Managing accounts payable is one of the most important tasks for any business.

In today’s economic fluctuations, controlling, tracking, and reporting on company spending has never been more important.

With PLANERGY’s integration with Sage Intacct, a cloud accounting automation software, Sage Intacct users can now link these two powerful systems to streamline the entire purchase order and accounts payable management system.

For businesses still deciding on accounts payable software, ERP, or accounting software application, we’ll provide an overview of Sage Intacct’s accounts payable module including key features and benefits you’ll derive from using this powerful software.

Next, we’ll explain how Sage Intacct interacts with other financial modules, the best way to optimize Sage Intacct for your business, and how the application can help you easily handle common AP challenges.

Finally, we’ll discuss how these two applications work together to provide you with a completely integrated, automated payables system.

Overview of Sage Intacct’s Accounts Payable Module

AP automation is the cornerstone of Sage Intacct’s accounts payable module, streamlining the entire AP process from purchase order to payment.

Using Sage Intacct, you can automate all of your workflows for greater departmental efficiency, which allows staff to focus more on analysis and less on repetitive tasks.

Key Features of Sage Intacct Accounts Payable

One of the key features of Sage Intacct Accounting is its use of AI.

This provides both AP workflow and accounts payable automation, including user access to automated bill entry where bill details are automatically extracted; prepopulating a draft of the bill for review.

The AI feature can correctly identify any vendor, the invoice amount, the invoice date, and all line item details.

Using AI, invoices are also auto-matched while flagging any duplicate transactions.

Key dashboards offer a detailed view of expenses for the month by preassigned category so you’ll always know exactly where your money is being spent while the accounts payable dashboard provides detailed information on total cash on hand, all operating expenses, and total accounts payable.

You can also view the Actual vs. Budget summary that provides information on both actual AP expenses and what was budgeted for that expense.

The open P.O. report provides details on all purchase orders that have not been converted to an invoice, and the vendor aging report provides details on funds due vendors including the amount, aging, and total due.

The accounts payable module in Sage Intacct also includes a spend management feature that alerts staff if the AP budget is exceeded, while the automated approval system will forward invoices to the correct staff for timely approvals, with management able to configure the approval process by role.

For example, if you require invoices exceeding a certain dollar limit to be subject to multiple approvals, you can include that in the rules that you establish.

Businesses with recurring bills can set up an automated pay bill system for bills where payment doesn’t change from month to month, such as rent or insurance.

Sage Intacct also provides a real-time total of cash available, this figure updating as bills are paid to always provide the most accurate available balance.

The application also offers multiple payment methods including credit card and ACH payments, reducing the time spent cutting, signing, and mailing checks.

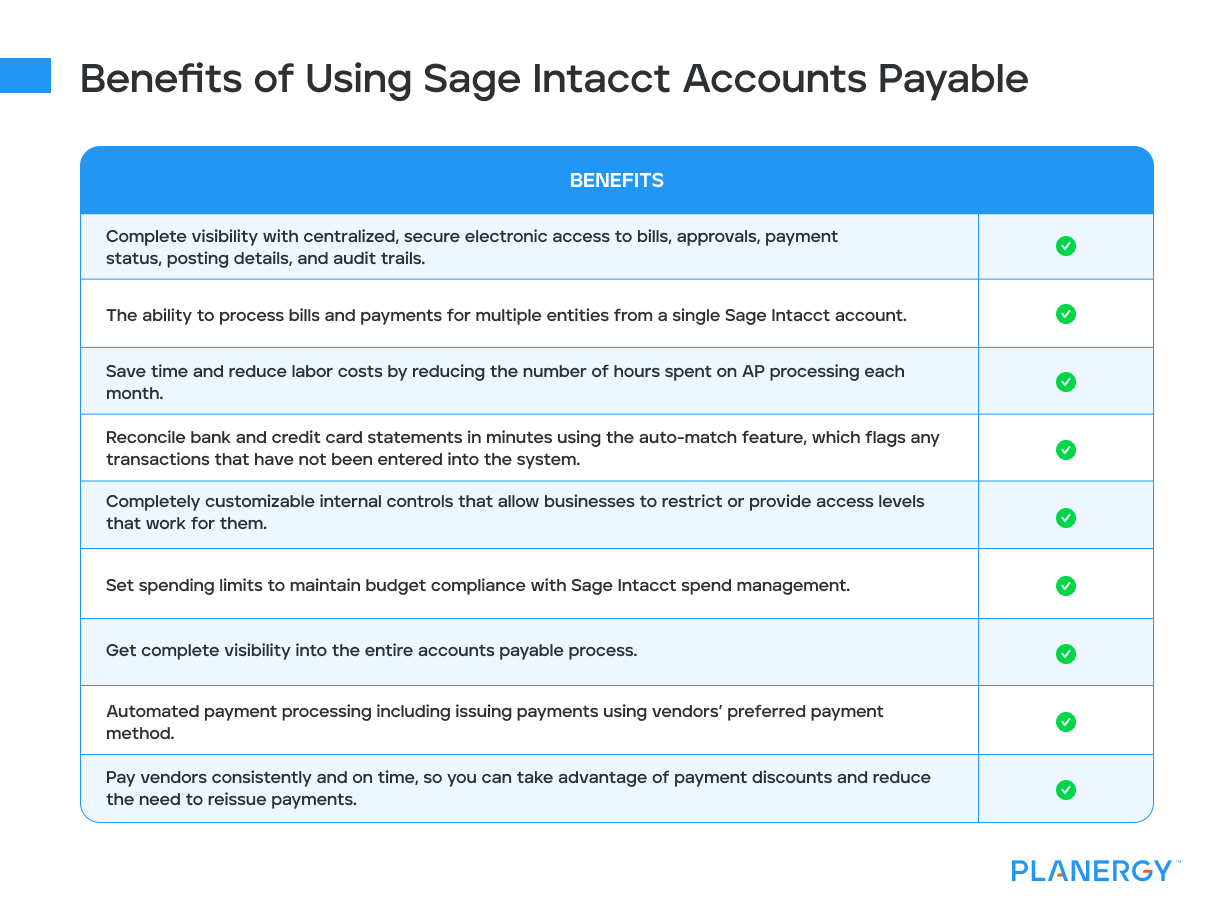

Benefits of Using Sage Intacct Accounts Payable

There are significant benefits to using Sage Intacct for accounts payable, including reducing or eliminating manual AP tasks while improving cash management.

With its multiple safeguards in place, Sage Intacct can also reduce or eliminate fraudulent activity, streamline the entire AP process from invoice receipt to payment, and offer a variety of management reports and dashboards all designed to provide complete visibility into accounts payable.

Other benefits include:

Complete visibility with centralized, secure electronic access to bills, approvals, payment status, posting details, and audit trails.

The ability to process bills and payments for multiple entities from a single Sage Intacct account.

Save time and reduce labor costs by reducing the number of hours spent on AP processing each month.

Reconcile bank and credit card statements in minutes using the auto-match feature, which flags any transactions that have not been entered into the system.

Completely customizable internal controls that allow businesses to restrict or provide access levels that work for them.

Set spending limits to maintain budget compliance with Sage Intacct Spend Management.

Get complete visibility into the entire accounts payable process.

Automated payment processing including issuing payments using vendors’ preferred payment method.

Pay vendors consistently and on time, so you can take advantage of payment discounts and reduce the need to reissue payments.

How Sage Intacct Accounts Payable Integrates with Other Financial Modules

Sage Intacct is a completely integrated application, with the accounts payable module seamlessly integrating with your completely customizable chart of accounts and general ledger, along with the following modules:

- Sage Intacct Cash Management

- Sage Intacct Inventory

- Sage Intacct Purchasing

In addition, Sage Intacct now offers complete integration with PLANERGY, with users able to export invoices directly to Sage Intacct automatically, eliminating the need to manually enter invoice information a second time.

Any invoice exported into Sage Intacct can be reviewed before payment is made or edited if needed.

Best Practices for Optimizing Accounts Payable in Sage Intacct

Sage Intacct offers a long list of features that can help you optimize your current AP processes.

While we’ve discussed the available features, there is one clear way to optimize those features for your business.

Use them.

There are so many features available in Sage Intacct, yet many businesses will choose to take advantage of only a few of them.

By choosing to utilize all of the available features, including seamless integration with PLANERGY, you can automate much if not all of your accounts payable tasks.

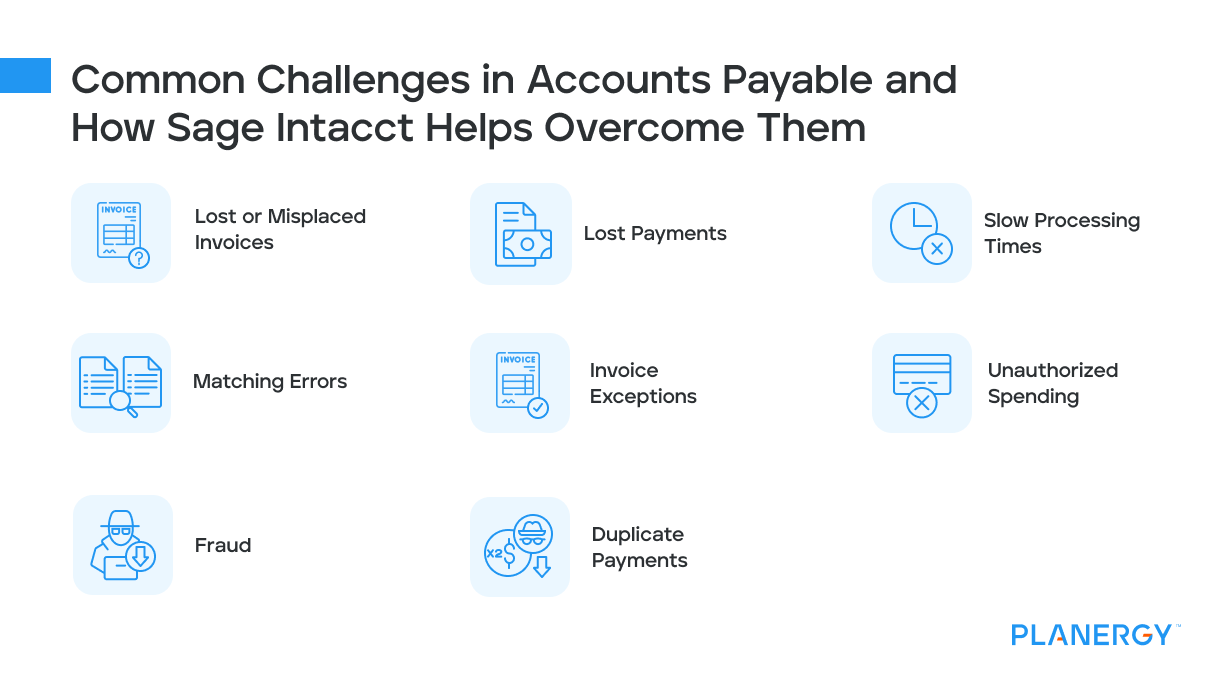

Common Challenges in Accounts Payable and How Sage Intacct Helps Overcome Them

Accounts payable departments have historically faced a series of challenges unique to their department.

These challenges include:

Lost or Misplaced Invoices

Every time a business places an order, it involves a purchase order, an invoice, and a shipping receipt.

That means three pieces of paper for every payment that you make.

If you’re still using paper to process your accounts payable, you run the risk of lost or misplaced invoices, invoices routed to the wrong department for approval, or an invoice received from a vendor that never finds its way to the correct staff member.

And you may not even realize an invoice is missing until you receive a late notice and a late payment fee from your vendors.

Lost Payments

Along with being a time-consuming process, paying invoices with paper checks opens your business up to the possibility of lost or fraudulent payments.

For example, every time a check is lost in the mail, it creates even more work for the AP department, which has to stop payment on the original check and then reissue and mail a new one.

Slow Processing Times

Paper-based accounts payable processing often leads to payment delays, the inability to take advantage of early payment discounts, and even missed payments.

Delays can stem from a variety of things including lost or misplaced invoices, delays in approval, and data entry errors.

Matching Errors

If you use a purchase order system in your business, you should be completing three-way matching, which matches an invoice to a purchase order and shipping receipts.

The problems begin when these three documents are not matched or when a discrepancy is found.

Invoice Exceptions

If a discrepancy is found, there can be a significant delay between when the source of the error is found and when an invoice can be processed for payment.

These delays can lead to late payments, resulting in fees being assessed, damaged vendor relationships and can even affect your company’s credit.

Unauthorized Spending

Sloppy record keeping and relying on paper processing can result in unauthorized spending.

Without the proper invoice routing and approval process in place, it can be difficult to manage or prevent unauthorized spending.

Fraud

Traditionally, the AP department had kept check stock locked up to prevent fraudulent activity.

But someone has the key to that locked file cabinet, making it relatively easy to access check stock for fraudulent purposes.

Duplicate Payments

Without an accounting software application in place that can detect duplicate invoice numbers and help prevent duplicate payments, it’s easy to pay an invoice twice.

How Sage Intacct Can Help

Sage Intacct helps eliminate many of these common issues.

Because invoices are automatically scanned, you’ll eliminate the threat of lost or misplaced invoices.

When an invoice is received, it’s automatically routed to the designated approvers, and with several payment options available in Sage Intacct, you can eliminate paper check runs and pay vendors using ACH or credit card.

Sage Intacct also eliminates duplicate payments, immediately flagging duplicate invoice numbers, and with automated three-way matching, your purchase orders, invoices, and shipping receipts will be matched or flagged for review immediately upon invoice receipt.

Finally, using Sage Intacct, you can significantly reduce processing times, allowing you to take advantage of early payment discounts and eliminate late fees permanently.

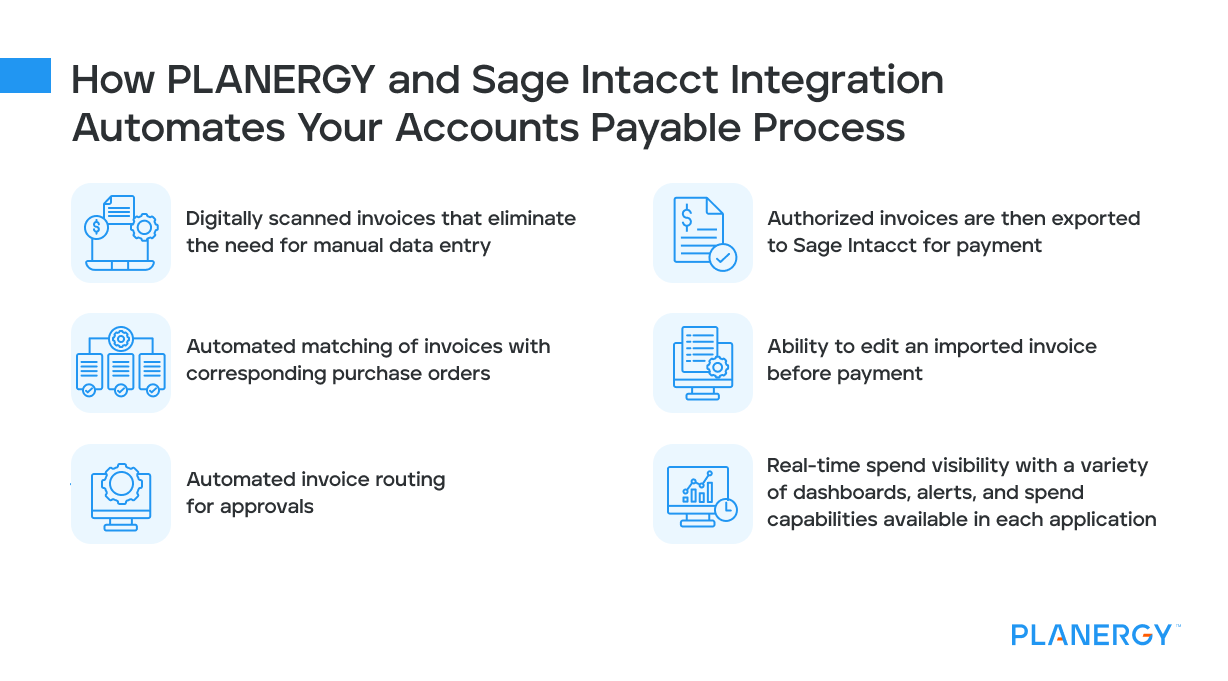

How PLANERGY and Sage Intacct Integration Automates Your Accounts Payable Process

Because of its seamless integration, PLANERGY can be used with Sage Intacct to provide a streamlined workflow process, with users able to take advantage of the automation available in each application, including:

Digitally scanned invoices that eliminate the need for manual data entry.

Automated matching of invoices with corresponding purchase orders.

Automated invoice routing for approvals.

Authorized invoices are then exported to Sage Intacct for payment.

Ability to edit an imported invoice before payment.

Real-time spend visibility with a variety of dashboards, alerts, and spend capabilities available in each application.

When used together, PLANERGY and Sage Intacct can provide the automation needed to better manage your accounts payable and your business.

Why Sage Intacct and PLANERGY Are a Good Option for Your Business

PLANERGY uses a combination of robotic process automation and AI to automate the purchase order and invoicing process, including invoice verification and authorization.

Because invoices are automatically scanned into PLANERGY upon receipt, businesses will see a decline in the number of data entry errors.

This process also provides business owners with a real-time look into spending with the ability to quickly identify and investigate discrepancies.

Integrating PLANERGY with Sage Intacct AP automation solution provides further functionality, providing real-time integration and real-time visibility into all accounts payable-related activities including invoice extraction and capture along with the ability to create custom invoice approval workflows that route invoices to the appropriate party(s) immediately upon matching.

Sage Intacct also offers comprehensive reporting tools that CFOs will appreciate including management and spend reports, financial dashboards that show current and upcoming spending, and vendor aging reports that display invoices that are due shortly.

Using PLANERGY and Sage Intacct together, you’ll gain access to a cloud-based, paperless system that will keep your accounts payable department at the top of its game while freeing up your finance team to work on more important tasks.