A double-entry accounting system that uses both a general journal and a general ledger is the most accurate way to keep track of your business finances.

But to understand the methodology behind a double-entry bookkeeping or accounting system, you must first understand the role that the general journal and the general ledger play in managing your accounting records.

What Is a General Journal?

Every financial transaction completed by your business needs to be adequately recorded.

If you’re using accounting software this process is primarily completed through the software.

However, if you’re still using a manual accounting system, or using Microsoft Excel, you’ll need to record those transactions in a general journal.

General journal transactions are always recorded by date, with columns used to display debits and credits, along with any other details such as invoice numbers, purchase order numbers, and a description of the transaction.

Some businesses keep special journals like a purchase journal or sales journal, while others use one general journal to record their business transactions, which are later posted to the general ledger.

What Is an Example of a General Journal?

A general journal is a ledger that records the date of a transaction, the type of transaction including specific details, and the debit and credit amounts.

Below is an example of what a general journal typically looks like.

In the general journal below, we’re going to record sales and purchases that will need to be later recorded in the general ledger.

| General Ledger | Page 1 | ||

|---|---|---|---|

| Date | Description | Debit | Credit |

| 3/01/2025 | Investment in business | $40,000 | |

| Cash | $40,000 | ||

| 3/01/2025 | Rent Expense | $1,000 | |

| Cash | $1,000 | ||

| 3/04/2025 | Office Supplies | $250 | |

| Cash | $250 | ||

| 3/15/2025 | Accounts Receivable | $4,000 | |

| Revenue | $4,000 | ||

| 3/21/2025 | Utilities Expense | $200 | |

| Cash | $200 | ||

| 3/27/2025 | Cash | $2,000 | |

| Accounts Receivable | $2,000 |

What Is a General Ledger?

The general ledger is considered the central repository for accounting transactions recorded.

The general ledger tracks five account types: assets, liabilities, owner’s equity, revenue, and expenses.

Any transaction that is recorded in a general journal must also be recorded in the general ledger.

Once general journal entries are recorded in the general ledger, the general ledger balances should be transferred to a trial balance report, where account balances can be checked for accuracy.

All general ledger accounts are often called T-accounts because they use a T-shaped table to record transactions.

The account name is recorded on the top of the T, with debits recorded to the left of the T and credits recorded to the right of the T.

What Is an Example of a General Ledger?

You can use T accounts or create entries in a hand-written general ledger which is separated by account.

If using the latest technology, businesses do not have to maintain a general journal or a general ledger separately, since most posting is completed automatically.

However, even when using accounting software there are times when you’ll need to post an entry to your general ledger, which is usually completed by creating the entry on paper as a backup and then processing the entry directly in the software application.

How Do Entries From the General Journal Get Posted to the General Ledger?

All of the transactions posted in the general journal above must be posted to your general ledger.

When posting to each general ledger T-account, you’ll want to make sure that both sides (debit and credit) are posted.

Let’s take a look at how we would post the cash account transactions.

Cash Account

Date Description Debit Credit Balance 3/01/2025 Cash $40,000 $40,000 3/01/2025 Rent Payment $1,000 $39,000 3/04/2025 Office Supplies $250 $38,750 3/21/2025 Utilities $200 $38,550 Rent Expense Account

Date Description Debit Credit Balance 3/01/2025 Rent Payment $1,000 $1,000 Office Supplies Account

Date Description Debit Credit Balance 3/01/2025 Office Supplies $250 $250 Utilities Account

Date Description Debit Credit Balance 3/01/2025 Utilities Expense $200 $200

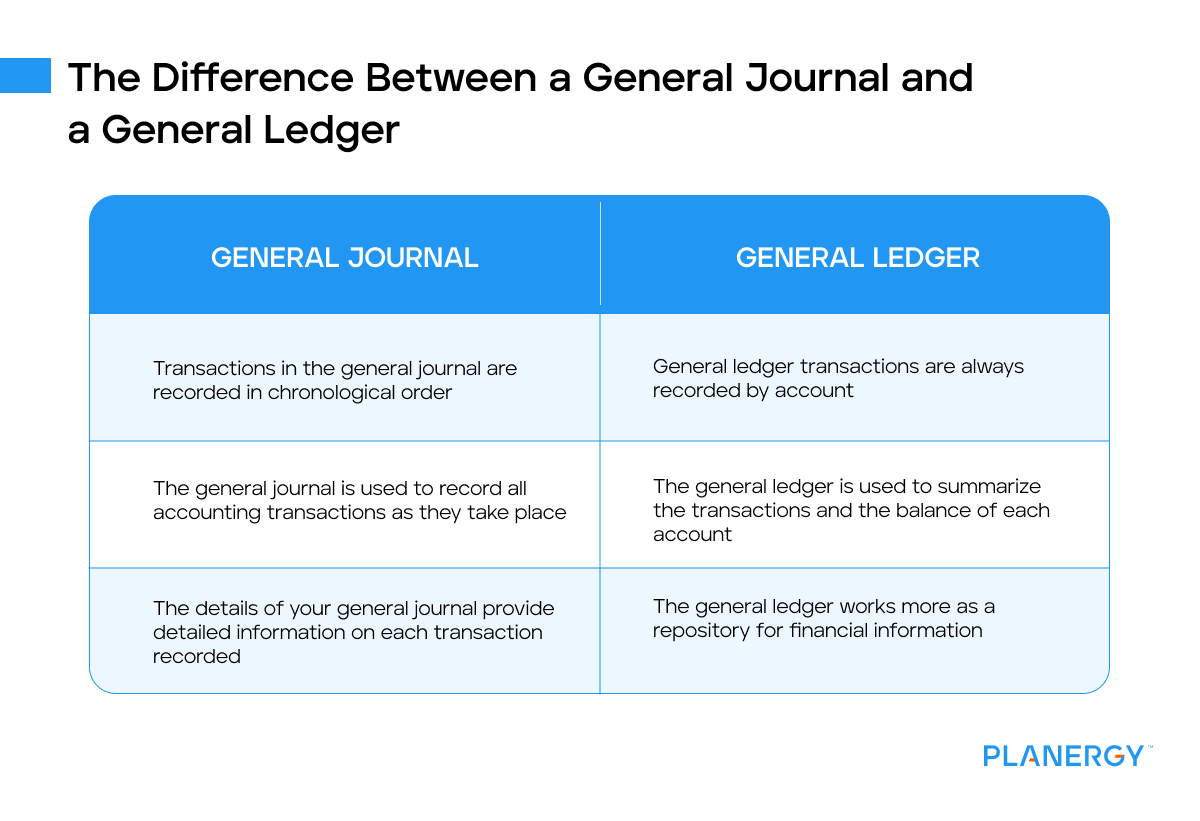

What Is the Difference Between a General Journal and a General Ledger?

A general journal records all financial activity that takes place daily with the transactions posted in date order, while the general ledger is the tool where you post all of the financial transactions to the appropriate account.

By posting to the general ledger you’ll be able to produce the necessary financial statements your business needs such as a balance sheet, trial balance, and income statement.

There are three key differences between a general journal and the general ledger.

Structure of the Journal: Transactions in the general journal are recorded in chronological order, while general ledger transactions are always recorded by account.

Purpose of the journal: The general journal is used to record all accounting transactions as they take place, while the general ledger is used to summarize the transactions and the balance of each account, ensuring accurate financial reporting.

Details Included in the Journal: The details of your general journal provide detailed information on each transaction recorded including a brief description of the transaction, while your general ledger works more as a repository for financial information.

While posting to the general journal is important, it’s equally important to post those transactions into your general ledger, which is keeping a running balance for all account activity for that accounting cycle.

If you have a lot of general journal activity, it may be a good idea to post the general journal entries to the general ledger weekly, while smaller businesses with less activity can post them monthly.

How Do Entries in the General Journal Differ From Those in the General Ledger in Accounting?

Entries in the general journal serve as the basis for all general ledger activity, providing the detail behind the general ledger balances.

For example, if someone wants to see when a customer paid their bill, they could return to the general journal to see when the payment was received.

The general ledger entries provide a summary of all activity that is recorded in the general journal.

For instance, while you can see how much revenue was received from your customers in March, you would have to return to the general journal posting to see which customers paid.

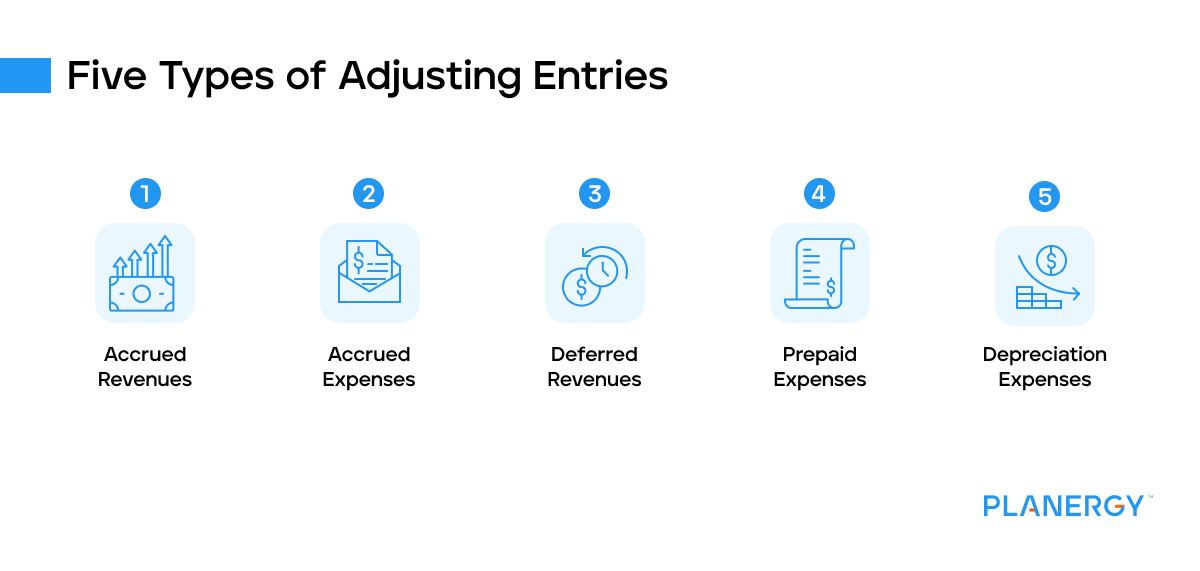

What Is an Adjusting Journal Entry?

An adjusting journal entry is made at the end of an accounting period and is used to record any income or expenses for the period that has not yet been entered into a relevant account during the regular journal entry process.

There are five types of adjusting entries:

Accrued Revenues – Accrued revenues are initially recorded as accounts receivable items but an adjusting entry is made to record them in the revenue account in the same month as the sales.

Accrued Expenses – Accrued expenses are typically any expense that was incurred in the present month but will not be paid until the following month. Many accrued expenses are processed through accounts payable.

Deferred Revenues – Deferred revenue is revenue paid in advance. For example, a client pays you for an entire year’s worth of services in advance.

Prepaid Expenses – Prepaid expenses are when expenses are paid in advance. For instance, you decide to pay your rent a year in advance.

Depreciation Expenses – If you buy large ticket items, you’ll likely expense them over multiple accounting periods rather than in a single accounting period.

Adjusting journal entries are typically made in these areas because the revenue and expenses involved span across multiple accounting periods.

Even if you’re using an automated accounting software application, for your financial statements to be accurate, you will need to complete adjusting entries.

For example, while the majority of your expenses have been recorded automatically by entering invoices and payments into your accounting software application, things like payroll accruals will need to be entered as an adjusting entry.

Let’s say your work week ends on March 31, but your employees will not be paid until April 7.

You’ll need to accrue the payroll expense for March otherwise your payroll expenses will be understated for the month.

How Can You Differentiate Between Journal Entries and Adjusting Entries?

An adjusting journal entry is still a journal entry, with the only differentiating factor when the entry is done.

If you’re using accounting software, one way to differentiate between the two types of entries is that you’ll need to write up a journal entry as a backup for the adjusting entry.

This is an important part of the audit process.

If an auditor wants to know why you created a journal entry for accrued expenses, you will have the backup information available on the form, that should be attached to any corresponding documentation.

How the General Journal and General Ledger Are Used With Accounting Software

Because the majority of businesses are using some type of accounting software to record their financial transactions, bookkeepers and accountants today will seldom directly access either the general journal or general ledger.

Instead, the majority of transactions are processed through an accounting software application that utilizes the chart of accounts, automatically recording the entries to the correct journal and general ledger account without any interaction at all on the part of the bookkeeper or accountant.

Regardless of whether your small business is using accounting software or still recording transactions in journals, a good understanding of general journals and the general ledger is essential.

Whether transactions are entered via computer or handwritten, adequate record-keeping is a necessity to maintain accurate financial data and create your company’s financial statements.