In the complex finance and supply chain world, a seamless flow of financial resources is crucial for business stability and growth.

If you’re a financial professional, supply chain manager, or business owner, understanding FSCM could be your game-changer.

We’ll explore FSCM in-depth, looking at its goals and benefits and showing how it can improve liquidity, reduce costs, improve financial health, and ultimately secure your financial future.

Understanding Financial Supply Chains

The financial supply chain refers to money movement between various stakeholders in the supply chain, from suppliers to manufacturers, retailers, and consumers.

The flow includes the order-to-cash process, payments for goods and services, working capital management, and credit terms.

The financial supply chain is distinct from the physical supply chain, which handles the flow of goods and services but is an equally important ecosystem.

Financial resource mismanagement can cause delayed payments, cash flow issues, and business failure.

Managing your financial flows is critical to maintaining smooth business processes and operations.

What is FSCM?

Financial supply chain management involves optimizing the financial processes related to the supply chain. It focuses on improving the efficiency of financial transactions, reducing costs, and enhancing liquidity.

FSCM aims to streamline the flow of financial resources, ensuring businesses have the right amount of cash at the right time to meet their obligations.

The Goals of FSCM

The main objectives revolve around enhancing financial health while reducing risks for full business process optimization.

Improve Liquidity

This involves ensuring the company has sufficient cash flow to meet its short-term obligations, such as paying suppliers, employees, and other operational costs.

Adequate liquidity is crucial for maintaining smooth business operations and avoiding financial distress.

Some strategies to improve liquidity include:

Efficient Accounts Receivable Management: Speeding up the collection of receivables can quickly convert sales into cash.

Optimizing Inventory Management: Reducing excess inventory frees up cash tied up in unsold goods.

Short-Term Financing Solutions: Short-term financing options like lines of credit can provide immediate access to cash when needed.

Cash Flow Forecasting: Regularly forecasting cash flow helps anticipate shortfalls and plan for necessary financing.

Cost Reduction

Reducing costs means lowering transaction costs and minimizing the need for expensive financing options.

This can help the company allocate resources more efficiently and improve profit margins.

Effective cost-reduction strategies include:

Negotiating Better Terms with Suppliers: Securing favorable payment terms or discounts can reduce procurement costs.

Streamlining Operations: Implementing lean processes to eliminate waste and improve efficiency.

Automating Routine Tasks: Using technology to automate repetitive tasks can reduce labor costs and increase accuracy, such as purchase orders or the entire procure-to-pay and cash cycle.

Reviewing Financing Options: Opting for low-interest loans or grants instead of high-cost financing options can save significant interest payments.

Financial Health Enhancement

Enhancing financial health involves strengthening the company’s overall financial stability by effectively managing debts and credits.

A financially healthy company is better positioned to withstand market uncertainties and capitalize on growth opportunities.

Key actions to enhance financial health include:

Debt Management: Refinancing high-interest debt with lower-cost options and prioritizing the repayment of high-interest obligations.

Credit Management: Monitoring and improving the company’s credit rating to secure better financing terms in the future.

Building Reserves: Setting aside funds in a reserve account to cover unexpected expenses or downturns.

Regular Financial Analysis: Continuously analyzing financial statements to identify issues early and make informed decisions.

Risk Reduction

Risk reduction entails mitigating financial risks associated with supply chain operations and disruptions, market volatility, and credit defaults.

Effective risk management ensures the company remains resilient despite potential challenges, and when implemented correctly, FSCM can even reduce risk across the global supply chain.

Strategies for risk reduction include:

Diversifying Supply Chains: Relying on multiple suppliers from different geographic locations can reduce the impact of any single disruption.

Hedging Against Market Volatility: Using financial instruments like futures and options to hedge against price changes in key commodities.

Credit Risk Management: Conducting thorough credit checks on new customers and setting appropriate credit limits to minimize the risk of defaults.

Insurance Coverage: Ensuring adequate insurance coverage for critical business areas to protect against unforeseen events.

Key Components of FSCM

Accounts Payable Management

Accounts payable is a critical component of FSCM. It involves managing the company’s obligations to pay its suppliers.

Effective accounts payable management ensures that payments are made on time, avoids late fees, and maintains good relationships with suppliers.

One key strategy in accounts payable management is negotiating favorable credit terms with suppliers.

This can help extend payment periods, allowing the company to manage its cash flow more effectively.

Businesses can take advantage of early payment discounts offered by suppliers to reduce costs.

Accounts Receivable Management

Just as important as managing what you owe is managing what you are owed.

Accounts receivable management ensures that the company collects customer payments on time.

Delays in receiving payments can lead to cash flow problems and affect the company’s ability to meet its obligations.

Implementing efficient invoicing processes and following up on overdue payments are essential for accounts receivable management.

Businesses can also offer incentives for early payments to encourage customers to pay on time.

Cash Management

It involves monitoring and optimizing the company’s cash flow to ensure that there is always enough liquidity to meet its obligations.

Cash management strategies may include forecasting cash flows, managing short-term investments, streamlined invoice reconciliation, and optimizing the use of working capital.

One effective tool for cash management is cash flow forecasts.

Businesses can better plan their finances and avoid liquidity crises by predicting future cash inflows and outflows.

Optimizing working capital by managing inventory levels and credit terms can significantly improve cash flow.

Benefits of FSCM for SMEs

Small and medium-sized enterprises (SMEs) can benefit greatly from implementing FSCM practices.

Capital Access

Improved Creditworthiness: FSCM involves the meticulous management of finances, which helps SMEs build a strong credit profile.

Accurate and timely financial reporting demonstrates reliability to lenders.

Efficient Financial Management: By showcasing effective financial practices, SMEs can attract favorable financing terms.

Lenders are more inclined to offer credit to businesses with sound financial health.

Access to Diverse Funding Sources: With a solid FSCM strategy, SMEs can explore funding options beyond traditional bank loans, including trade credit, invoice financing, and supply chain financing.

Efficiency

Cost Savings: SMEs can reduce operational costs by automating and optimizing financial workflows.

This includes minimizing manual entry errors and labor costs associated with repetitive tasks.

Operational Efficiencies: Efficient financial processes lead to faster transaction times and improved cash flow management.

This ensures that resources are utilized effectively and business operations run smoothly.

Enhanced Productivity: Streamlined financial processes allow staff to focus on strategic activities rather than administrative tasks, thereby boosting overall productivity.

Risk Mitigation

Avoid Potential Crises: By proactively identifying and managing financial risks, SMEs can avoid situations that could lead to financial distress or business failure.

This includes monitoring cash flow, credit risks, and market volatility.

Ensure Long-Term Sustainability: Effective risk management helps SMEs maintain stability and continuity, even in the face of unforeseen challenges.

This resilience is vital for sustaining growth and achieving long-term goals.

Enhanced Decision-Making: A robust risk management framework allows SMEs to make informed decisions based on accurate financial data, reducing the likelihood of costly mistakes.

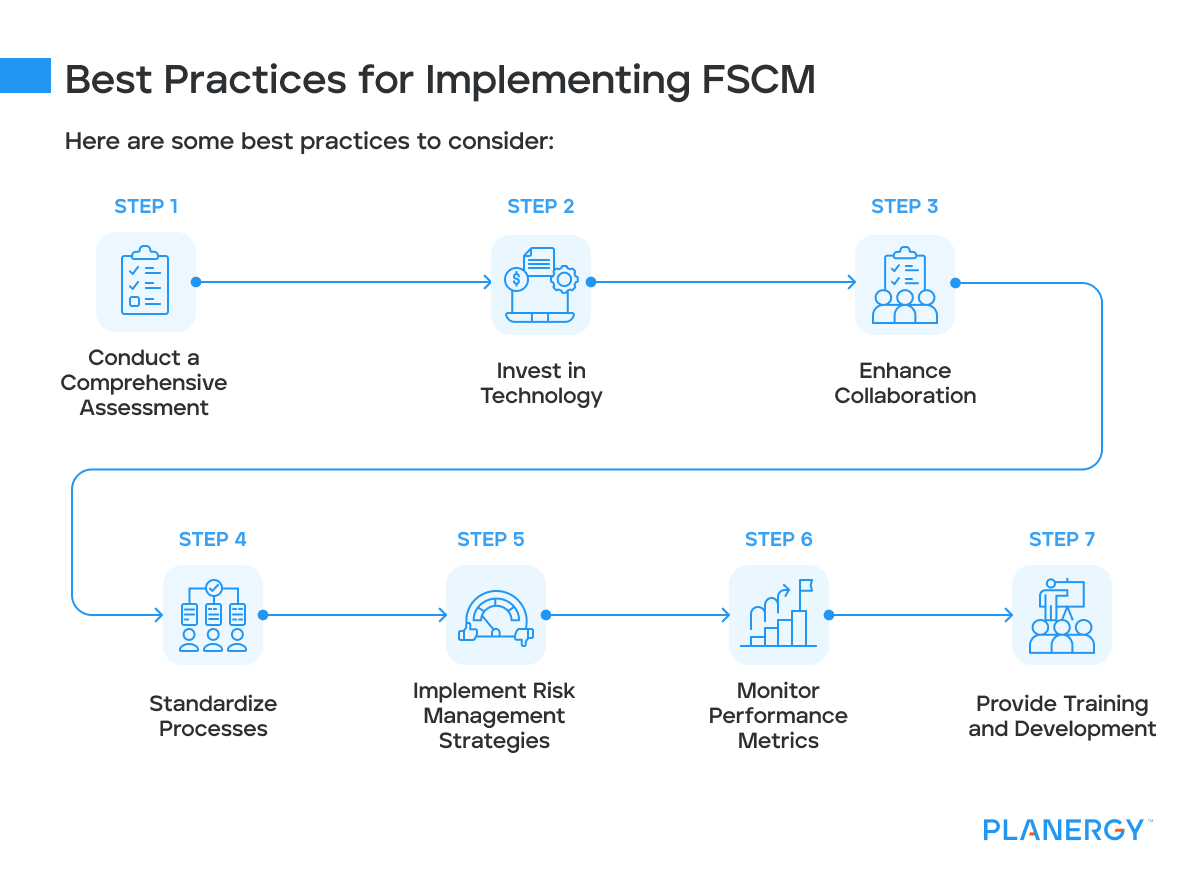

Best Practices for Implementing FSCM

Implementing Financial Supply Chain Management requires a strategic approach to optimize its benefits.

Here are some best practices to consider:

Conduct a Comprehensive Assessment: Evaluate your current financial supply chain processes. Identify inefficiencies, bottlenecks, and areas for improvement to develop a tailored FSCM strategy.

Invest in Technology: Leverage technology solutions such as enterprise resource planning (ERP) systems, automation tools, the blockchain, and analytics software.

These technologies enhance data accuracy, streamline operations, and facilitate real-time financial monitoring.

Enhance Collaboration: Foster open communication and collaboration with suppliers and other stakeholders.

Share financial insights and forecasts to build mutually beneficial relationships that promote trust and operational synergy.

Standardize Processes: Create standardized policies and procedures for financial transactions, invoicing, and payment processing.

Consistency in these processes minimizes errors and accelerates workflow.

Implement Risk Management Strategies: Regularly assess financial risks associated with suppliers and external market factors.

Establish mitigation strategies to support distressed suppliers and develop contingency plans to address potential supply chain disruptions.

Monitor Performance Metrics: Establish key performance indicators (KPIs) to track the effectiveness of your FSCM initiatives.

Metrics such as cash conversion cycle, days payable outstanding (DPO), and supplier payment terms can provide valuable insights for continuous improvement.

Provide Training and Development: Ensure that your finance team and key stakeholders are well-trained in FSCM principles and tools.

Continued professional development will enhance their skills and improve overall financial management within the supply chain.

Challenges in FSCM Implementation

Resistance to Change

Internal Stakeholders and Suppliers: Adopting new processes or technologies can disrupt established workflows, prompting reluctance to participate, which may stress supplier relationships.

Established Workflows: Changes in procedures may lead to discomfort and resistance among those accustomed to existing methods.

Collaboration Difficulties

Multiple Supply Chain Partners: Achieving genuine collaboration can be difficult due to varying degrees of financial literacy, differing priorities, and lack of communication.

Communication Barriers: Misaligned expectations and inadequate communication can hinder effective collaboration.

Data Integration and Management

Disparate Systems: Many companies operate with separate systems leading to data silos that obstruct visibility and accurate financial analysis across the supply chain.

Technology Investment: Addressing integration issues requires significant investment in technology and establishing robust data governance practices.

Regulatory Compliance and Security: Critical concerns include navigating the compliance landscape and ensuring the security of sensitive financial information.

Limited Resources

Smaller Businesses: SMEs may struggle to allocate sufficient financial and human resources, making developing and sustaining effective FSCM practices challenging.

Resource Allocation: Limited budget and manpower can impede progress and implementation efforts.

FSCM is a powerful tool for improving financial health and reducing business risks.

Optimizing cash flows, managing credit terms, and leveraging automation and analytics can help businesses achieve greater efficiency and stability.

Understanding and implementing FSCM practices can significantly enhance a company’s performance.

Investing in FSCM today can secure your business’s financial future and drive long-term success.