To properly manage their books, accountants and bookkeepers need to be familiar with both accounts payable and notes payable. While both accounts are liability accounts, there are significant differences between the two that need to be understood.

What's PLANERGY?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with PLANERGY.

Cristian Maradiaga

King Ocean

Download a free copy of "Preparing Your AP Department For The Future", to learn:

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Accounts Payable vs Notes Payable: What’s the difference?

Category

- Written by Mary Girsch-Bock

- 16 min read

Last edited

May 12, 2025

IN THIS ARTICLE

- What Are Accounts Payable?

- What Are Notes Payable?

- What Is the Difference Between Accounts Payable and Notes Payable?

- Can Notes Payable Be Converted to Accounts Payable?

- What Is the Difference Between Notes Payable and Other Long-Term Debt?

- How Are Accounts Payable More Complicated Than Notes Payable?

- Automation Can Simplify Both Accounts Payable and Notes Payable

What Are Accounts Payable?

Accounts payable represents the money you owe to vendors, suppliers, and other creditors. Your accounts payable balance is considered a short-term debt or current liability and appears as such on your balance sheet.

Your accounts payable balance also directly impacts your cash flow statement along with your working capital.

A high accounts payable balance providing you with additional working capital, while a lower AP balance gives you less working capital to use for your business. This means AP also has an important role to play in liquidity management.

When invoices for items purchased on credit are entered into your accounting software application, a debit is made for the respective expense, while the accounts payable account is credited.

For example, an accounts payable entry for travel expenses for the month of June would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 6-15-2023 | Travel Expense | $900 | |

| 6-15-2023 | Accounts Payable | $900 |

The above entry ensures that the travel expense is posted in June, when it occurred, not in the month that the invoice was paid.

When the invoice is paid, the following reversing entry will need to be completed:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 7-10-2023 | Accounts Payable | $900 | |

| 7-10-2023 | Cash | $900 |

This entry reduces your accounts payable balance while also reducing your cash balance.

Accounts payable is considered a short-term liability because AP invoices are typically paid within a year’s time.

What Are Notes Payable?

Notes payable represents the amount of money your business owes financial institutions and other creditors.

Notes payable entries always involve a written agreement between the buyer and seller, usually in the form of a promissory note. Like accounts payable, the current notes payable balance can be found on your company balance sheet.

A promissory note is a written promise to repay a loan. Promissory notes contain all the details of the loan including repayment terms, principal amount, interest rate, maturity period of the loan, as well as the date of the loan, and the signature of both the borrower and the lender.

A promissory note may also indicate whether there is a provision for late payment fees and whether the loan is secure or unsecured.

For example, in May, you take out a loan for $20,000 from a local bank to help fund your business. You agree to pay 10% interest on the loan which needs to be paid quarterly.

To record the loan as notes payable, you’ll first complete the following journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 4-01-2022 | Cash | $20,000 | |

| 4-01-2022 | Notes Payable | $20,000 |

Next, you’ll need to enter the interest expense for the quarter.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 6-30-2022 | Interest Expense | $500 | |

| 6-30-2022 | Interest Payable | $500 |

When you pay the first quarterly interest expense, you’ll make the following entry, which should be paid at the end of the quarter.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 6-30-2022 | Interest Payable | $500 | |

| 6-30-2022 | Cash | $500 |

You will have to continue making quarterly interest payments until the maturity date of the loan, entering a journal entry for September, December, and March to record the interest payments made on the loan.

Finally, when the note is paid off in full, you would complete the following entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 4-30-2023 | Notes Payable | $20,000 | |

| 4-30-2023 | Cash | $20,000 |

Notes payable are always in writing, with specific terms included, including the loan maturity date, which indicates the date that a business has to pay the principal amount owed plus any interest as shown in the promissory note if it has not already been paid.

Whether the promissory note indicates a maturity date of a year or five years, the balance in your notes payable account should always be reconciled against promissory notes that have been issued.

What Is the Difference Between Accounts Payable and Notes Payable?

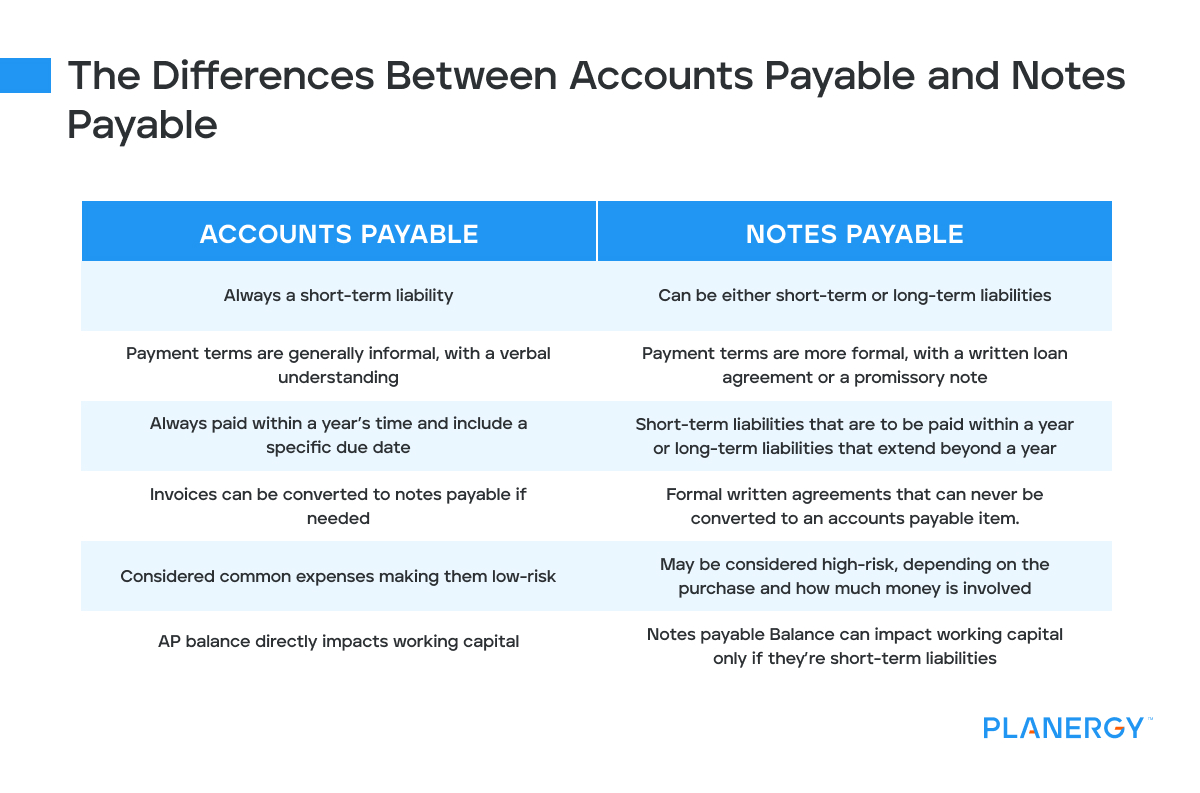

Though accounts payable and notes payable both represent money owed, in many ways they are quite different. One key difference between the two is that accounts payable is always a short-term liability while notes payable can be either short-term or long-term liabilities.

But there are other differences as well.

Payment terms

Accounts payable terms are generally informal, with a verbal understanding between the buyer and seller. AP terms usually include a specific due date along with a fee for late payment of the invoice, occasionally offering an early payment discount option as well.

Notes payable terms are more formal, with a written loan agreement or a promissory note issued that provides details on repayment terms, interest rates, payment schedules, and specific clauses that are put into place to address late payment or payment default.

Payment Timeline

Accounts payable are always paid within a year’s time and include a specific due date that is based on terms provided by the vendor or supplier.

Notes payable can be either short-term liabilities that need to be paid within a year or long-term liabilities when payment terms extend beyond a year.

Conversion

Accounts payable invoices can be converted to notes payable if desired. This is typically done for invoices in larger amounts that a company is unable to pay within the original terms of the invoice.

Notes payable are formal, written agreements and can never be converted to an accounts payable item.

Risk

Accounts payable invoices are considered common expenses making them low-risk.

Notes payable may be considered high-risk, depending on the purchase and how much money is involved, which is why an interest charge is normally included on notes payable items. Typical notes payable expenses can include purchasing a building, purchasing business equipment, business loans or lines of credit.

Impact on Working Capital

Accounts payable balances directly impact working capital and play an important role in proper working capital management and day-to-day business operations. Better management of accounts payable can have a positive impact on cash flow.

Notes payable balances can also impact working capital, but only if they’re short-term liabilities, which can be used to estimate current working capital. Long-term liabilities should not be included in working capital estimates.

Can Notes Payable Be Converted to Accounts Payable?

Because of its long-term nature, notes payable should never be converted to accounts payable.

However, it is possible to convert an accounts payable expense to notes payable if necessary. This is usually done if the company needs more time to pay an accounts payable invoice.

For example, Dave owns a small manufacturing company. He recently ordered $5,000 worth of materials for his business, but because of an economic downturn, sales have slowed considerably, leaving him unable to pay the $5,000 invoice.

Dave contacts his supplier and asks if the $5,000 accounts payable item can be converted into a notes payable expense, which will provide specific repayment terms for the $5,000 invoice and allow Dave to make monthly payments rather than paying the entire $5,000 at one time.

The supplier agrees and issues a promissory note to Dave for repayment within a year, with 5% interest.

What Is the Difference Between Notes Payable and Other Long-Term Debt?

The biggest difference between notes payable and other debt is the length of the debt obligation itself.

Though some notes payable expenses are due in less than a year, other notes payable items are considerably longer-term, ranging from twelve months up to thirty years.

This long-term obligation can result in a highly leveraged company that may run into cash flow problems.

While long-term debt can help with cash flow management, since the monthly cash outlay is often less than that for a short-term notes payable expense, it also ties up your money for a significantly longer period.

Excessive long-term debt can also inhibit company growth since the increased debt makes it more difficult to obtain additional loans or make additional outside investments.

How Are Accounts Payable More Complicated Than Notes Payable?

While notes payable uses a formal written agreement or promissory note, managing notes payable is a straightforward task.

However, when managing accounts payable, there are numerous processes that need to be performed regularly to ensure AP accuracy and proper processing.

These tasks include:

Managing Vendors and Suppliers

Depending on your organization, your accounts payable department may be responsible for sourcing and managing vendors and suppliers or it may be handled by the procurement department.

Whether AP or procurement is responsible for managing vendors and suppliers, both finance and procurement departments need to work together to ensure suppliers are managed properly from the very beginning.

Accounts Payable will always play an important role in managing vendor relationships. If you are not paying your suppliers invoices on time they are not going to remain happy to work with you over the longer term.

Invoice Processing

If you’re still using a manual AP system to process AP, your invoice processing time will be much higher than a company using AP Automation software.

Invoice processing requires the completion of the following:

Invoice Delivery

Paper invoices require proper distribution to the correct department but invoices can become lost in the process, delaying processing times considerably. Delivering invoices electronically can save tremendous processing time.

Three-Way Matching

Three-way matching helps authenticate any invoice by matching key totals such as pricing, invoice totals, quantities, and due dates against a corresponding purchase order and shipping receipt.

An automated system completes this time-consuming task for you, saving you both time and labor costs.

Invoice Approvals

Again, if you’re using a manual AP system, your invoice approval processing will be manual as well, which often results in missing invoices and approval delays.

Processing Payments

Issuing paper checks can cause numerous delays, ranging from check fraud to payments lost in the mail. They’re also an added burden during bank reconciliation time, requiring additional work hours to follow up on uncashed checks.

On the other hand, notes payable requires two processes; setting the expense up in the general ledger and timely payments made to the holder of the note.

Both are vital but fairly uncomplicated compared to managing accounts payable processes.

Automation Can Simplify Both Accounts Payable and Notes Payable

Understanding the difference between accounts payable and notes payable is essential to keep your business operations running smoothly.

But handling these two key liabilities can be challenging, particularly if you’re using a manual accounting application.

Using a procure-to-pay application, like PLANERGY, allows you to take charge of the entire process, streamlining time-consuming manual tasks like manual data entry and three-way matching while managing notes payable efficiently.

What’s your goal today?

1. Use PLANERGY to manage purchasing and accounts payable

We’ve helped save billions of dollars for our clients through better spend management, process automation in purchasing and finance, and reducing financial risks. To discover how we can help grow your business:

- Read our case studies, client success stories, and testimonials.

- Visit our Accounts Payable Automation Software page to see how PLANERGY can automate your AP process reducing you the hours of manual processing, stoping erroneous payments, and driving value across your organization.

- Learn about us, and our long history of helping companies just like yours.

2. Download our guide “Preparing Your AP Department For The Future”

Download a free copy of our guide to future proofing your accounts payable department. You’ll also be subscribed to our email newsletter and notified about new articles or if have something interesting to share.3. Learn best practices for purchasing, finance, and more

Browse hundreds of articles, containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.