Why Measure AP Performance?

Measuring the performance of accounts payable is not the goal in and of itself. If you can measure performance, then you can improve it. The overall goal is to improve the performance of your accounts payable team over time by applying best practices for accounts payable.

AP performance can impact your business directly, in both good and bad ways. If you’re content with the status quo, you may never know exactly how much time or money your business is spending processing AP. And while increasing efficiency in processing AP is important, the accounts payable department is so much more than simply paying bills.

In a procure-to-pay environment, your AP department is locating and creating relationships with vendors, sourcing affordably priced goods and services for your business, and making sure that these same suppliers are paid timely.

For example, Jeff is responsible for sourcing new vendors and maintaining a relationship with them. Jeff does not handle the payable process directly but hands it off to his team. In the meantime, his team has routed several invoices from the new vendor to the department manager for approval.

Since the manager is out this week, they will remain on her desk until she’s back in the office, since there is no designated backup approver.

When AP finally does get the approved invoice back, it’s already three days past the due date. In the meantime, Jeff receives a call from the vendor, asking why the payment is late, particularly since during negotiations, the supplier provided Jeff’s company with a 2% discount if they paid early.

Not only did Jeff’s company not take advantage of the discount, which would have saved them close to $100, but the first two invoices the new supplier sent are already three days past due, and the payment hasn’t even been processed yet.

Jeff promises to push the payment through, but the supplier, no longer so amiable, has now shortened their due date from 30 days to 10 days for future orders and eliminated the early payment discount.

Jeff now has the option to try and source yet another supplier, accept the new payment restrictions, or try an rebuild the supplier relationship.

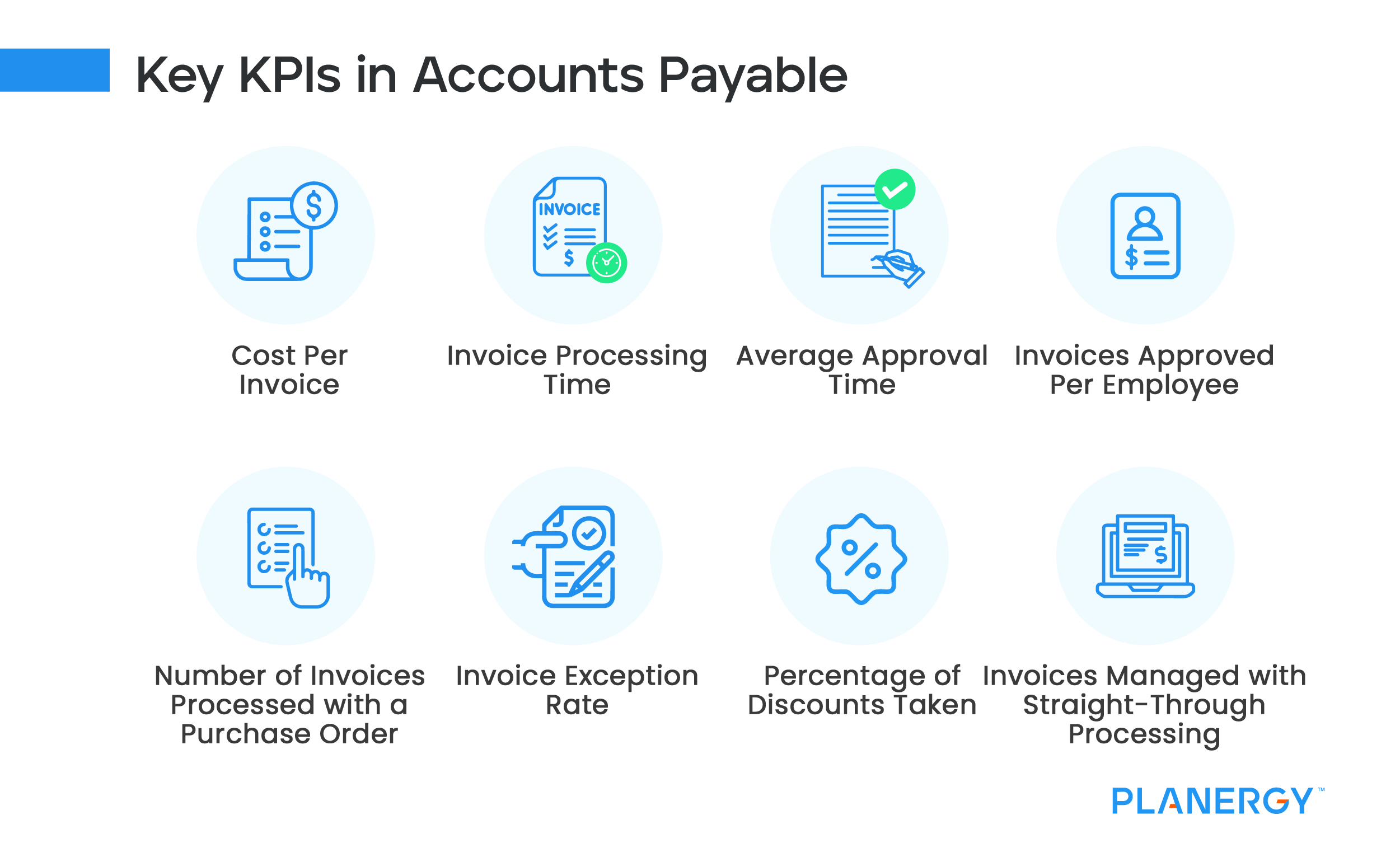

That’s why AP performance needs to be measured. Accounts payable KPIs and accounts payable benchmarking is how to measure performance.