Before you can institute the record to report process for your business, you should first understand exactly how it works.

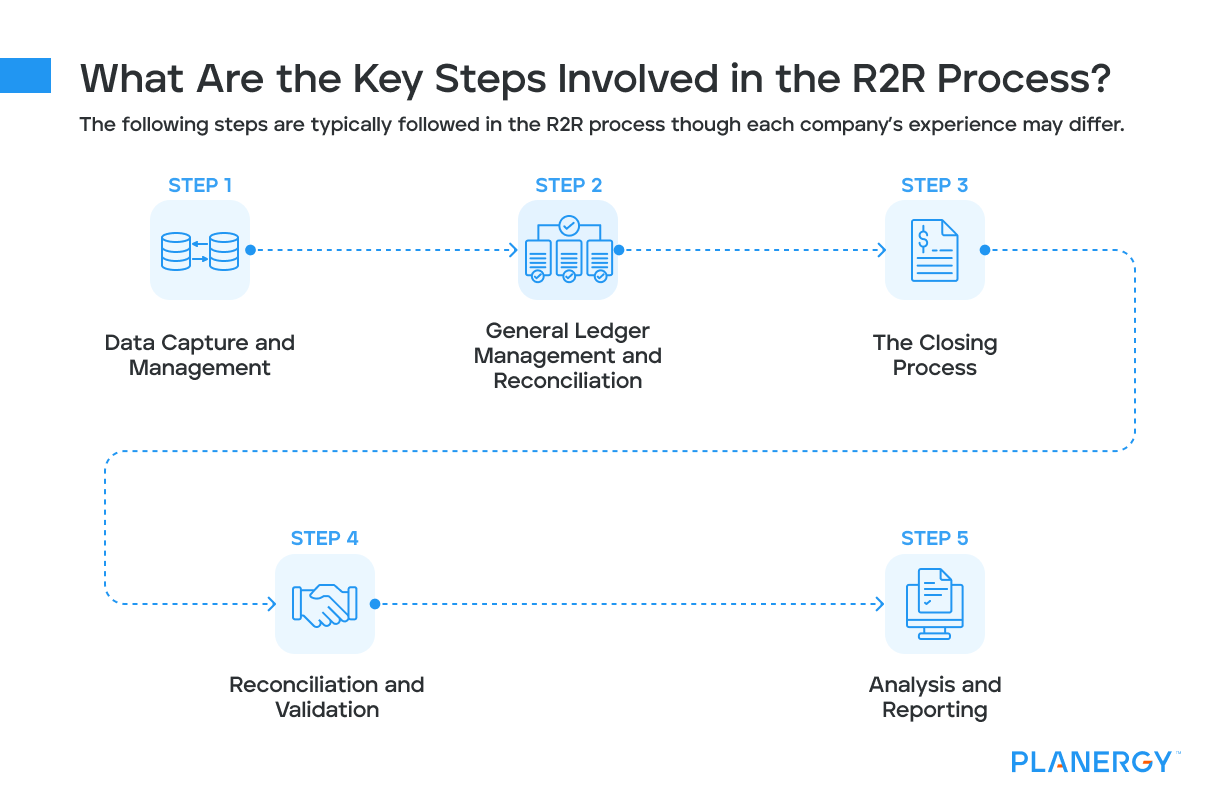

The following steps are typically followed in the R2R process though each company’s experience may differ.

Data Capture and Management

The first part of the R2R process is the collection of data by your accounting team that serves as the building blocks for creating financial statements.

Perhaps the most important step, the accuracy of the financial records collected is a direct reflection of how accurate your financial statements will be.

The data collection process includes all financial transactions completed for the month such as product sales, money paid to vendors and suppliers, and money received as well as journal entries made throughout the month.

The best way to ensure that collected data is accurate and not overlooked is to use an enterprise resource planning (ERP) solution or other automated system.

General Ledger Management and Reconciliation

The general ledger is a repository of sorts for all of your accounts.

Before you can prepare reports, all journal entries must be prepared and posted to the general ledger.

This step also includes the review and reconciliation of accounts including both bank statements and credit card statements.

For example, if you forego reconciling your bank statement for the month, bank charges, outstanding checks, and NSF checks may not be properly posted to the general ledger.

If you’re using an automated accounting software application, much of this process will be completed for you, but a review of account balances is always necessary to check for posting accuracy.

Though you’ll need to analyze completed financial statements once they’re finalized, a brief review before closing helps identify any issues before the closing process begins.

The Closing Process

The closing process also known as the closing cycle is completed at the end of each accounting period.

During the closing process, all additional journal entries are completed to ensure that the general ledger and all subsequent reports are accurate.

During the financial close process, all balances in temporary accounts such as expense and revenue accounts are moved to a permanent account so that the balance will be zero at the start of the next accounting period.

This will need to be done manually if you’re using a paper-based accounting system, though it will be completed automatically if you’re using an accounting software application.

Reconciliation and Validation

Once the closing process is complete, senior staff should review the recorded transactions.

This includes all intercompany accounting transactions to ensure that all transfers have been properly accounted for and all relevant accounting standards have been met.

This step must be completed for financial statements to be accurate.

Analysis and Reporting

The final step in the R2R process is the reporting process, with the appropriate staff creating the necessary financial reports that are usually distributed to senior staff and outside stakeholders.

However, creating the reports is only the first step; spending time analyzing the results is just as important for strategic decision-making.

Reports that should be created and analyzed include:

- Income statement

- Balance sheet

- Profit and loss statement

- Cash flow statement

During this final step, you’ll also want to create any other necessary reports and calculate relevant accounting ratios if desired.