Part of managing your business is having a system in place to record all financial activity.

Whether it’s paying a utility bill, purchasing laptops for your employees, or selling 1,000 baseball bats, it’s essential that any transaction that involves money, either coming in or going out, is recorded properly.

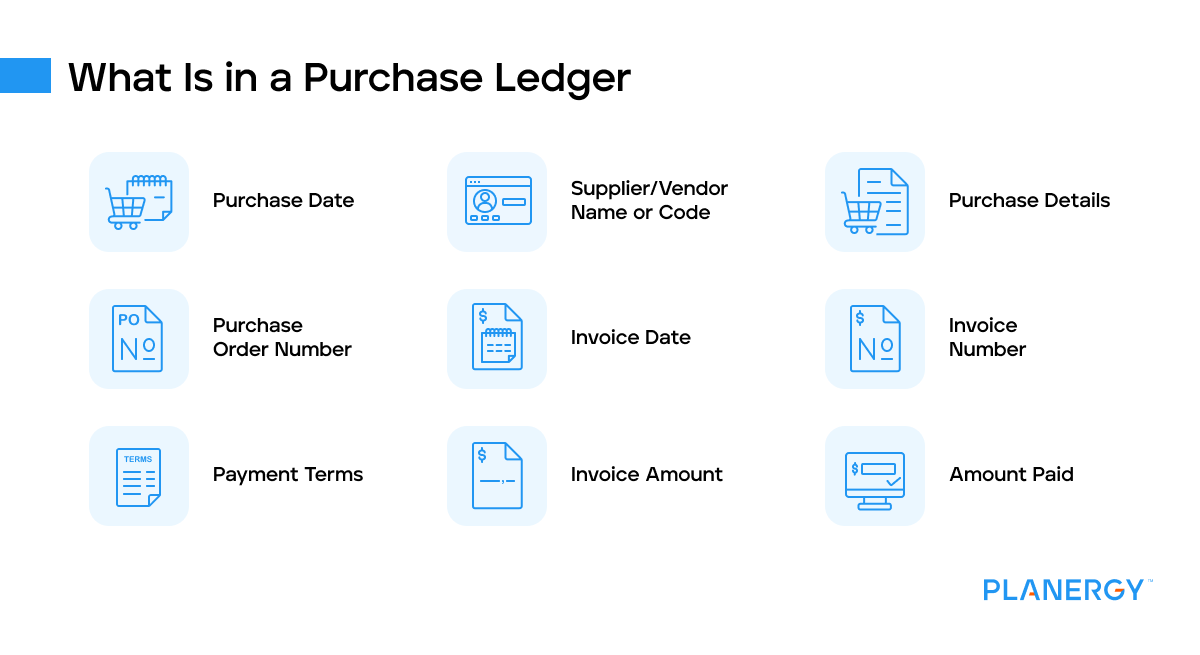

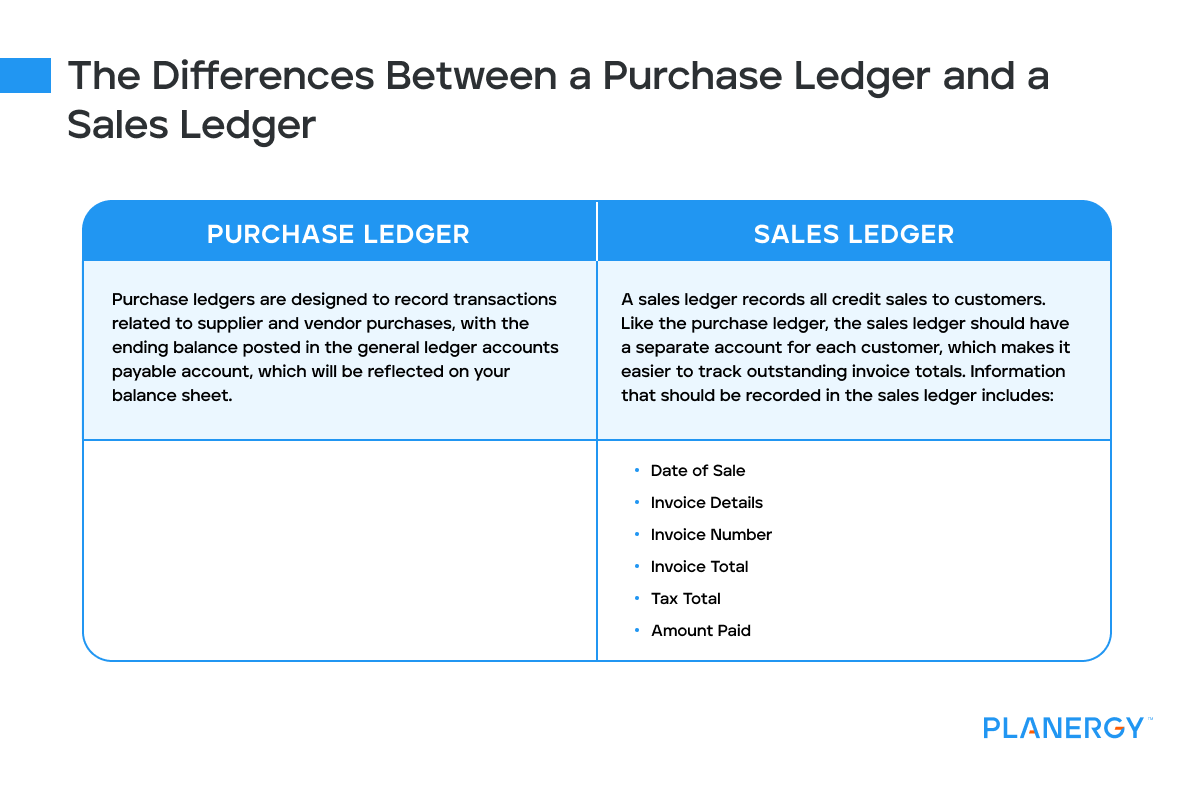

That’s why accounting ledgers are so important. Accounting ledgers like the purchase ledger, also known as a sub-ledger, are an important part of the double-entry bookkeeping process, providing a place for you to record your company’s purchases.

The purchase ledger also provides a complete accounting record of any related transactions such as money paid to vendors or a credit memo from a supplier or vendor.