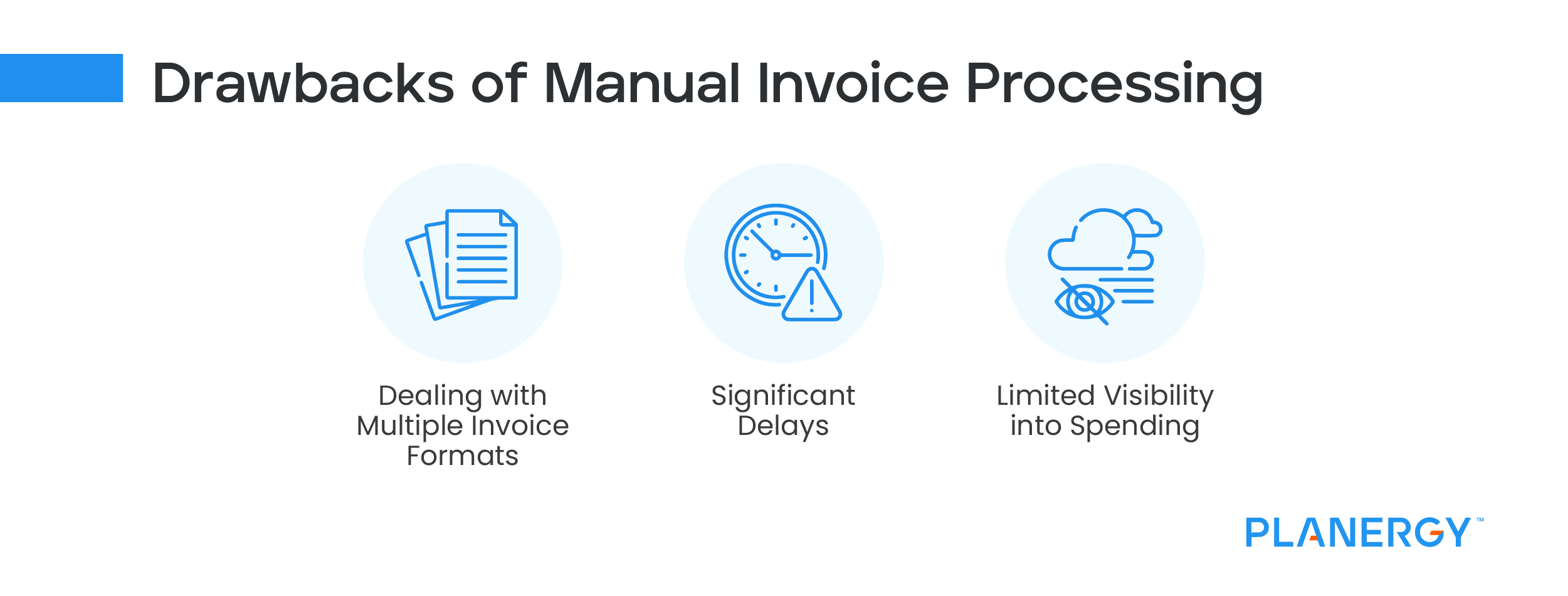

As more businesses begin to understand the importance of accounts payable, the focus has turned to ways to streamline the time-consuming manual processes that have historically bogged down AP systems.

While paper-based business processes have been in place for decades, many businesses have begun to make the switch to a more automated, paperless AP management system that can provide value to both the business and its suppliers.

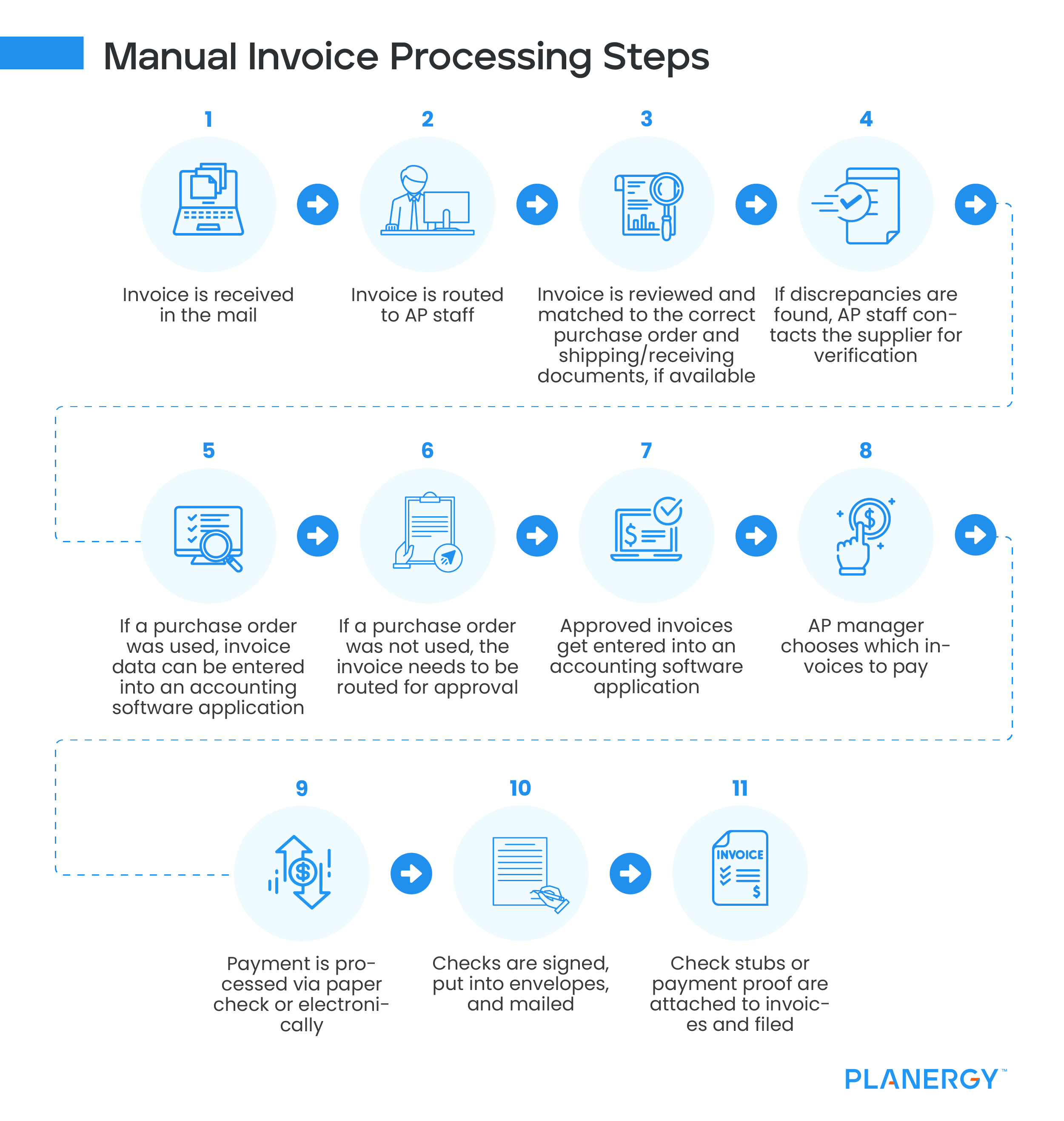

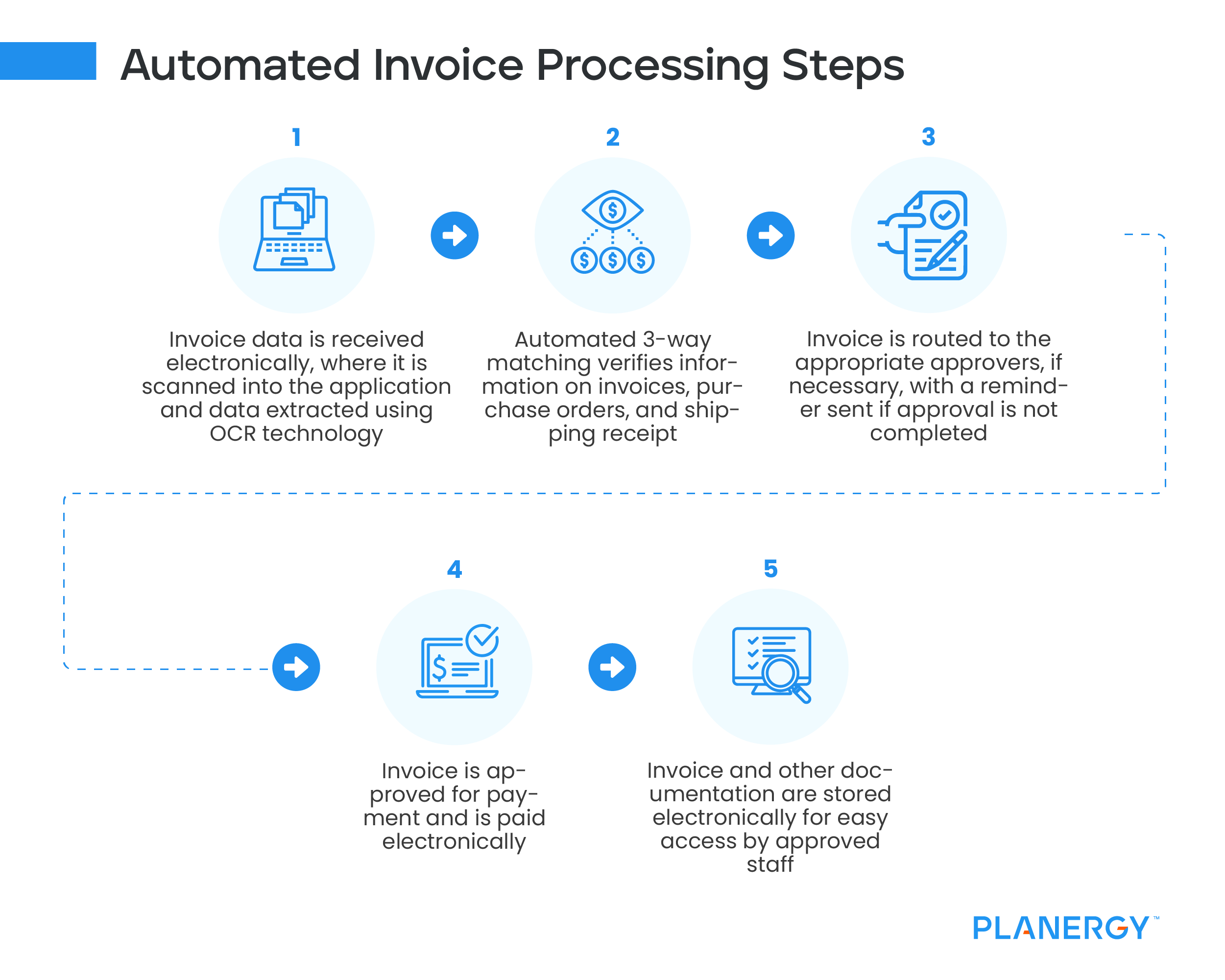

Generally, the manual AP process includes a minimum of eleven steps, with some businesses finding even more steps needed. The good news is that those eleven steps are cut to less than half when using an automated invoice process, completing the workflow process up to 81% faster.