More businesses are embracing the latest technology, particularly in the accounts payable department where paper invoices are quickly becoming a thing of the past.

Today, the majority of invoices are received electronically via email, where they are presented in a variety of digital formats that include PDFs and scanned images.

But without the proper automation in place at your end, your invoice processing times will likely remain the same.

To cut down on processing times, many businesses have turned to a variety of solutions including automated invoice scanning software.

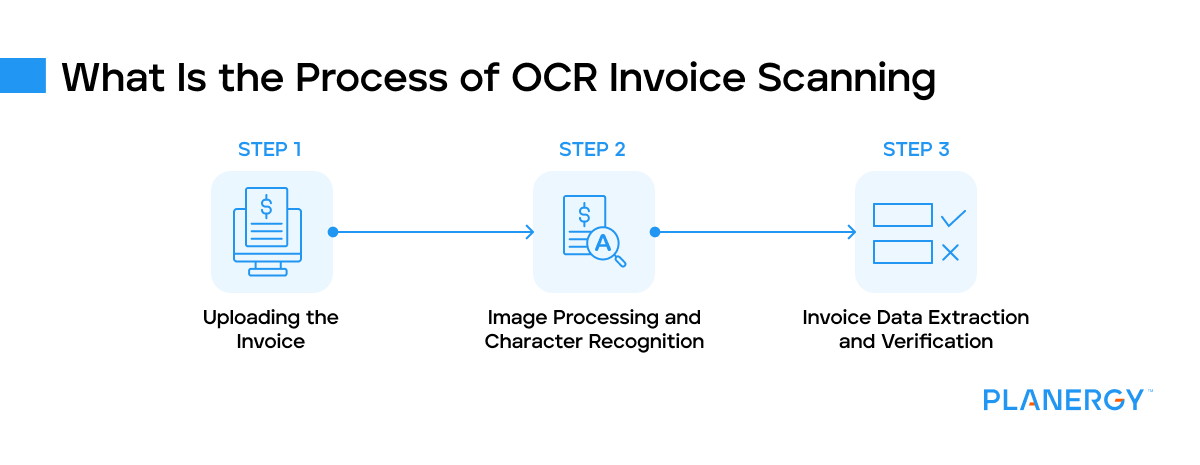

This software, powered by optical character recognition (OCR) and artificial intelligence (AI) allows AP departments to capture important data from vendor and supplier invoices received, later sharing that data with their ERP or accounting software solution.