Accounting is a pivotal part of day-to-day school operations.

From tracking tuition payments to managing budgets and grants, schools handle complex financial landscapes that require transparency and precision.

Accounting software is a vital tool that helps institutions streamline financial management, maintain regulatory compliance, and improve accountability.

Choosing the right software is critical because educational institutions operate under unique constraints.

The wrong choice could ruin efficiency. So, here, we’ll explore the must-have features to look for, as well as 10 of the top solutions out there.

Why Educational Institutions Need Accounting Software

Schools, colleges, and universities manage significant sums of money daily.

Tracking these funds using manual data entry or outdated systems isn’t just time-consuming but increases the risk of errors and financial mismanagement.

The software helps with:

Financial Management

The software uses detailed tracking and automated processes to ensure that every dollar received and spent is accounted for accurately.

Compliance

Most educational institutions are subject to specific financial regulations and reporting requirements.

Accounting tools offer features designed to make compliance management easier.

Transparency

Automated reporting allows stakeholders like government agencies, school boards, and donors to see clear and accurate insights.

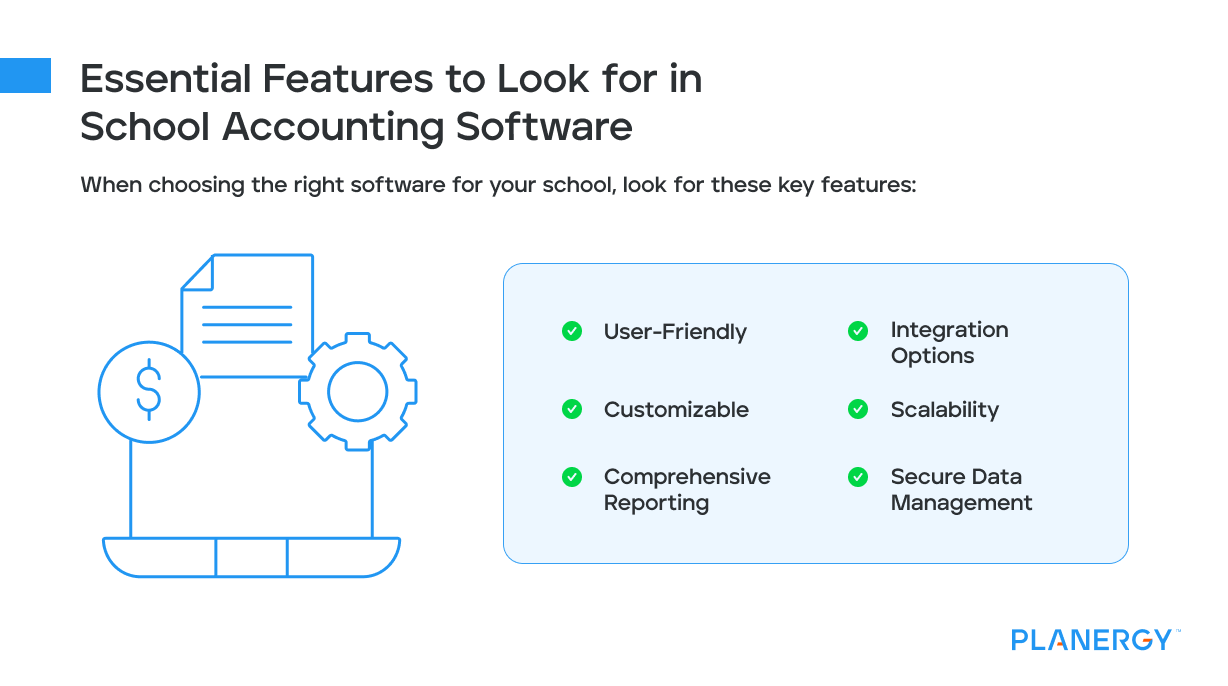

Essential Features to Look for in School Accounting Software

When choosing the right software for your school, look for these key features:

User-Friendly

The platform must be easy to navigate and understand for all users. Getting the staff to use it won’t be easy if it’s challenging to use.

Even those with limited computer knowledge or skills should be able to use the tool efficiently.

Most tools online today provide extensive help and support documentation like how-to guides and webinars, but consider investing in additional training at onboarding to ensure your staff is well-equipped.

And make sure customer support is responsive so that if you do run into issues, you can get them solved quickly.

Customizable

Every school has unique needs, so any tool must be customizable to meet your needs.

A private school will need a tuition payment tracking system, whereas a public school won’t.

Comprehensive Reporting

The more detailed the reports, the better.

Look for options like income statements, budget analysis, and grant usage summaries.

Integration Options

To save time and simplify things, you need software that seamlessly integrates with other systems you’re already using, such as student information systems, payroll, and payment gateways.

Scalability

Accounting software should grow alongside your organization, adapting as operations increase in complexity and volume.

Scalability ensures you don’t face limitations a few years down the line and can avoid the costly process of switching to new software.

Secure Data Management

Make sure your chosen option has enhanced security measures to protect insensitive personal and financial data.

Data breaches are expensive and damage trust.

Implementing accounting software in schools is more than just simplifying bookkeeping—it’s about empowering educational institutions to allocate resources efficiently, enhance compliance, and drive greater transparency for stakeholders.

Top 10 Accounting Software Solutions for Educational Institutions

Blackbaud Financial Edge NXT

Designed for educational organizations and nonprofits, Financial Edge NXT is excellent for fund accounting and compliance.

It offers strong reporting tools and integrates with other Blackbaud products.

Pricing information isn’t publicly listed, but multiple sources report midrange pricing.

Key Features and Benefits

- Specialized functionality for grant management.

- Real-time budgeting tools.

- Access to tailored dashboards for performance tracking.

- Separate modules for tuition management and K12 school management.

Sage Intacct

Sage Intacct is a versatile solution known for its advanced reporting and automation.

Designed for growing organizations, it meets the needs of schools managing complex finances.

It’s best for mid-sized to large institutions or multi-academy trusts (MATs).

Pricing is customized based on your school’s needs. You must book a demo to learn more.

Key Features and Benefits

- Advanced dashboards for real-time financial insights.

- Tailored grant accounting and fund management.

- Simplified adherence to financial regulations and audit management.

- Automated payment processing, revenue recognition, and more.

Intuit QuickBooks

Most well-known for small businesses and enterprises, QuickBooks offers several versions, both cloud-based and desktop.

In recent years, they’ve added features specific to nonprofits that can help those in the education sector.

With it, you can accept donations, connect donation apps, track grants, and more. It works well for smaller schools and programs, though plans scale as you grow.

Pricing varies depending on the plan and features, ranging from $35 to $235/month before the optional payroll add-on and any promotional discounts that are subject to change at any time.

The payroll add-on costs an additional $50 to $130/month, with $6 to $11 per employee, depending on the plan.

Key Features and Benefits

- Affordable and cost-effective plans for school districts.

- Scalable to grow with your institution’s needs.

- Seamlessly integrates with payment gateways for online payments and payroll systems.

- Simple customization for tracking budgets and generating compliance reports.

Tipalti

Tipalti is a comprehensive financial management software that simplifies and automates global payment processes.

It’s ideal for managing complex vendor payments, grants, and partnership funding while ensuring compliance with financial regulations.

Pricing starts at $99/month, but the two higher tiers offer customized pricing to meet your needs.

Key Features and Benefits

- End-to-end payment automation

- Compliance and risk management

- Scalability

- Multi-currency and global payments

- Custom reporting and analytics

NetSuite ERP

NetSuite ERP is a popular cloud-based enterprise resource planning solution for streamlining financial and operation management.

Its vast integration capabilities make it highly valuable for educational institutions, especially MATs, that must manage budgets, grants, and multi-campus operations.

Key Features and Benefits

An integrated financial management system combines budgeting, accounting, and reporting in a single platform to reduce silos and improve accuracy.

Adapts to the needs of growing institutions, whether adding new campuses or expanding academic programs.

Grant and fund management tools to simplify financial reporting for grant-funded projects.

Xero

Xero is a cloud-based accounting software known for its user-friendly interface and adaptability.

It’s ideal for schools, colleges, and other educational organizations looking to streamline bookkeeping, budget management, and reporting.

Xero offers three pricing plans, but the bottom two options don’t provide project tracking or expense management (unless you add the features for an additional monthly fee), which is crucial for educational institutions.

You can expect to pay $80/month after any promotional deals.

You also have the option to add the Inventory Plus module for an additional $39/month.

Key Features and Benefits

24/7 access to financial data, supporting remote work and collaboration across departments.

Simplifies complex financial tasks, making it accessible even for those with limited accounting expertise.

Connects with various third-party apps to automate processes such as payroll, invoicing, and expense tracking.

Provides up-to-date reports for better budgeting and financial planning.

Speeds up routine processes like bank reconciliations and invoice creation, reducing administrative workload.

MIP Fund Accounting

MIP Fund Accounting is a specialized accounting software tailored to nonprofit and government organizations, making it perfect for the educational sector.

Its focus is on fund tracking, compliance, and detailed reporting. You can choose from cloud-based or on-premise installation.

Pricing information isn’t available. You must request a demo to learn more.

Key Features and Benefits

Core accounting functionality – general ledger, accounts receivable (AR), accounts payable (AP), bank reconciliation, etc.

Option to run integrated payroll and HRMS in-house.

Helps meet reporting requirements and adhere to financial regulations with built-in compliance support for fundraising, grants, etc.

Provides custom reports and dashboards for clear budget performance and financial health insights.

Adapts to the needs of growing enrollment, supporting multi-program or multi-campus operations.

Simplifies the accounting and reporting of grant funding.

FreshBooks

Like QuickBooks and Xero, FreshBooks is a cloud-based accounting solution for small to medium-sized businesses.

But, it too, can be helpful for smaller educational institutions looking to simplify financial management.

Though cheaper plans are available, the premium plan, which is recommended for businesses with employees, is $60/month.

Institutions requiring more than what’s in that plan can talk to a consultant about the Select plan, customized based on your needs.

Key Features and Benefits

Simplifies the creation and management of invoices for various services and payments.

Automates the tracking of expenses, ensuring clear and accurate records.

Enables financial data to be accessed and updated from anywhere.

Tracks billable hours for projects or grants with precision.

Offers insights into financial performance with tailored reports.

Ellucian

Ellucian is a tailored software solution for educational institutions, offering seamless financial and student information system integration.

It supports comprehensive financial planning while simplifying administrative processes.

With its focus on higher education, Ellucian helps institutions enhance efficiency, maintain data accuracy, and make informed decisions.

Pricing isn’t publicly listed. You’ll need to request a demo and inquire to learn more about costs.

Key Features and Benefits

Connects financial processes with student data for streamlined management.

Facilitates accurate budgeting and long-term financial strategy development.

Provides detailed financial and operational insights tailored to institutional needs.

Ensures secure data management with scalability to support growth.

Reduces administrative workload through automated financial processes.

Synergetic

Synergetic is an all-in-one management system for educational institutions, integrating financial data with student information systems.

It helps schools and colleges streamline administrative and financial operations while ensuring accurate and efficient record-keeping.

Key Features and Benefits

Combines student, staff, and financial data into a single platform for seamless management.

Offers detailed, customizable reports to support data-driven decisions.

Simplifies accounting tasks, including budgets, payroll, and fee collection.

Designed for ease of navigation by both administrators and staff.

Adapts to the needs of growing institutions, supporting multiple campuses.

How to Choose the Right Solution for Your Needs

Define Budget and Goals

Establish what you need from the software and what you can afford to spend on it.

Consider both the initial costs, such as licensing fees or setup charges, and ongoing expenses, like subscriptions and support services.

Factor in potential upgrades as your institution grows.

Having a budget in place narrows down your options and ensures you don’t overcommit financially.

Knowing what you need the software to do or to help you accomplish ensures you don’t waste time and energy on solutions that won’t meet your needs.

Talk With Your Staff

Your staff will use the software frequently, so their input is vital.

Talk to administrative, finance, and IT teams to understand their pain points and must-have features.

Finance teams might emphasize flexible reporting tools, while IT departments prioritize integration capabilities.

Getting input from everyone ensures you choose software that meets optional needs while reducing resistance during implementation.

Take Advantage of Demos

Most software providers offer demos or trial periods—take full advantage of these.

Use this opportunity to explore functionality, test ease of use, and gauge how the software integrates with your current systems, like student information systems or payroll platforms.

Encourage key staff to participate in the demo to get a variety of perspectives.

Streamlining Operations with Accounting Software

Adopting accounting software goes beyond basic bookkeeping. Using these tools, schools can:

- Automate repetitive tasks

- Produce accurate financial statements

- Better allocate resources

Your school can achieve operational harmony by integrating them with existing systems, such as student information or HR management tools.

For example, automating tuition payment tracking with a student records system simplifies administrative workflows and reduces redundancy.

What’s Next for Accounting Software in Education

Though no one can predict the future accurately, within the next three to five years, we can expect to see things like:

Adoption of AI-Driven Financial Tools

Today, more institutions use AI tools to automate budgeting, payroll, and expense tracking.

This reduces human error and allows for real-time data analysis to spot cost-saving opportunities and inefficiencies.

AI streamlines decision-making and ensures resources are allocated effectively for schools and universities handling complex funding and grants.

Greater Focus on Sustainability Reporting

Stakeholders are demanding transparency about institutions’ environmental and societal impact.

Accounting departments in the education sector will need to incorporate sustainability metrics into their reporting.

This shift involves tracking energy usage, waste management, and community contributions.

By aligning with global sustainability goals, institutions can attract eco-conscious donors, students, and partners, while meeting regulatory requirements.

Blockchain Integration for Transparency and Security

Blockchain technology is revolutionizing how financial data is stored and verified.

It allows tamper-proof records, securing sensitive information like tuition payments, grants, and endowments.

Adopting this technology enhances transparency since it offers detailed transaction histories that stakeholders and auditors can trust.

Regardless, one thing is for sure: Schools will continue to demand smarter, faster, and more secure financial tools.

PLANERGY’s Role in Optimizing Accounts

PLANERGY takes financial management to the next level by offering AP automation tailored to academic institutions.

Its ability to integrate with existing accounting systems ensures a smooth transition to automated invoicing and payment processes, reducing workload and increasing accuracy.

Even if you don’t see your accounting software on our integrations list, custom integrations are available to ensure you can seamlessly add PLANERGY to your workflow.

With real-time tracking and reporting, PLANERGY’s tools are perfect for boosting efficiency in school finance departments.

Transform Your Financial Operations Today

Choosing the right accounting software can make a world of difference for educational institutions.

Schools can enhance financial transparency, stay compliant, and achieve better outcomes by adopting tools designed specifically for the sector.

Don’t wait—invest in the right solutions today to prepare for tomorrow’s opportunities!