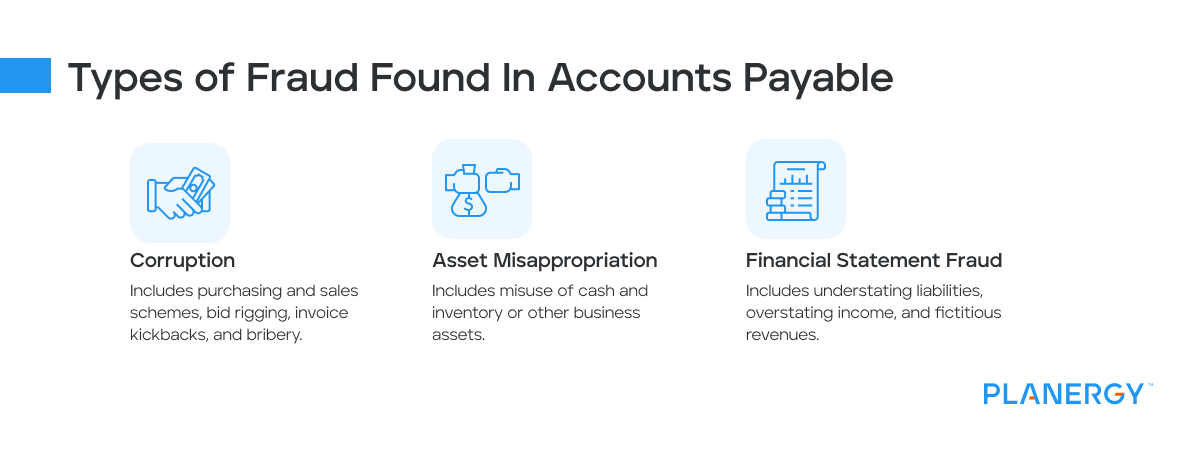

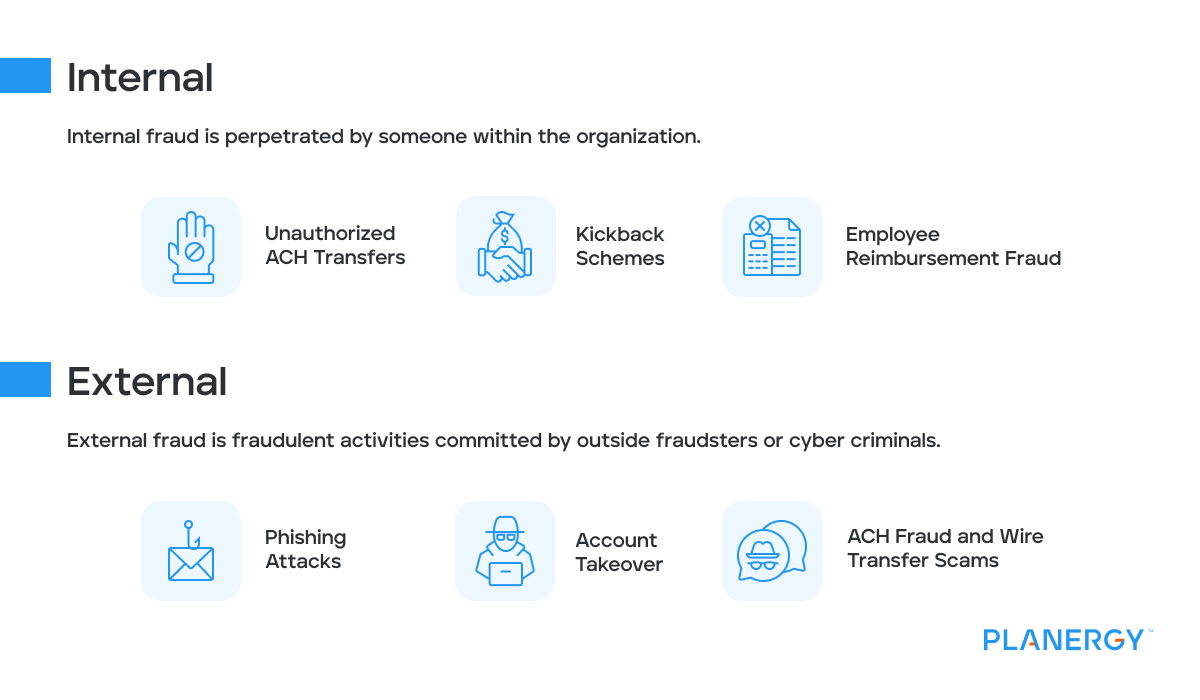

Any business, small or large, is at risk from procurement fraud and financial fraud.

According to the Association of Certified Fraud Examiners 2022 report, the median loss per fraud case was $117,000, with the average loss totaling more than $1.7 million.

In 2022 alone, the ACFE reported that more than 2,000 businesses worldwide suffered more than $3.6 billion in losses.

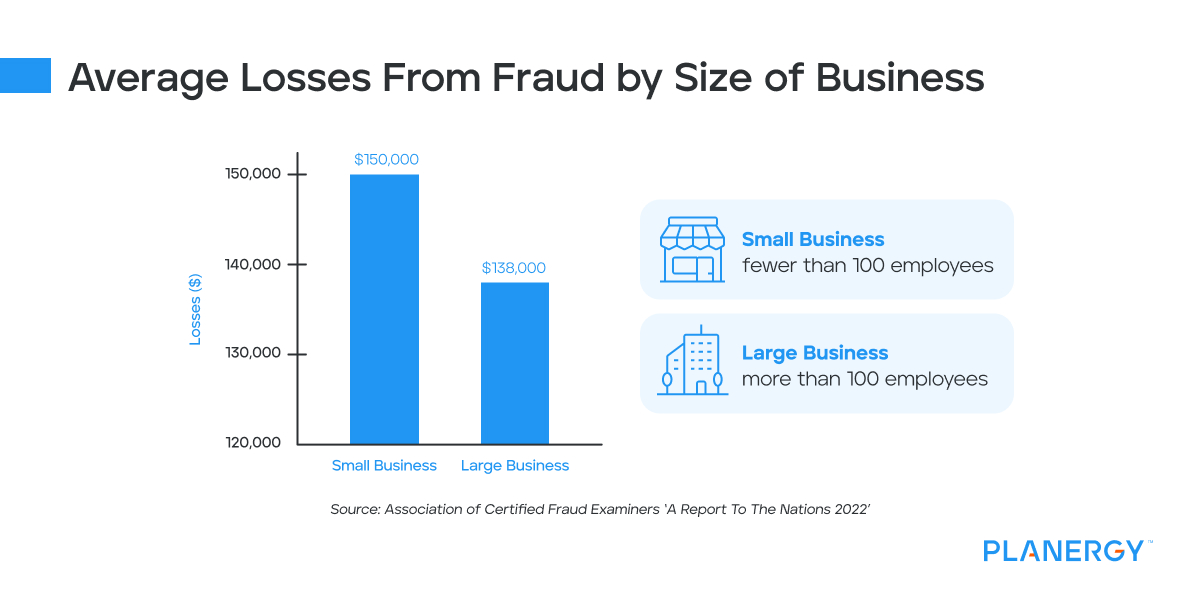

Even more alarming for small business owners, according to the ACFE study, organizations with the fewest number of employees had the highest median loss at $150,000.

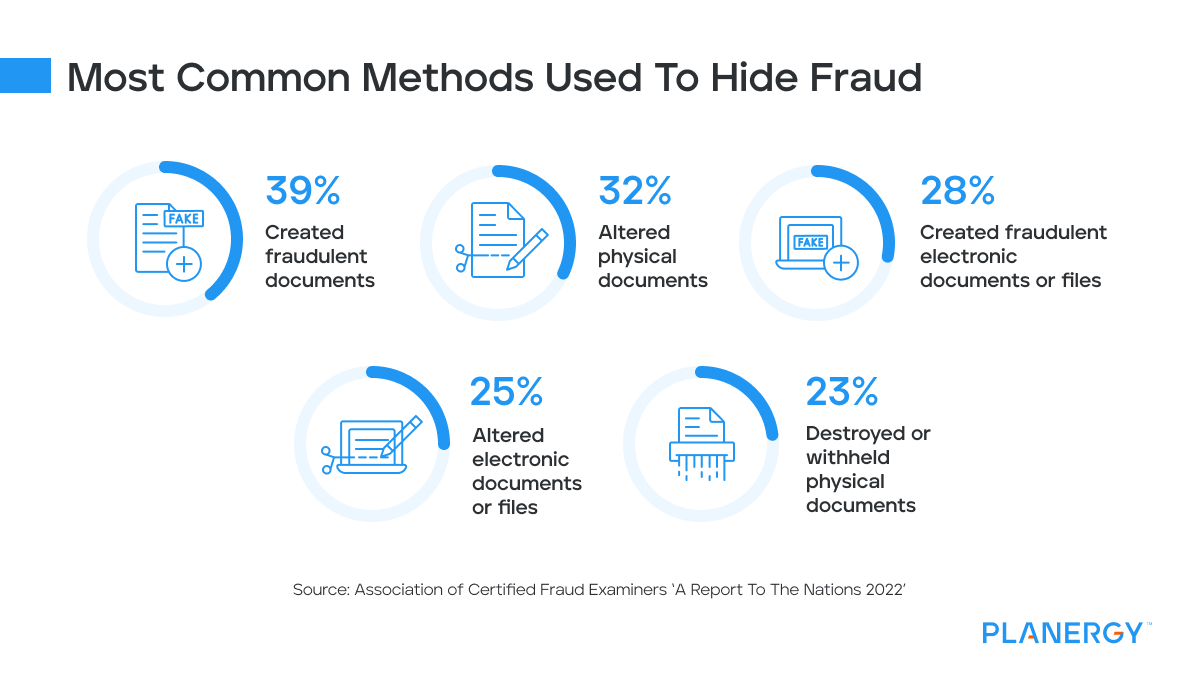

How is fraud being committed? According to the ACFE report, the top methods to hide fraudulent activity are:

- 39% created fraudulent documents

- 32% altered physical documents

- 28% created fraudulent electronic documents or files

- 25% altered electronic documents or files

- 23% destroyed or withheld physical documents

Though larger businesses with more than 1,000 employees reported more cases of fraud, smaller businesses tend to suffer the biggest losses, with businesses with less than 100 employees having a median loss of $150,000 compared to larger businesses with a median loss of $138,000.

Regardless of size, no business can afford to lose money to fraud.

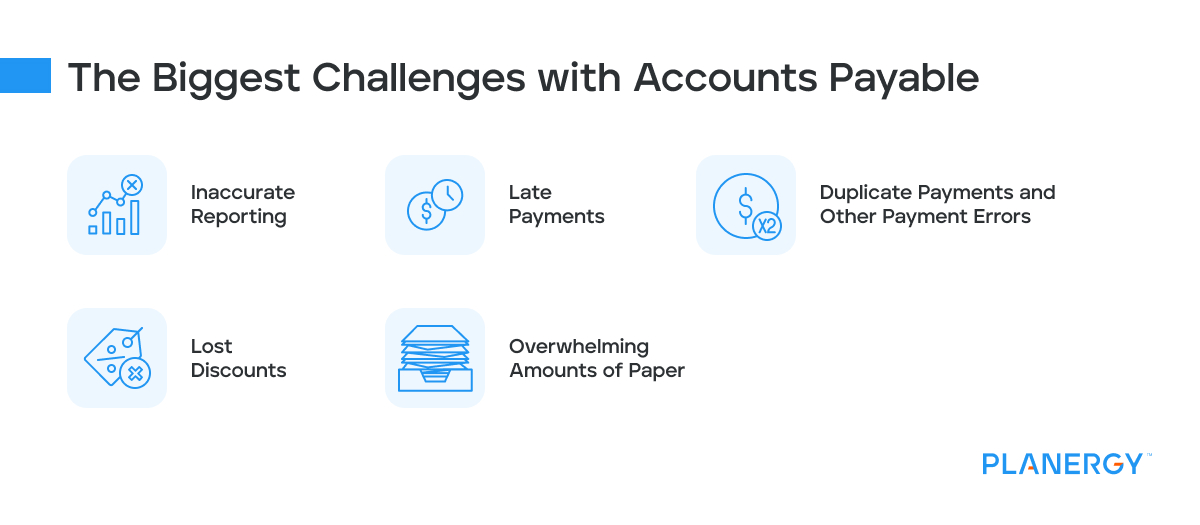

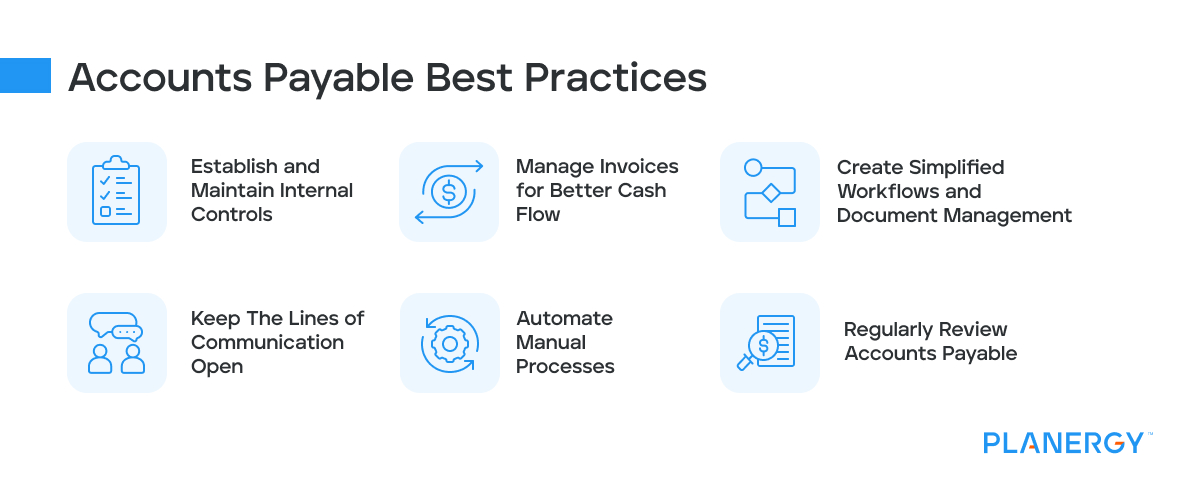

Read on to learn some of the biggest challenges of facing accounts payable when it comes to dealing with fraud, along with what you can do to protect your business from fraud.