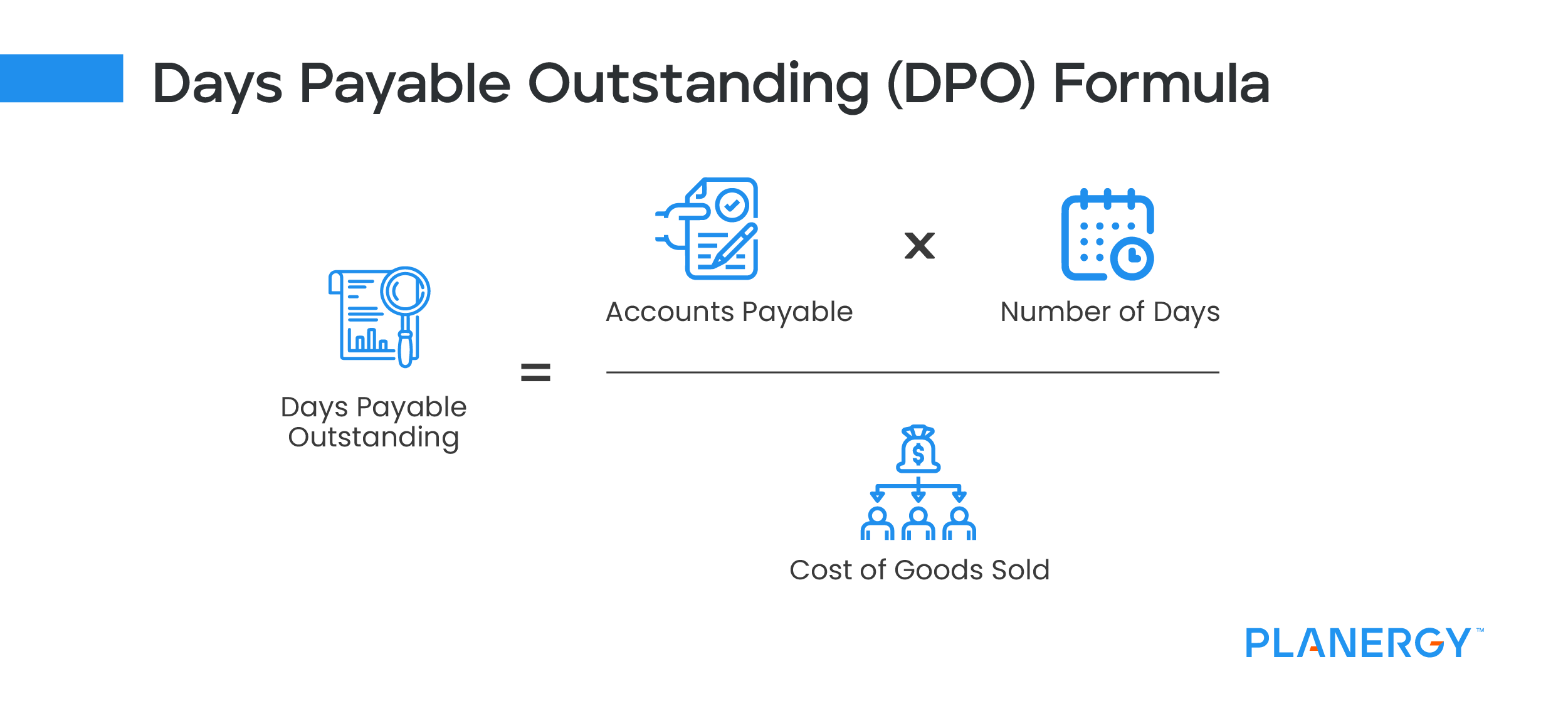

Higher DPO

A higher DPO means that it takes your business more time to pay your bills. A higher DPO can be the result of not having enough cash flow to pay bills faster, but it can also mean that your suppliers and vendors have provided you with more favorable payment terms.

There are numerous advantages to having a higher DPO, with the main advantage having more cash available for short-term investments or to boost working capital.

Investors also tend to look at businesses with a higher DPO more favorably, since it can indicate better cash management.

One significant drawback to a higher DPO is that you’ll miss out on any early payment discounts you may be eligible for.

Of course, waiting too long to pay your vendor and supplier bills can result in late payment fees, and changes in your current payment terms, and may even jeopardize your vendor and supplier relationships.

Though it can be considered a strategic decision to pay bills less frequently, a higher DPO can also be the result of manual AP processing.

If you’re still entering invoice data manually, three-way matching with paper documents, and routing paper invoices to approvers, the odds are good that your higher DPO is because of manual processes, not because you’re proactively managing your cash flow.

If DPO is consistently high because of AP inefficiencies, you may want to consider switching to an AP automation software like PLANERGY, which uses machine learning and AI to automate time-consuming manual processes such as three-way matching and invoice approvals, allowing you to pay bills in a manner that can be beneficial for your suppliers and for your business.

Low DPO

A low DPO means that your business is paying your vendors and suppliers quickly. In some situations, a low DPO can be advantageous, particularly when looking to negotiate payment terms with new suppliers, or if looking to obtain supplier or vendor discounts.

However, a low DPO is viewed unfavorably by investors, who place a higher value on businesses with a more robust cash flow.

Paying your bills too early can also deplete cash flow levels, prohibiting your business from making any short-term investments or using your cash for business growth.

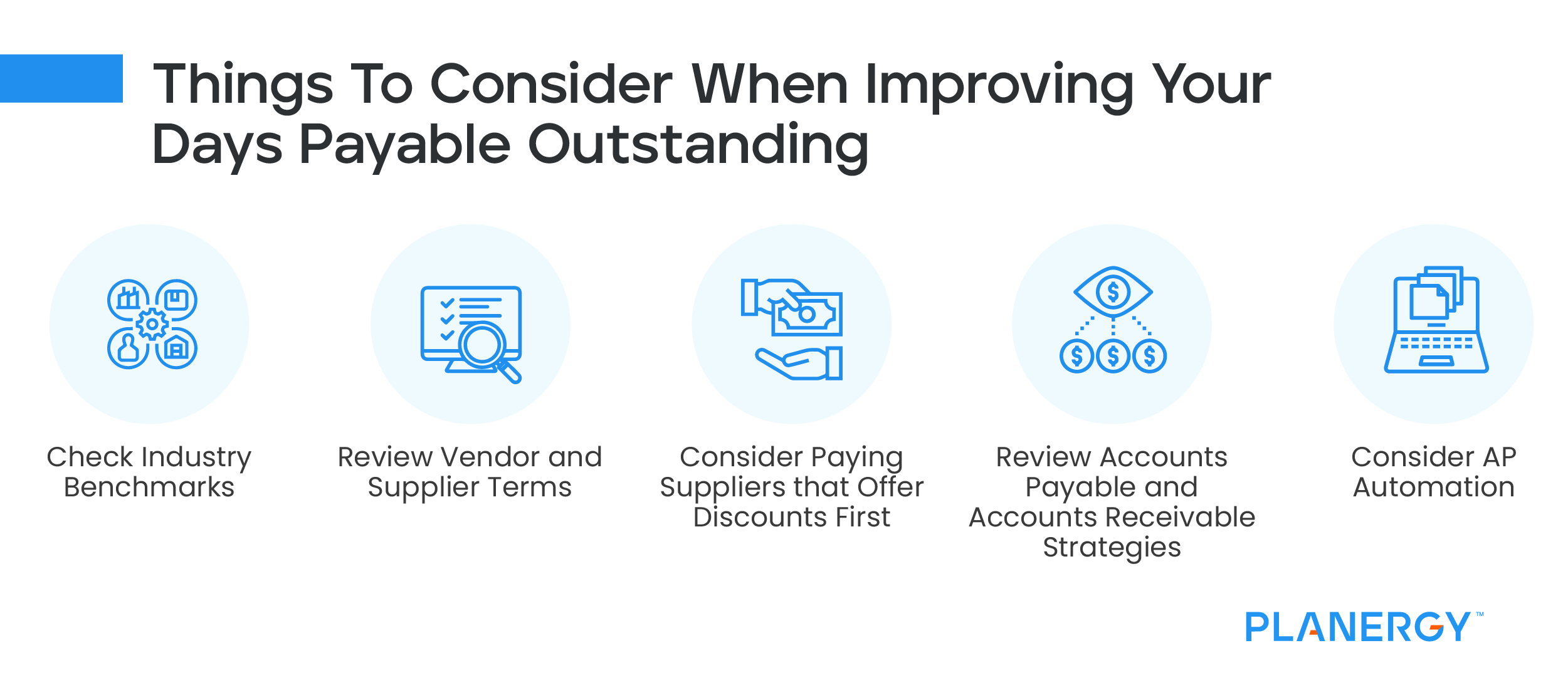

In many cases, it helps to determine payment frequency based on each vendor or supplier while keeping payment terms in mind.

Businesses often will pay some vendors early to take advantage of early payment discounts, while actively working with others to obtain more favorable credit terms which allow them to pay less frequently.

After calculating your DPO, it can also be beneficial to compare your results with that of similar companies. This is because acceptable DPO values can vary widely from industry to industry.

For example, Apple’s DPO as of September 2022 was 97 days, while Walmart’s DPO as of October 2022 was 46, but comparing the DPO of these two very different companies would not be helpful.