Metrics and KPIs are important for staying on top of accounting processes, including processing accounts payable.

While every business needs to pay bills, it’s how efficiently you process those bills for payment that can directly impact your business.

In fact, the more time you spend processing invoices, the more money you spend as well.

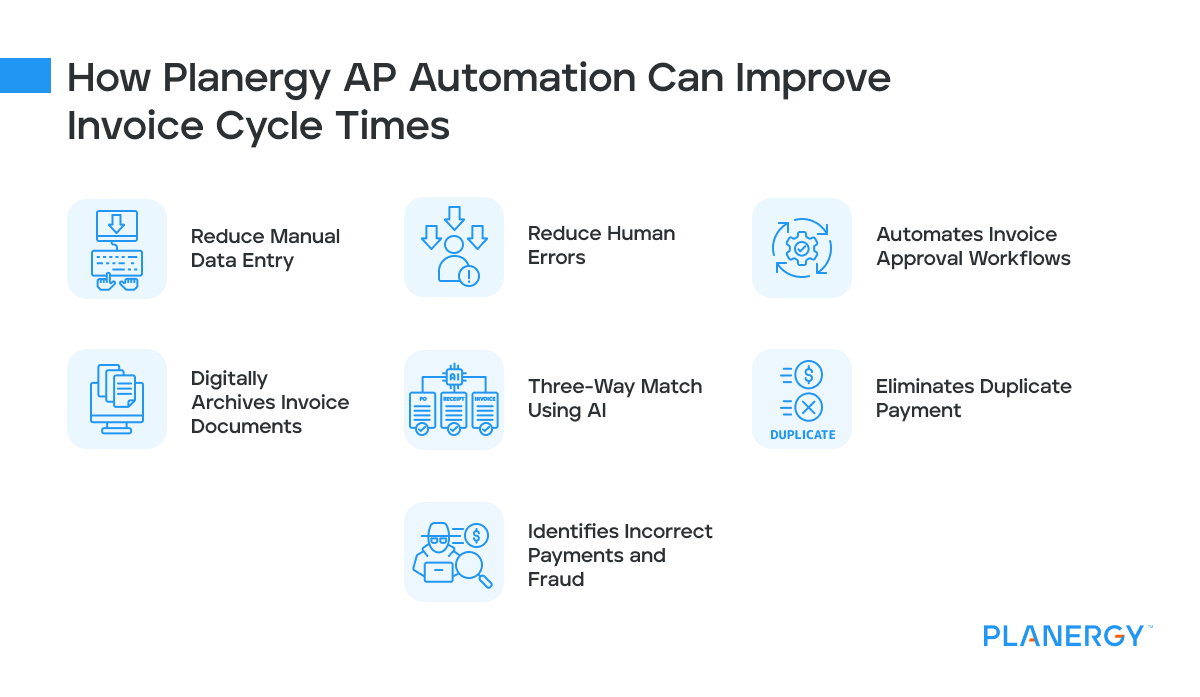

Every hour that your AP department spends copying invoices for processing, manually matching invoices with purchase orders and shipping receipts, and manually entering those invoices into the system once they have been approved, is an hour lost to more productive tasks.

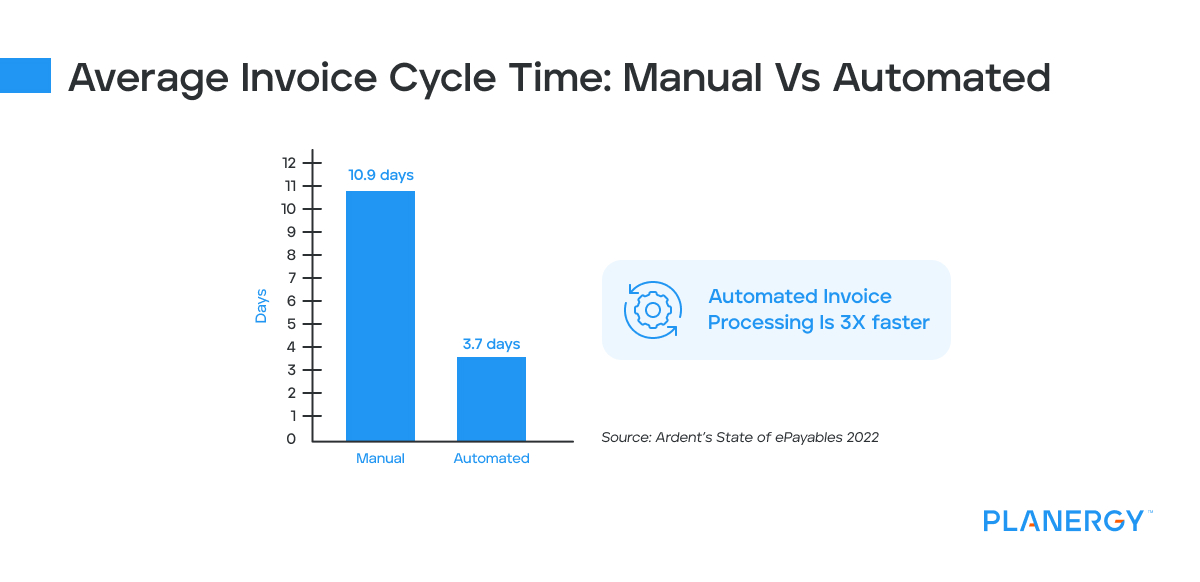

An automated accounts payable process can significantly reduce the number of hours required to process invoices manually.

Automation is also a must if you want to take advantage of early payment discounts as well as manage cash flow properly.

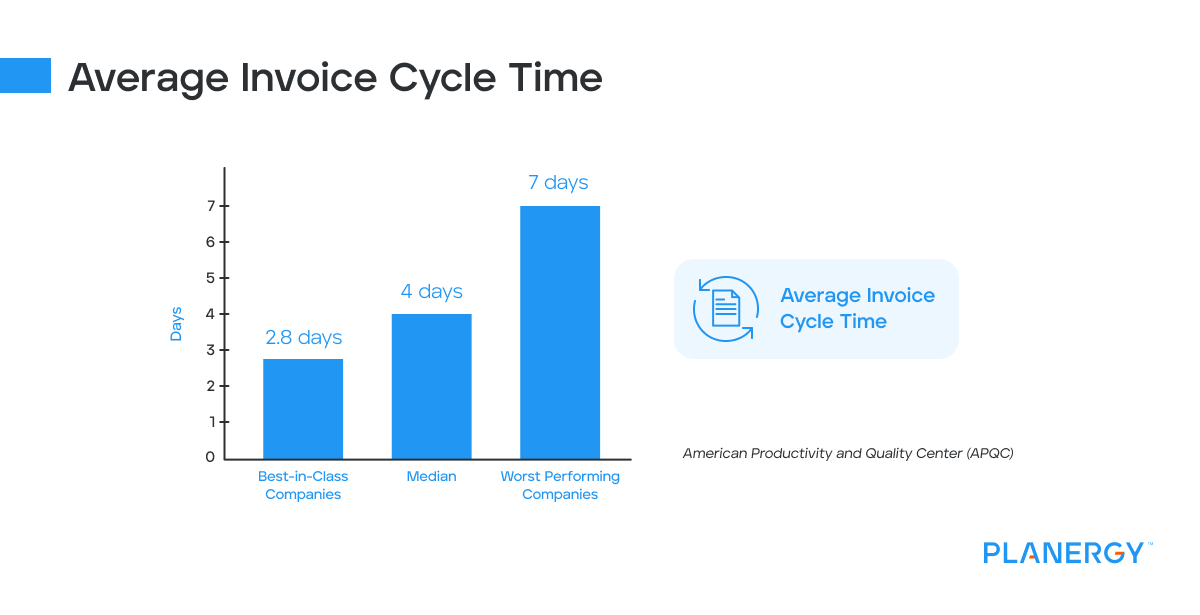

While the number of invoices you process daily directly impacts your invoice cycle time, the processes you’re currently using impacts that time even more.

But what exactly is invoice cycle time and why should you be concerned about this benchmark?