Managing finances can be complex, from assets, liabilities, and even investment portfolios. Many professionals use financial ratios to understand and manage their financial dealings.

One key term that features prominently in these ratios is “current assets.”

Whether you are a procurement or an accounting professional, understanding current assets and how they can influence financial ratios can be essential to your job.

In this comprehensive guide, we will explain what current assets are, the types of current assets, provide examples of current assets, explain the differences between current and non-current assets, and highlight financial ratios that use current assets.

What are Current Assets?

Current assets are those assets that are easily converted into cash within a year or are expected to be used up within the year. They represent a category on a company’s balance sheet.

Current assets are used to evaluate a company’s liquidity because they are the assets that a business can use to pay its short-term obligations.

For instance, if a company is having a tough time making payroll, they can use their current assets to pay their employees.

Current assets are also a way to evaluate a company’s risk profile, with a high amount of current assets indicating a lower risk for the company.

Types of Current Assets

Cash and Cash Equivalents

These are the most liquid assets. Cash refers to physical currency held by the company’s bank account or savings accounts, while cash equivalents are short-term investments that can be quickly converted into cash with minimal risk of changes in value.

Examples of cash equivalents include treasury bills, commercial paper, and short-term government bonds.

Marketable Securities

Marketable securities are investments that can be quickly sold if needed, providing an additional source of liquidity.

They typically include equity or debt securities, such as money market funds, shares of stock or bonds issued by other companies, that the company intends to sell within one year.

Accounts Receivable

Accounts receivable represents money owed to a company by its customers for goods or services delivered but not yet paid for.

This type of current asset is crucial for businesses that offer credit terms to their customers. It’s important to note that not all accounts receivable may be collected, so companies often establish an allowance for doubtful accounts to account for potential losses.

If an account isn’t collected, it is written off as a bad debt and not included.

Supplies

Supplies can be a bit complex as they are categorized as current assets only until they are utilized. Once used, they are recorded as an expense.

If your organization possesses a reserve of unused supplies, they should be documented under the current assets section on your balance sheet.

Inventory

Inventory includes raw materials, work-in-progress goods, and a company’s finished goods. Inventory liquidity can vary – raw materials and finished goods are typically more liquid than work-in-progress goods.

Retail and manufacturing businesses often have a significant portion of their current assets tied up in inventory.

That’s why it’s so important to balance inventory needs – too much on hand that doesn’t turn over quickly will affect your total available working capital, which affects your ability to handle day-to-day operations.

Prepaid Expenses

Prepaid expenses are payments made in advance for goods or services the company expects to receive.

Common examples of prepaid expenses include rent, insurance premiums, and annual subscriptions.

These costs are initially recorded as current assets and then gradually expensed over the period of use or benefit.

Other Current Assets (OCA)

This category includes various other short-term assets that don’t fit neatly into the other categories.

Examples include deferred income taxes, income accrued but not received, and supplies.

Understanding these different types of current assets can provide valuable insights into a company’s financial health and operational efficiency.

Analyzing trends in these accounts over time can give you a clearer picture of a company’s liquidity, operating cycle, and overall financial management.

The more current assets a small business has, the better. It means they are financially stable, and agile.

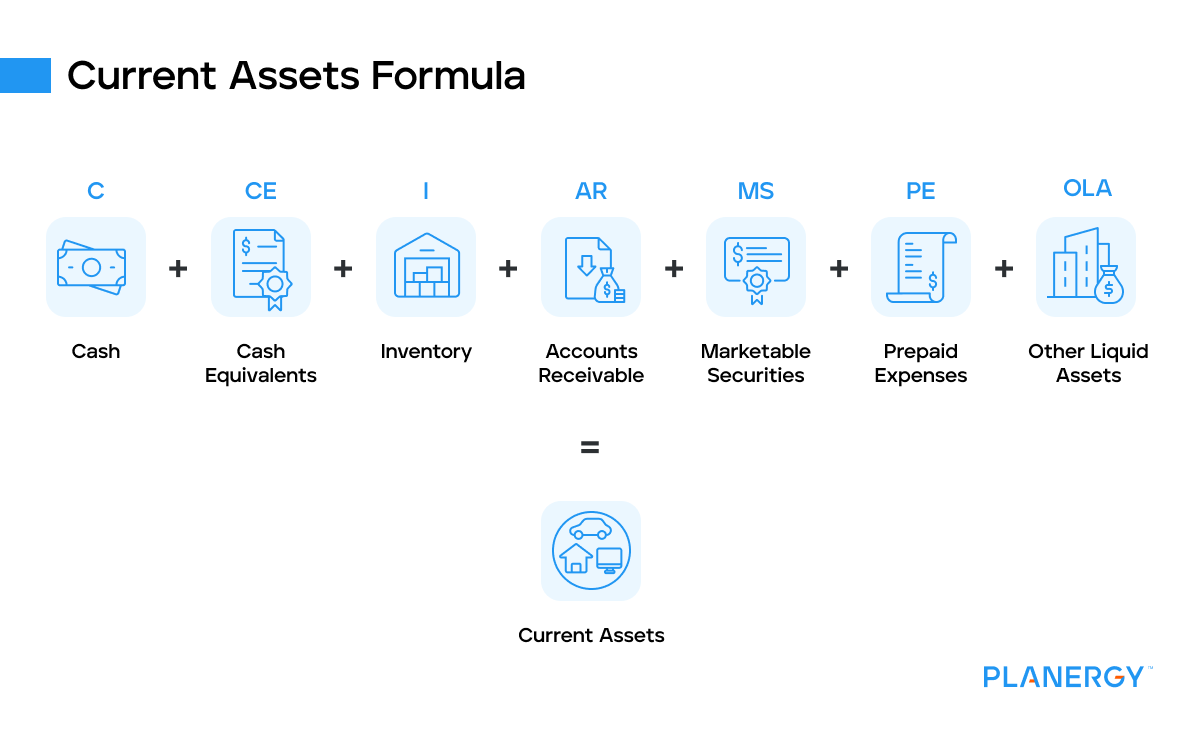

How to Calculate Using the Current Assets Formula

Current Assets = C + CE + I + AR + MS + PE + OLA

- C = Cash

- CE = Cash Equivalents

- I = Inventory

- AR = Accounts Receivable

- MS = Marketable Securities

- PE = Prepaid Expenses

- OLA = Other Liquid Assets

Let’s take a look at a real-world example of a company’s assets. SEC data for Amazon shows the following data in the assets section, in millions as of March 2022:

- Current assets:

- Cash and cash equivalents: $36,393

- Marketable securities: $29,992

- Inventories: $34,987

- Accounts receivable, net and other: $32,504

- Total Current Assets: $133,876

What’s the Difference Between Current Assets and Non-Current Assets?

While current assets are assets that can be easily converted to cash or consumed within a year, non-current assets are assets that have long-term value and are not typically used as a source of cash.

Examples of non-current assets include long-term investments and real estate (land and buildings) because they will retain their value and are not generally used to pay bills or short-term debts.

Non-current assets are also known as fixed assets and depreciate over time.

Depreciation is a method by which the expense of such assets is matched with the revenue they generate for the company over their useful lifespan.

These should not be confused with intangible assets – those that are not physical – such as patents, trademarks, brand, or copyrights.

Understanding Financial Ratios That Use Current Assets

Many professionals use financial ratios to understand the financial health of a company.

Current assets play an important role in three specific financial ratios, known as liquidity ratios:

Current Ratio: The Current Ratio is calculated by dividing the current assets of a business by its current liabilities. This ratio measures the company’s ability to pay its debts that are due within the year.

Quick Ratio: The Quick ratio is calculated by dividing the total amount of “quick” current assets by its total current liabilities. Quick assets are calculated by subtracting inventory and prepaid expenses from current assets.

Cash Ratio: The cash ratio is calculated by dividing cash and near cash current assets by total liabilities. Near-cash assets are those assets that are easily and quickly converted into cash.

Net Working Capital: This is calculated by subtracting current assets from current liabilities. If it is negative, you do not have enough funds to maintain business operations.

Other liquidity ratios do not use current assets as part of the calculation, such as days sales outstanding or DSO.

How Companies Use Current Assets

Generating Income

Current assets are integral to income generation. For example, a company sells its inventory to customers, which leads to sales revenue.

Similarly, companies can put their excess cash into marketable securities to earn interest or dividends.

Cash Flow Management

Current assets are pivotal in managing cash flow. By collecting accounts receivable on time, companies can enhance their cash inflow.

Conversely, companies can decrease their cash outflow by delaying expenditure on prepaid expenses or using supplies wisely.

Maintaining Liquidity

Current assets symbolize a company’s liquidity. A higher amount of current assets suggests greater short-term liquidity.

Businesses require liquid assets to fulfill short-term obligations, such as paying suppliers, employees, or lenders. Cash and cash equivalents, the most liquid assets, hold significant importance for maintaining liquidity.

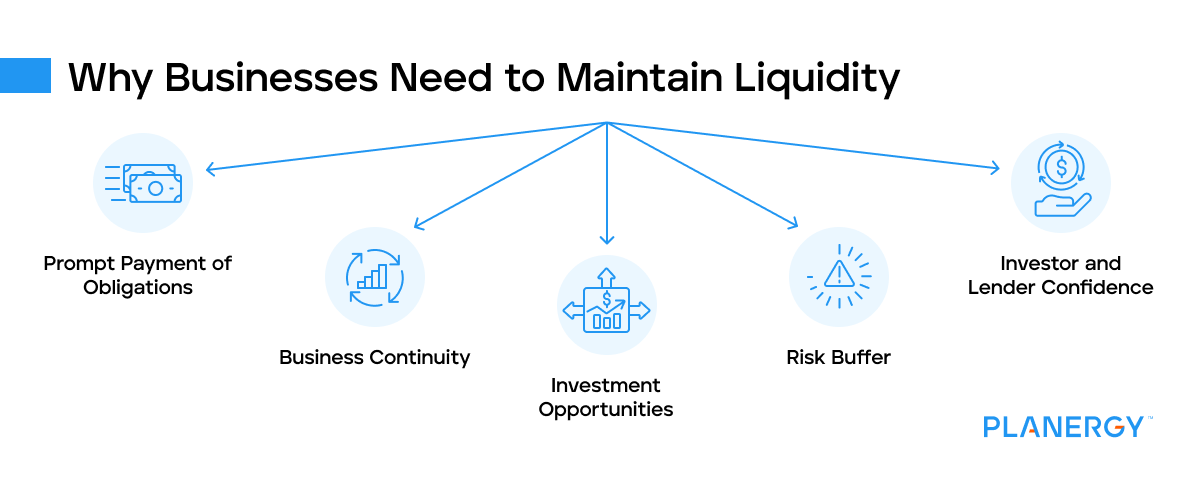

Why Businesses Need to Maintain Liquidity

Maintaining liquidity is crucial for businesses for several reasons:

Prompt Payment of Obligations

Liquidity ensures that a business can meet its short-term obligations, such as salaries, rent, utilities, and loan repayments.

Failure to meet these liabilities could harm the company’s reputation and lead to legal issues or even insolvency.

Business Continuity

Having readily available funds allows a business to continue its day-to-day operations smoothly, including purchasing inventory, investing in marketing, and other operational expenses.

Without adequate liquidity, a business may struggle to perform these basic functions, impacting its ability to generate revenue.

Investment Opportunities

A liquid business is better positioned to seize investment opportunities that may arise, such as acquiring assets, expanding into new markets, or investing in research and development.

These investments can fuel future growth.

Risk Buffer

Liquidity acts as a buffer against unforeseen risks or economic downturns.

In times of financial stress, having accessible cash or liquid assets can mean the difference between surviving or going out of business.

Investor and Lender Confidence

High liquidity levels can boost the confidence of investors and lenders in the business’s financial stability, making it easier to attract investment or secure loans.

Final Thoughts

Current assets, including cash and cash equivalents, marketable securities, accounts receivable, inventory, prepaid expenses, and other current assets, play a vital role in understanding a company’s financial health.

They provide the lifeblood of an organization’s daily operations, offering a clear snapshot of its liquidity and operational efficiency.

As we’ve explored, these assets are not just figures on a balance sheet. They’re dynamic elements that can shape a company’s strategic decisions, influence its cash flow, and ultimately drive its success.

For business owners and financial professionals, a firm grasp on current assets is not just beneficial—it’s essential.

Start by regularly reviewing your company’s balance sheet or those of companies you’re interested in. Look at the different types of current assets and how they fluctuate over time.

Pay attention to the ratios involving current assets, such as the current ratio (current assets divided by current liabilities), which provides insight into a company’s short-term financial strength.