Part of owning a business is making sure that bookkeeping and accounting are completed properly.

Whether you have a completely automated system or still use manual ledgers, you should be familiar with full-cycle accounting, which encompasses all of the accounting processes and procedures that need to be completed monthly.

Do you know what full-cycle accounting is? If not, we’ll explain the entire process from identifying transactions to closing the books.

What is Full Cycle Accounting?

Full cycle accounting, also known as the accounting cycle, is the process used to record business transactions, including adjustments, produce financial statements, and then close the books for the accounting period.

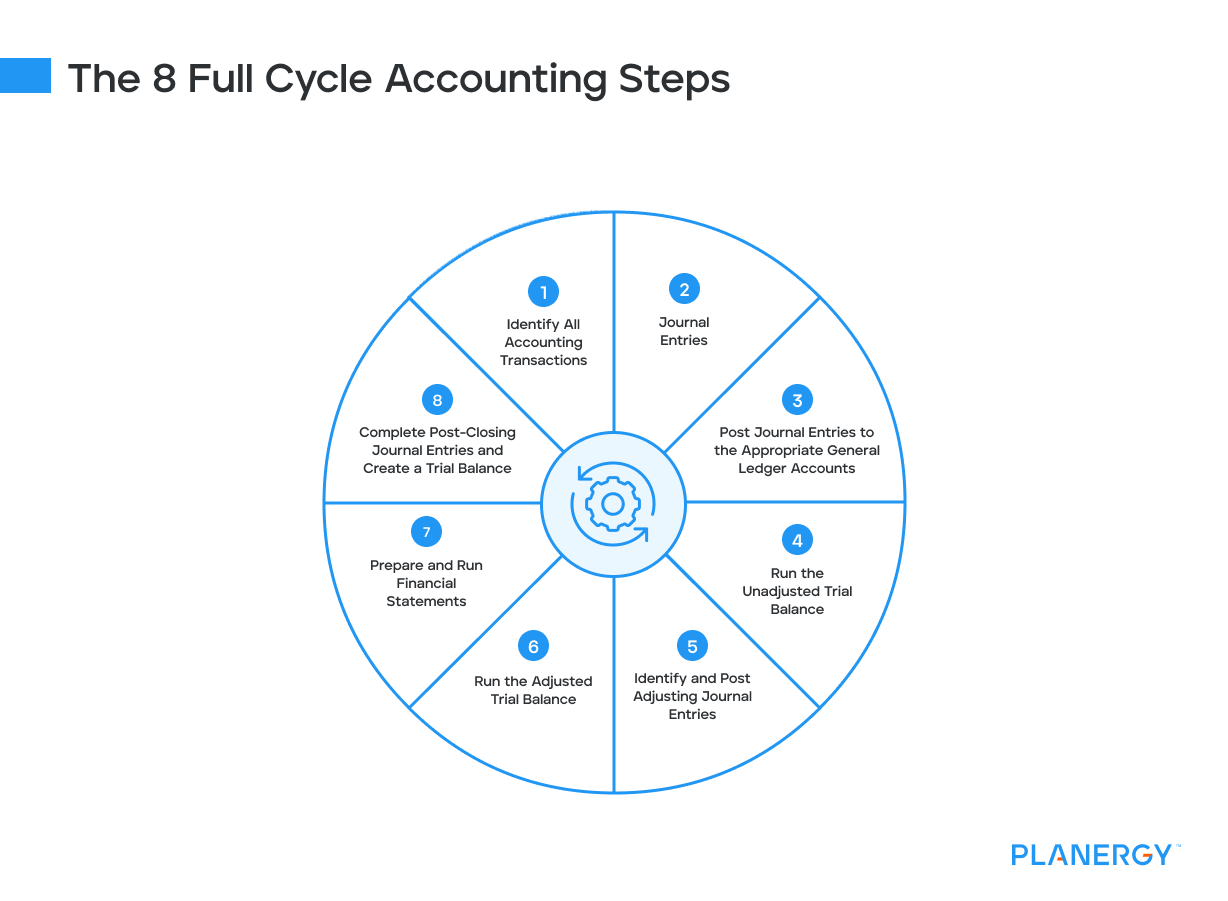

The 8 Full Cycle Accounting Steps

Full cycle accounting includes eight steps that should be followed at the end of the accounting period.

Some of the steps may vary depending on whether you’re using cash accounting, which records transactions when money changes hands, or accrual accounting, which records income and expenses when they occur.

These steps may also vary depending on if you’re using single-entry or double-entry accounting.

Most businesses will benefit from using double-entry accounting where there is a debit and a credit entry recorded for all accounting activity unlike the simpler single-entry accounting, which is maintained much like a standard checkbook.

Here are the eight steps to follow for full-cycle accounting:

Identify All Accounting Transactions

Any financial activity that a business conducts must be identified, preferably as the activity occurs.

For example, if you purchase $500 worth of office supplies from the office supply store, that expense should be recorded when the items are purchased.

Today, much of this is done by connecting your accounting software application with related bank and credit card accounts, which will automatically import your expenses, eliminating the need to enter them manually.

Journal Entries

Once the accounting transactions have been identified, you’ll need to prepare them to be entered.

When the journal entries are posted will depend on the accounting method your business is using.

If you’re entering journal entries into an accounting software application, remember to write down the information for the entry.

Doing so creates an audit trail which can be helpful should the transaction be questioned in the future.

If you’re recording these manually in individual subsidiary accounts, a reference to the account or transaction can be helpful, should you need to locate the backup information in the future.

Post Journal Entries to the Appropriate General Ledger Accounts

Before the accounting period can be closed, you’ll need to record the balances in the subsidiary accounts in the general ledger.

This ensures that the general ledger balance matches the balances in the subsidiary ledger.

Run the Unadjusted Trial Balance

The unadjusted trial balance can help you identify any potential errors, missed transactions, or other discrepancies.

For example, while reviewing the unidentified trial balance report, you note that your utility expenses seem too low.

While researching, you discover that the electric bill for the month was never posted.

The unadjusted trial balance also displays total debits and credits posted for the month and should always balance.

If it doesn’t, you’ll have to research why and correct the issue.

Identify and Post Adjusting Journal Entries

Along with any correcting entries, your also have several adjusting entries that will need to be completed.

These entries usually can include revenue deferrals, depreciation and amortization expenses, and expense accruals such as payroll.

Run the Adjusted Trial Balance

Once these entries are complete, you’ll need to run the adjusted trial balance.

This trial balance looks at all entries for the accounting period.

If the trial balance looks accurate, you can move on to running financial statements.

Prepare and Run Financial Statements

Now that all of the entries for the period have been posted, you can run your financial statements for the current reporting period.

The following three reports should be run; the balance sheet, the statement of cash flows, and the income statement.

The balance sheet provides a detailed summary of the financial position of a business as of a specific date, usually the last day of the accounting period.

The statement of cash flows provides a snapshot of incoming and outgoing cash throughout the period, as well as an ending cash balance.

Finally, the income statement provides a detailed list of income and expenses for the period, including any net profit or net loss.

While small, privately owned businesses can choose the financial statements they need, any publicly owned business is required to provide these three reports regularly.

Complete Post-Closing Journal Entries and Create a Trial Balance

With financial statements printed, you’re ready to complete your closing entries, which transfer account balances from your temporary accounts into a permanent account.

The balances on these accounts must be reset to zero when the accounting period is closed so that you have accurate totals going forward.

For example, if your temporary expense account isn’t reset to zero, the following month’s expense totals will be overstated.

Again, accounting software automates this process, so you don’t have to perform this manually.

Once this is complete, you can generate your post-closing trial balance.

Once Step 8 is complete, the accounting cycle starts over again for the next accounting period.

What Is the Main Purpose of the Accounting Cycle?

Even businesses using the latest technology need to keep track of financial transactions.

Following the steps in the accounting cycle helps keep financial reporting accurate by ensuring that all transactions are recorded properly and that debits and credits remain in balance at all times.

In addition, following the steps in the accounting cycle can enhance the decision-making process considerably, boosting the accuracy of your business decisions.

What Is the Difference Between Full-Cycle Accounting and General Bookkeeping?

The two processes are more similar than different, with general bookkeeping playing a large role in full-cycle accounting.

General bookkeeping is used to record a company’s financial transactions regularly.

A bookkeeper is generally responsible for recording purchases made and payments received.

General bookkeeping processes also manage receipts, prepare reports, and may also process accounts payable, handle accounts receivable and invoicing, and follow up and past due invoices.

Full cycle accounting is a process that is followed to help ensure that all of the aforementioned activities such as recording expenses and payments are entered accurately and the general ledger is in balance.

Full-cycle accounting also is tasked with recording accruals and adjustments, closing out subsidiary balance accounts, and preparing accurate end-of-month financial statements.

What Is the Difference Between the Accounting Cycle and the Budget Cycle?

The accounting cycle and the budget cycle play two important but very different roles for a business.

Accounting Cycle

The accounting cycle is a series of steps that is completed monthly.

The accounting cycle begins at the start of the accounting period and records all of the financial activity of the business for that period.

The steps in the accounting cycle also include posting any month-end adjusting entries such as accruals, depreciation expense, and deferred revenue.

The main purpose of the accounting cycle is to make sure that all of the transactions for the period have been entered and all adjustments made before running financial statements for the period.

Depending on your business, the accounting cycle may be monthly, quarterly, or at the end of the fiscal year and is repeated throughout the life of the business.

Budget Cycle

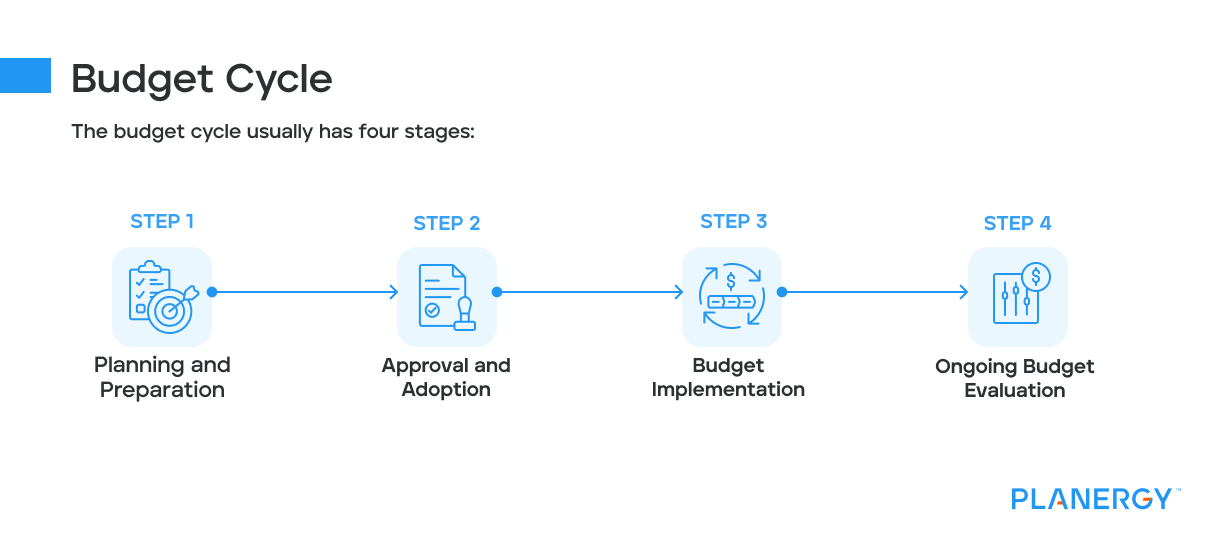

Budgeting plays just an important, albeit different role in a business. The budget cycle usually has four stages:

- Planning and Preparation – this stage includes the initial forecasting, setting objectives, and creating a financial plan.

- Approval and Adoption – After the budget has been completed, it must be approved by the various departments as well as the CFO and perhaps the company’s CPA.

- Budget Implementation – Once the budget has been approved, monitoring begins to ensure alignment with the financial goals and objectives.

- Ongoing Budget Evaluation – Part of the budget cycle is the continuous evaluation of the budget including budget versus actual to assess any variances and take corrective measures.

Unlike the accounting cycle, which is a set of processes in place to record transactions and maintain accuracy, the budget cycle is a forward-looking process that is used to help predict future financial performance.

How Does Full-Cycle Accounting Differ From Transactional Accounting?

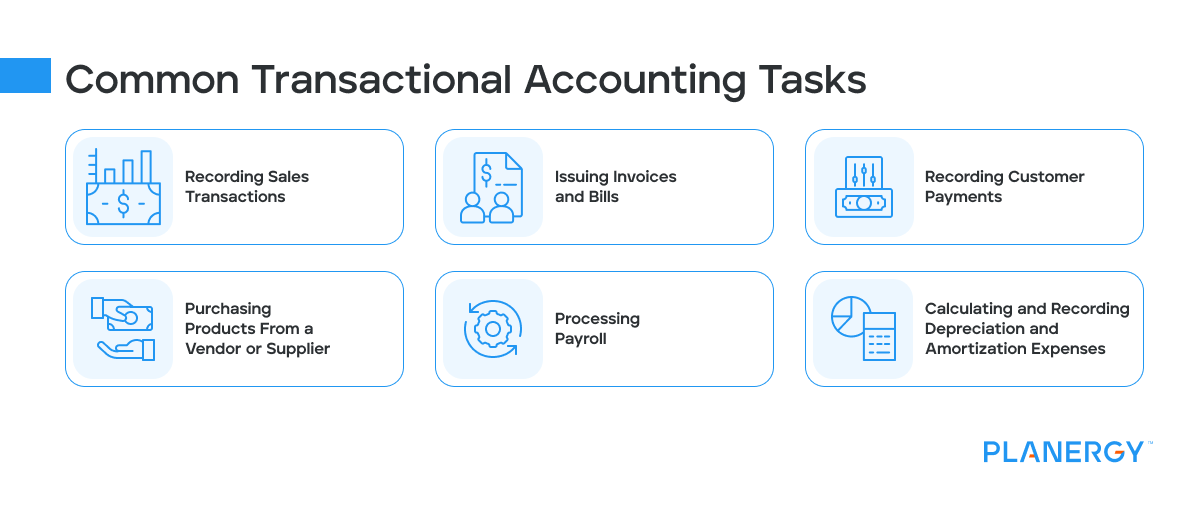

Before you can complete the accounting cycle, you must first complete transactional accounting.

Transactional accounting focuses on tracking and recording all financial transactions of a business, which is necessary for the first few steps of the accounting cycle.

Some of the more common transactional accounting tasks include:

- Recording Sales Transactions

- Issuing Invoices and Bills

- Recording Customer Payments

- Purchasing Products From a Vendor or Supplier

- Processing Payroll

- Calculating and Recording Depreciation and Amortization Expenses

Managing Full-Cycle Accounting

If you’re still using manual processes or Microsoft Excel for your business bookkeeping, it’s important to complete each step of the cycle accurately.

If even a single transaction is not recorded or a journal entry is not posted, your month-end financial statements will in inaccurate.

Accounting software and other related technology play a large role in the proper management of full-cycle accounting, making it the best way to handle all eight steps of the accounting cycle.

With automation doing most of the heavy lifting for you, the majority of steps in the accounting cycle are completed for you.

Why is the Accounting Cycle Important for a Small Business?

A lack of properly trained accounting staff or relying on manual processes alone can make a small business particularly vulnerable to financial inaccuracy, eventually impacting its financial health.

Using the accounting cycle, business owners can be confident that all financial transactions related to business activities have been posted into the general ledger during the correct accounting period.

The accounting cycle also ensures that all appropriate income and expenses are posted properly, keeps companies compliant with current tax laws, helps staff maintain a more efficient workflow, and produces timely, accurate financial statements.

It bears repeating that the best way to handle full-cycle accounting is to automate the process with accounting software.

While a very small business may be able to continue using manual processes, as your business grows and expands, the number of transactions that need to be posted increases and can quickly become unsustainable.

Using automation in your business also eliminates the need to manually post transactions into multiple subsidiary ledgers, eliminates the need to manually zero out those same accounts once the new accounting period begins, and can help understaffed accounting departments handle an influx of transactions easily and efficiently.

Whether you’re a small, one-person business or have a global presence, using full-cycle accounting is one of the best things you can do for your company’s financial health.