business performance.

Top Challenges and Priorities for CFOs

While chief financial officers have different priorities with regard to their specific industries, company size, and areas of expertise, today’s CFOs face a set of common challenges that must be addressed to ensure their organizations are able to compete and grow effectively today and into the future.

- Digital Transformation

The COVID-19 pandemic has been both vilified as a killer of traditional business paradigms and praised as an unlooked-for blessing for businesses swift, innovative, and lucky enough to adapt to rapidly shifting market conditions.

But even before the pandemic struck, digital transformation was redefining the parameters within which the finance function must operate—and creating new opportunities to seize competitive strength through data-driven process optimization and analytics.

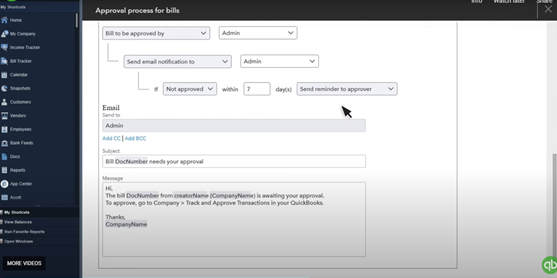

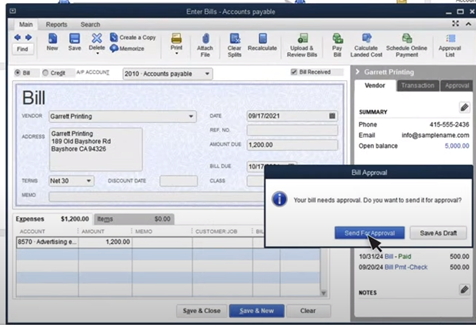

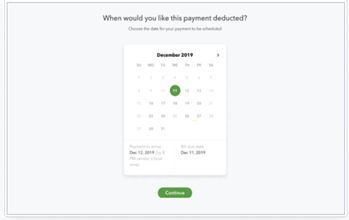

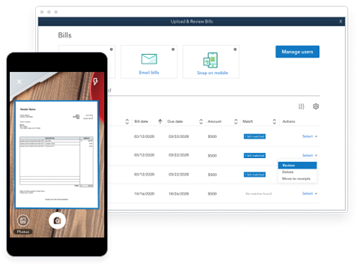

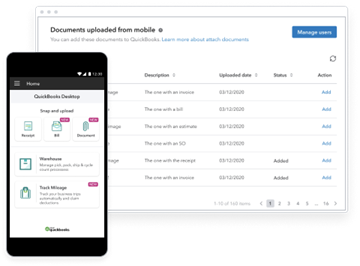

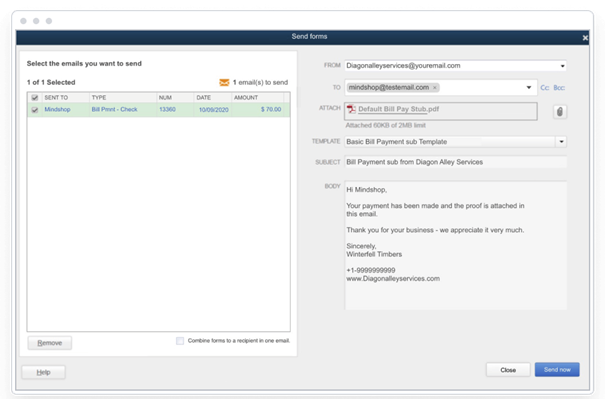

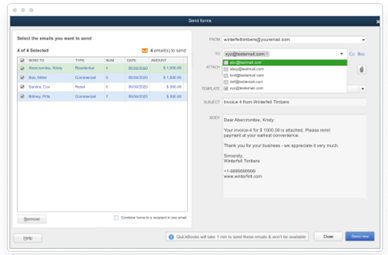

Digital transformation technologies grant finance leaders and their teams hitherto-unimaginable capabilities. Accounts payable (AP) automation eliminates the need for manual data entry, boosts the speed and accuracy of high-volume, otherwise tedious processes, and eliminates human error while simultaneously freeing staff to apply their valuable skill sets to more important tasks no computer can handle (at least, not yet).

AP automation immediately lowers costs—still the number one priority for CFOs in 2021, according to Deloitte research—and sets up further cost reductions over time via continuous improvement via self-guided process optimization.

It also supports important internal process improvements such as guided buying and full integration with vendor systems, reducing or even eliminating common (and costly) issues such as maverick spend and invoice fraud.

Deep data analytics, combined with rich and intuitive reporting and forecasting tools, make it easy to monitor spend in real time, create accurate and strategically valuable reports drawn from actionable insights, and support the alignment of procurement and AP processes with organization-level goals.

Centralized data management, paired with a fully integrated software environment, connects all applications—from enterprise resource planning (ERP) to accounting software to marketing and customer management platforms—while providing role-appropriate, secure access to all stakeholders.

It also eliminates data silos and reduces the risk of miscommunication. It improves data quality, which in turn improves the strategic utility of analytics, forecasting, reporting, and decision-making.

Cybersecurity also improves thanks to state-of-the-art encryption, centralized data storage on the cloud (rather than local servers), and secure, single sign-on (SSO) access.

Simply by implementing a cloud-based, comprehensive procure-to-pay (P2P) system like PLANERGY, today’s CFOs can kickstart digital transformation for their organizations and begin to integrate core concepts such as continuous improvement, strategic sourcing (including more soft-value concerns such as ethical procurement, sustainable sourcing, etc.), and data-based business continuity planning into workflows at all levels.

The result? Greater competitive strength, more agile and flexible responses to both business disruptors and unexpected opportunities, and improved risk management.

CFOs who invest in digital transformation and make strategic use of emerging technologies are far better equipped to ensure financial activities generate value for their organizations and provide a direct, demonstrable, and positive impact on profitability, business performance, and growth.

- Adapting the Company Business Model to Fit a Changing Marketplace

Today’s global marketplace is complex. Businesses who want to push past the competition rather than play catch-up need strategies in place to help them pivot in time to minimize disruptions and capture profitable opportunities for growth and innovation.

When the pandemic struck, for example, many restaurants, retailers, and grocery stores were swift to either modify their business models to incorporate delivery or partner with emerging businesses such as DoorDash and Uber Eats.

Elsewhere, brick-and-mortar institutions whose employees were quarantined at home found themselves formulating and implementing remote working protocols and procedures—either as an expansion of existing work-from-home programs or for the first time in their histories.

As business leaders, CFOs are taking an increasingly large role in the decision to pivot their companies’ business models. As financial activities and the data they generate have a more profound effect on the overall strategic and financial planning for the business, CFOs must consider questions such as:

- What uncertainties are we facing, and how does that affect our risk exposure?

- What limitations are inhibiting growth, and how can we scale effectively to move beyond them to ensure revenue grows faster than costs?

- Which emerging technologies do we need to compete effectively, and are we ahead of or behind the competition in implementing them?

- What changes are necessary to maximize our procedures, protocols, and processes for maximum performance and efficiency—both in the finance department, and the organization as a whole?

- Which metrics should we track to develop and implement these changes?

- How can we improve cash flow management to ensure we have sufficient working capital for investment in growth opportunities as well as covering emergencies and meeting our financial obligations?

Carefully considering the answers to these questions will help CFOs and the rest of the C-suite react effectively and make intelligent business decisions when faced with a changing business environment.

- Managing Cash Flow

While Deloitte found that cutting costs remained the number one priority for respondents In its Q2 2021 survey of CFOs, finding ways to increase liquidity was a close second.

That’s not exactly surprising. Cash is the lifeblood of most businesses, and if the flow grows sluggish or erratic—or worse yet, stops altogether—then crisis isn’t far behind. Keeping sufficient working capital helps companies insulate themselves against risk created by supply chain disruptors.

On the other hand, keeping too much cash free can hamper business growth and performance when that cash is simply stashed rather than put to work via investment.

Cash flow management is closely tied to inventory management, supplier management, and supplier relationship management.

For inventory in particular, the situation is very similar to cash. Keeping enough on hand to meet demand is important, but too much can end up costing you, either in stock loss/deadstock or by tying up capital that could be generating a profit via investment, product development, etc.

Taking a collaborative approach to supplier relationship management can help improve cash flow. Strong relationships make it easier to negotiate better pricing and payment terms, capture discounts reserved for the best customers, etc.

Ultimately, these complex, interconnected systems and their shared dependencies require careful oversight and proactive management strategies, which is another reason why digital transformation is so important.

Without the right data management, automation, and forecasting tools, it’s very difficult for even seasoned CFOs to get the clear and complete picture they need of the various “moving pieces” involved in optimizing cash flow.

- Building a Diverse, Growth-Minded, and Collaborative Corporate Culture

While corporate culture might seem more the province of human resources than the chief financial officer, modern CFOs understand that getting all the stakeholders in their organization on board with their plans and policies will ultimately lead to a more cohesive corporate culture driven by a shared vision for success.

Diversity, Equity, and Inclusion (DEI) initiatives—both within their companies and as part of external initiatives such as vendor diversity programs—are one of the ways in which CFOs are providing the leadership needed to build this kind of corporate culture.

- Companies with DEI programs are up to 120% more likely to hit their financial goals;

- Companies employing an equal number of men and women produced up to 41% higher revenue;

- Companies with diverse management staff reported up to 19% higher revenue than those without it.

Beyond the financial benefits, diversity initiatives help strengthen the interpersonal bonds between team members.

They empower employees by letting them know their voices will be heard and respected. And best of all, diversity naturally fosters innovation and collaboration through the inclusion of new viewpoints, skill sets, and voices.

(Diversity also attracts new talent and boosts a company’s reputation, providing soft value that can lead to more sales, new markets, etc.)

Innovation is also at the core of growth, another important aspect for finance leaders looking to build a corporate culture focused on the future. Savvy CFOs understand and leverage techniques such as cross-functional collaboration to help all stakeholders understand not just their own roles in the company’s success, but the ways in which their team members contribute to the same.

Forward-thinking CFOs:

- Prize innovation and education, making smart investments to expand skill sets, support research and development to secure new markets and customers, improve products, increase sustainability, etc.

- Put a premium on attracting top-shelf talent familiar with digital transformation technologies and the strategies they support.

- Augment the existing skills of their team with additional training, and aren’t afraid to outsource to secure new skills or build remote teams.

- Prioritize work-life balance and strive to connect with their teams as human beings while simultaneously encouraging team members to build strong professional relationships with one another.

These same CFOs also invest in strategic initiatives and partnerships. They make targeted acquisitions to lower costs, improve quality, and further streamline internal processes. They prioritize agility and look for opportunities to protect business continuity in every process.

Are You Ready to Tackle Today’s Biggest CFO Challenges?

Cutting costs is just the beginning. Today’s CFOs have a powerful opportunity to shape not only their companies’ financial health, but their strategic planning and competitive strength.

Make digital transformation a priority, and use its tools to improve liquidity, reduce risk, and boost performance and profits.

Guide your entire organization toward a diverse, collaborative culture focused on shared purpose and success. Prioritize effective responses to today’s biggest CFO challenges, and make sure your business is ready to take advantage of tomorrow’s opportunities