If you’re like most business owners and managers, you’re constantly worrying about how your business is performing.

If that’s the case, it may be time to start tracking some financial benchmarks, which are a series of measurements that you can track regularly to help you determine whether your company is operating efficiently and if there’s a need for improvement.

Smart businesses use benchmarks across multiple departments including accounts payable.

We’ll explain exactly what accounts payable benchmarking is and why it’s a good idea for your business.

What Is Accounts Payable Benchmarking?

Accounts payable benchmarking uses a combination of quantitative and qualitative metrics that are used to compare your company’s AP performance against current industry peer standards as well as competitors.

These benchmarks are also used to identify inefficiency and cost-effectiveness.

Knowing where your business stands in relation to your industry niche and your competition can help you identify any weak spots in your processes and work proactively to improve them.

Accounts payable benchmarking is also a useful tool to consistently track accounts payable performance to ensure continued improvement while providing the data needed to improve the decision-making process.

Why Accounts Payable (AP) Benchmarking Is Important

The CEO of a furniture manufacturing company is communicating with one of their suppliers when the supplier asks why they never take advantage of their discounts.

The CEO has no idea.

Accounts payable benchmarking can provide an answer to that question, along with several others including:

- How long does it take to process a bill?

- What are the total late fees the business has paid?

- How many days does it take to process an invoice from receipt to payment?

- How many invoice exceptions does the AP department typically see?

- Where in the accounts payable process do the most inefficiencies occur?

- What is the average cost to process a single invoice?

- Does the current AP workflow need to be improved?

Knowing the answers to these questions can help a business determine what processes are working and what areas need improvement.

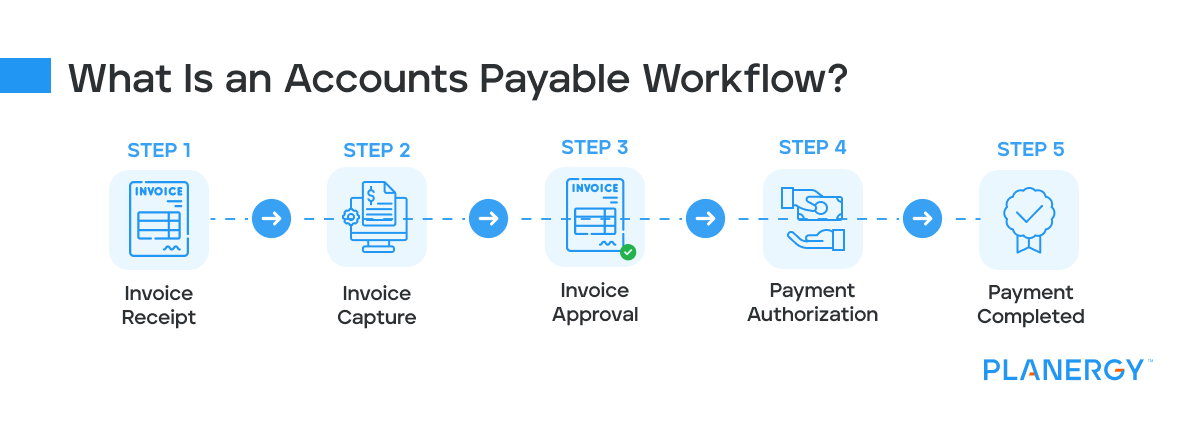

The Accounts Payable Workflow

The accounts payable workflow starts when goods and services are obtained and ends when payment is processed.

Reviewing your current AP workflow is an important part of the benchmarking process, and should include the following steps:

Invoice Receipt

The first thing an AP employee does is receive the invoice. Invoices can be received in the mail, via fax, or sent electronically.

Invoice Capture

Once the invoice has been received, it will be entered into your accounting software or ERP system.

How the invoice gets into the system can vary, depending on the type of software in use.

It may be entered manually using data entry by a member of the AP team.

If you are using AP Automation, the invoice can be scanned directly into the system, where the details are automatically captured by your software application.

Or suppliers can send invoices to a dedicated email address, where the data will be automatically captured and extracted upon receipt.

Invoice Approval

Depending on the current AP workflow, an invoice may be approved before entry into the system, or if an automated AP system is in use, can be routed and approved automatically.

Part of the invoice approval process includes matching the invoice against a purchase order. Commonly a 3-way match is expected with the PO, receipt, and invoice.

For invoices manually entered into the system, this process must also be completed manually.

Once the matching process is complete, the invoice is then routed to another staff member for approval.

For invoices automatically captured and extracted, both the matching process and the approval process can be automated.

Payment Authorization

Once an invoice has been entered and approved, the next step is payment authorization.

Again, when using a manual workflow, this process can be time-consuming as it involves creating a current AP report where a manager, controller, or CFO can choose which invoices should be paid.

However, when using an automated system, the invoices that are due and payable are automatically paid, unless otherwise indicated.

Payment Completed

If you’re still processing checks for payment, AP staff will complete a check run, which involves printing a check, matching the check stub to the invoice, and then filing both in the vendor/supplier file.

The payment process is much faster when using an electronic payment method such as ACH transfer.

Nestled between these steps is vendor and supplier management, which plays an important role in the entire workflow process.

Being able to proactively manage your vendors and suppliers means easier initial onboarding, a faster response time to issues and exceptions, and the ability to maintain a better relationship with them.

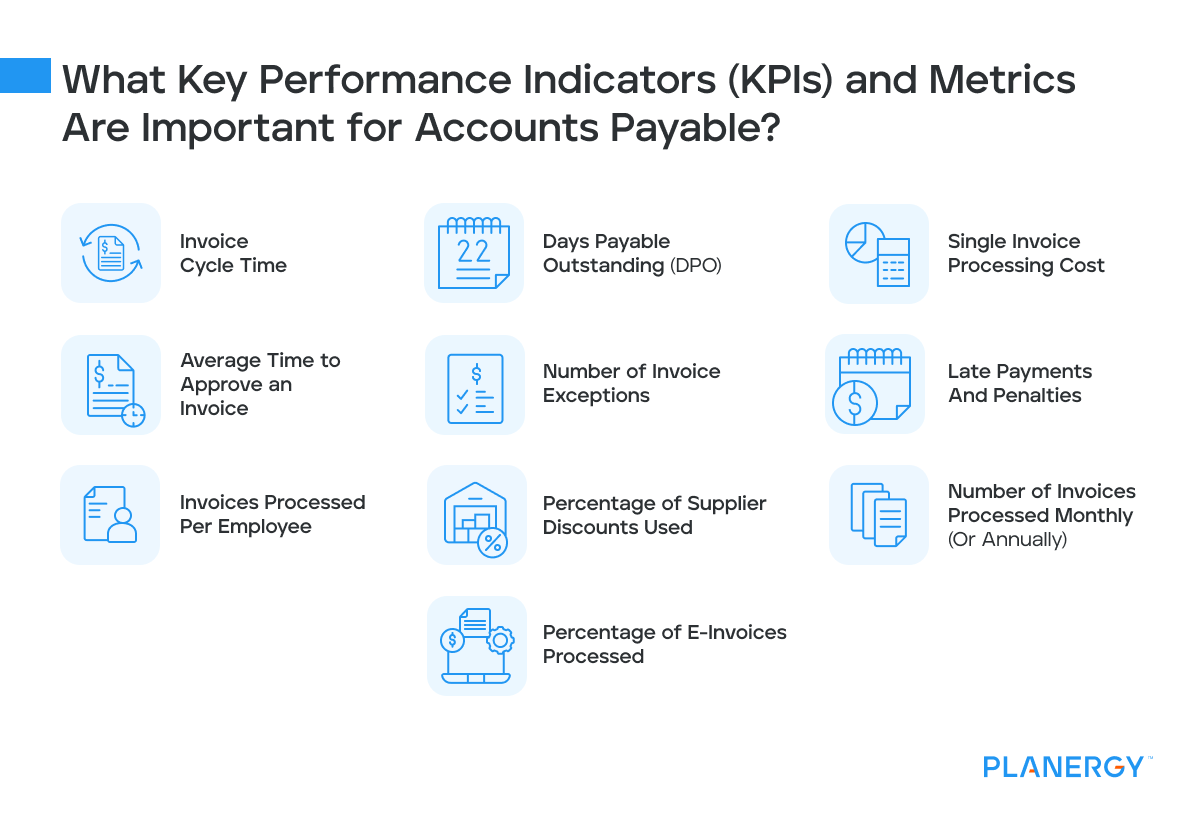

Key Performance Indicators (KPIs) and Metrics That Are Important for Accounts Payable

There are numerous accounts payable KPIs and metrics that can be useful for your business.

These are the 10 most important one’s:

Invoice Cycle Time

The most important KPI you can track, invoice cycle time measures the average amount of time it takes to process an invoice, from receipt to payment.

Once you have this information, you can begin to look at individual KPIs and metrics more specific to your business.

To calculate invoice processing time, you can start by tracking the amount of time it takes to get an invoice to the AP department once received.

Then how long the approval process takes, how long it takes to enter the invoice into your system, and how long it takes to process payment.

Add these together to get the full cycle time for an invoice.

Days Payable Outstanding (DPO)

Among the top KPIs to track, days payable outstanding measures the number of days that it takes your business to pay an invoice once it’s received.

To calculate days payable outstanding, you’ll divide your total accounts payable balance by your total cost of goods sold for the period you’re calculating.

A higher DPO can be good for businesses since it can improve cash flow.

But if your DPO results are too high, vendor and supplier payments are likely late, which increases the likelihood of penalties and strained vendor relationships.

Single Invoice Processing Cost

The longer it takes to process an invoice, the more it will cost.

To determine how much money you’re currently spending to process a single invoice, you’ll need to calculate any related processing costs such as department labor, software costs, overhead costs, and even incidentals such as ink, check stock, envelopes, and postage.

When you have the relevant costs, you can then divide that total by the number of invoices processed for the same accounting period.

This calculation can be eye-opening for businesses that have no idea how much it costs them to process an invoice.

Remember, the longer the invoice takes to process, the more money you’re spending.

Average Time To Approve an Invoice

Any number of things can cause bottlenecks when processing invoices manually, but one of the main culprits is the invoice approval process.

Manual approvals require that the invoice be forwarded to one or more approvers, where it can sit in a pile of inbox items for days before being looked at. Invoices can also be routed to the wrong individual.

Both result in late charges and other additional fees. It can be a little tricky to calculate this KPI, since one invoice may be approved immediately while others aren’t.

The best way to calculate the average invoice approval time is to determine how long it takes to approve each invoice and then calculate the average for that period.

Number of Invoice Exceptions

Invoice errors may be the fault of the supplier or the purchaser, depending on the types of discrepancies encountered.

In any case, you’ll want to calculate this KPI for a few reasons.

First, if the errors occur on your end, you can take steps to address the issue internally.

Second, if the error originates with the vendor or supplier, you’ll need to address the issues directly with them.

To calculate the number of invoice exceptions, you’ll need to determine your total number of invoices processed along with the total number of exceptions and divide it by the number of invoices processed for that period.

Late Payments and Penalties

Another area you’ll want to take a look at is the number of late payments and penalties you’ve paid since both are an indication that there are significant issues in your invoice processing workflow.

While an occasional late payment may not be cause for concern, if your business is consistently paying vendors and suppliers penalties and late fees, you’ll need to examine every aspect of your invoice process to determine where the issues are.

You’ll need to track all of your late payments and penalties paid within a specific accounting period to see how much you’re paying unnecessarily.

Invoices Processed per Employee

If you want to get better insight into employee productivity, you can calculate the number of invoices processed per employee.

This metric can help identify any bottlenecks in the department along with possible staffing needs.

To calculate this metric, simply divide the number of invoices processed during a specific period by the number of AP employees in the department.

Percentage of Supplier Discounts Used

If you regularly receive vendor and supplier discounts, are you taking advantage of those discounts, or letting them expire?

To find out, divide the number of invoices that have taken discounts against the total number of invoices that offered discounts to see what percentage you’re currently taking advantage of.

Number of Invoices Processed Monthly (or Annually)

Knowing how many invoices you’re processing each period, whether quarterly, or annually can help you pinpoint trouble spots and address any staffing issues.

The only number you need is your total number of invoices processed for the period.

Percentage of E-Invoices Processed

If your suppliers are beginning to use e-invoicing, it can be helpful to know just how many invoices you receive in this manner.

To calculate, just divide the number of e-invoices processed by the total number of invoices received during the period.

Best Practices in Accounts Payable Benchmarking

If you’re just beginning to use benchmarking in your accounts payable department, following these best practices can help determine what areas you need to examine and how those results can benefit your business.

Calculate Invoice Cycle Time to Identify Immediate Areas for Improvement

Calculate the invoice cycle time before delving into other metrics. This can help you immediately identify areas that need further examination.

Benchmark Your Metrics Against Industry Standards

Compare results against those in a specific industry. If you’re in the tech industry, compare your metrics against other tech companies.

This will give you a better idea of what current industry standards are and how close (or far) your business is from meeting those standards.

Regularly Monitor Benchmarks to Track Progress Over Time

Use benchmarks regularly. It’s useless to calculate a metric a single time.

Calculating them regularly allows you to view any progress your business has made over time or if it still has a lot of work to do.

Address Areas of Concern Promptly for Effective AP Process Improvement

Address areas of concern immediately. It’s great that you’re measuring KPIs, but if you don’t use that information to improve your AP processes, it’s pointless to measure them at all.

Implement AP Automation for Greater Departmental Efficiency

Start using AP automation. If you’re still struggling with the entire AP process, using AP automation can provide greater efficiency department-wide.

Benefits of Accounts Payable Benchmarking

Measuring and analyzing benchmarks takes time and right now you may be wondering if the information garnered from these metrics is worth the time you’ll need to invest in completing them.

The answer is yes. Measuring these benchmarks and using the resulting information can lead to several positive changes in your business including:

Streamline AP Processes to Eliminate Delays in Invoice Processing and Payment

A more streamlined AP process is a key benefit of implementing AP automation.

If your benchmarking indicates slow processing times, you can take corrective steps to eliminate issues that may be hindering on-time invoice processing and payment.

Compare Business Results to Industry Peers for Performance Insights

Comparing your business results to your peers can help you see how your business measures up and whether there’s a need for improvement.

Take Quick, Corrective Action to Address Areas of Concern in AP Processes

The ability to take quick, corrective action on areas of concern.

For instance, if your benchmarks indicate that invoices are not approved promptly, you can take measures such as automating the approval process to eliminate this costly delay.

Leverage Early Payment Discounts by Streamlining Invoice Processing

Gives you the ability to take advantage of early payment discounts more easily.

While a 3% discount may not seem like much, when they’re all added together, you’re missing out on an easy way to save some money.

Streamlining the invoice process can lead to earlier payments and the ability to save a little money as well. The realized cost savings will add up.

Avoid Late Fees and Additional Charges Through Timely Invoice Payments

Elimination of late fees and other charges.

If you’re consistently paying invoices late, it’s likely that you’re also incurring additional charges such as late fees, penalties, and additional interest.

Enhance Supplier Relationships with Timely Payments

Improved supplier relationships. Everyone wants to be paid on time, including your vendors and suppliers.

By ensuring that invoices are processed timely, you’re able to save a few dollars on late fees, while keeping your vendors and suppliers happy.

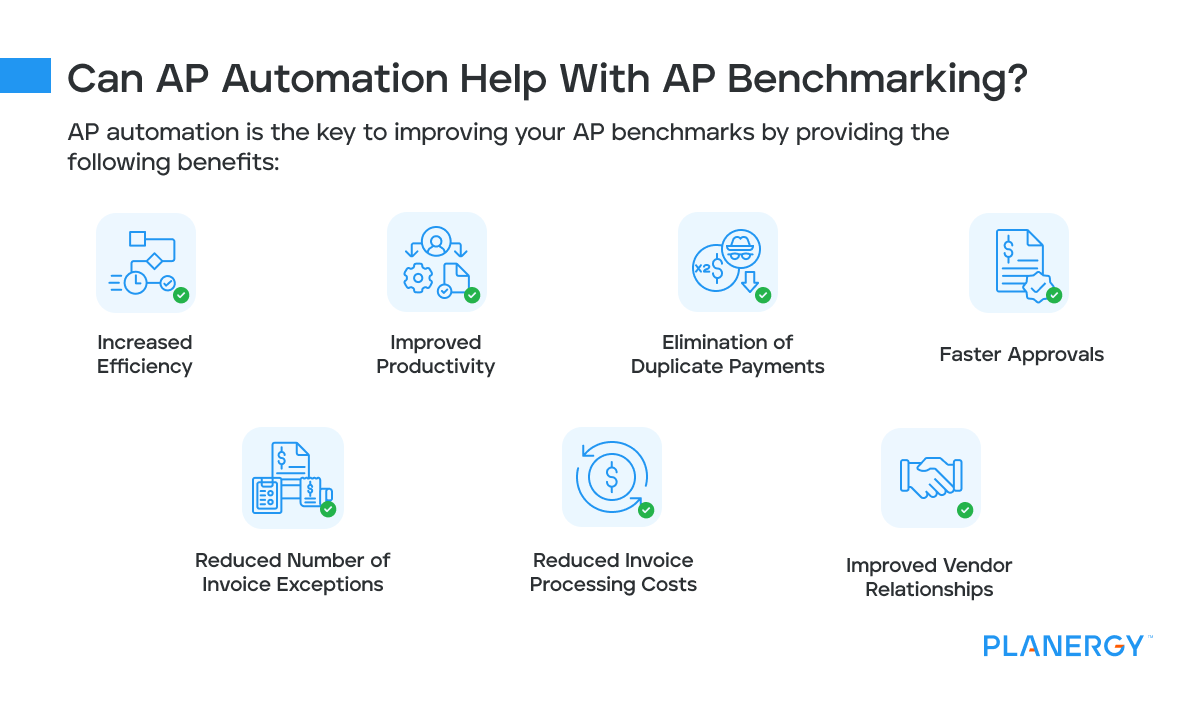

How AP Automation Can Help with AP Benchmarking

AP automation is the key to improving your AP benchmarks. Improving the full accounts payable cycle will improve many of the key KPIs you should use for benchmarking.

AP automation provides the following benefits:

- Increased Efficiency

- Reduced Number of Invoice Exceptions

- Elimination of Duplicate Payments

- Faster Approvals

- Improved Productivity

- Reduced Invoice Processing Costs

- Improved Vendor Relationships

Using AP benchmarks and KPIs in your AP department helps pinpoint areas of concern.

By introducing Accounts payable automation, you can improve performance metrics while optimizing the entire AP process from procurement to payment.