Accounting For a Credit Memo As a Buyer

If you’re the buyer and you’re issued a credit memo from a vendor, you’ll need to record the transaction by debiting the supplier’s account (accounts payable) for the amount of the credit note and crediting the purchase return account.

Creating this entry will reduce the vendor account balance to properly reflect the amount of the credit memo and will also reduce your purchase account for the same amount.

For example, you ordered $15,000 worth of materials from your materials supplier, but you only received $10,000 worth of materials.

When you receive the invoice after the purchase, the amount due is shown as $15,000. Three days later, the supplier issued a credit memo for $5,000.

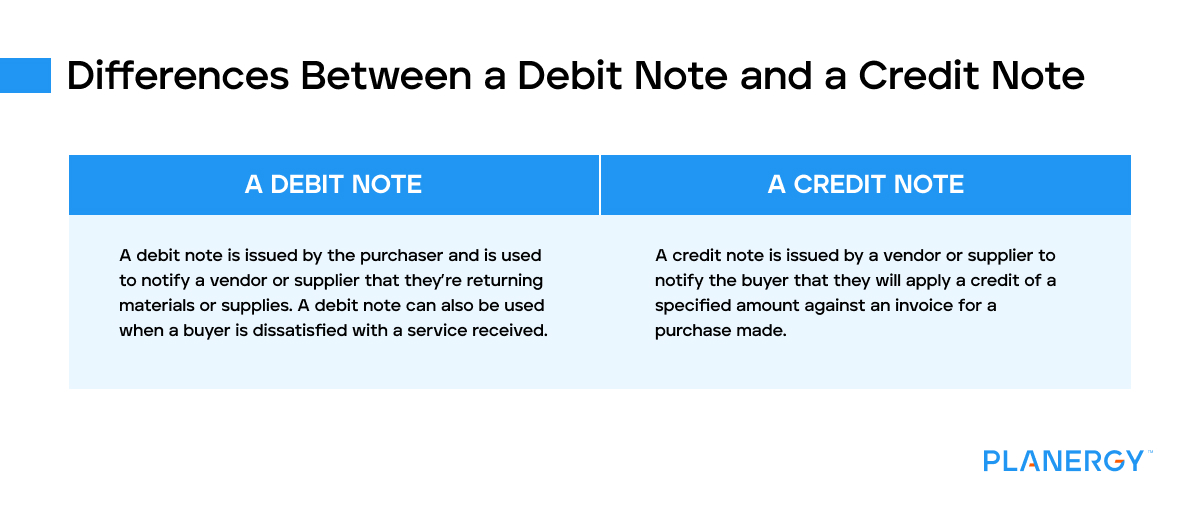

Rather than wait for the seller to issue a credit memo, you can choose to issue a debit memo in the amount you need to be credited.

Either way, the journal entry will be the same.

| Account | Debit | Credit |

|---|

| Vendor/Supplier Account (AP) | $5,000 | |

| Purchase Return | | $5,000 |

If you mistakenly pay the entire invoice, any unused credit will be placed on your account and used as a credit for your next order.

In certain circumstances, you can opt to request a refund from the vendor if you aren’t planning on using them again in the future.

Accounting For a Credit Memo As a Seller

If you’re the seller and you regularly issue credit notes to your customers, the process is similar.

When you issue the credit memo, you will need to debit the sales return account and credit the customer’s account (accounts receivable).

This will reduce your sales total while also reducing the accounts receivable balance of the customer.

For example, if you sell $5,000 worth of goods to your customer, but $1,000 worth of those goods are damaged during transit, you would need to issue a credit memo, while also completing the following journal entry.

| Account | Debit | Credit |

|---|

| Sales Return | $1,000 | |

| Customer Account (AR) | | $1,000 |

When you create a credit note on a customer’s account, the credit should be applied promptly to avoid out-of-balance customer accounts that can cause issues at year end.