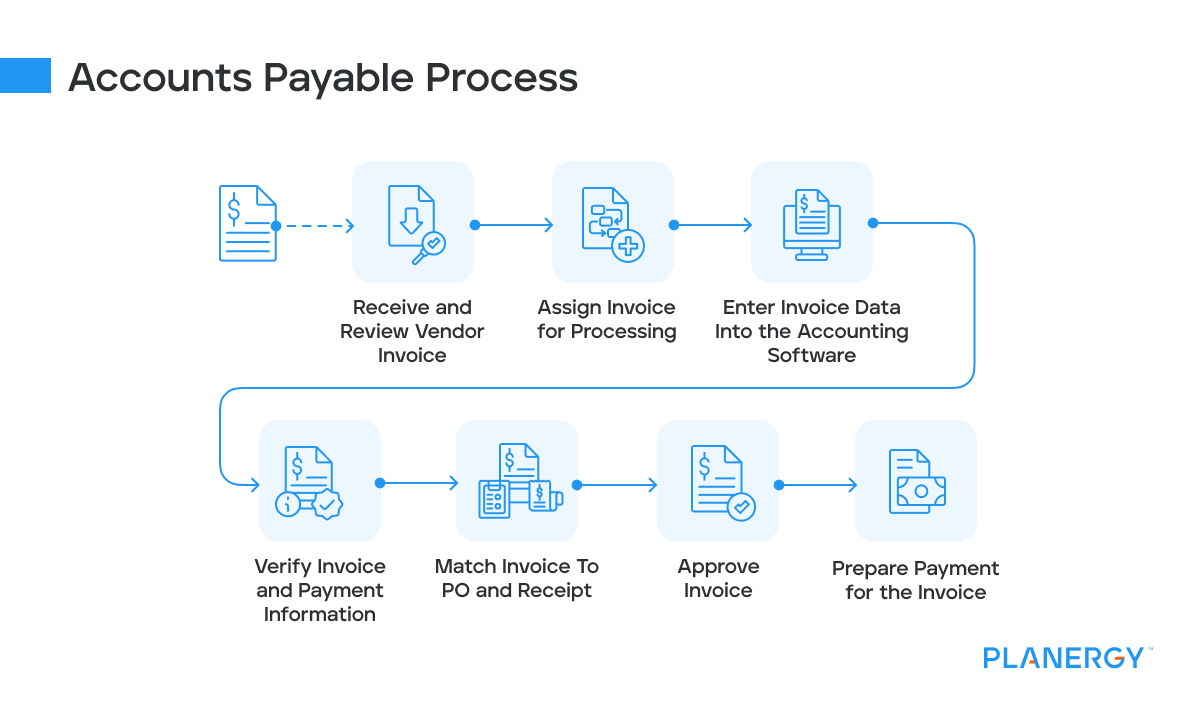

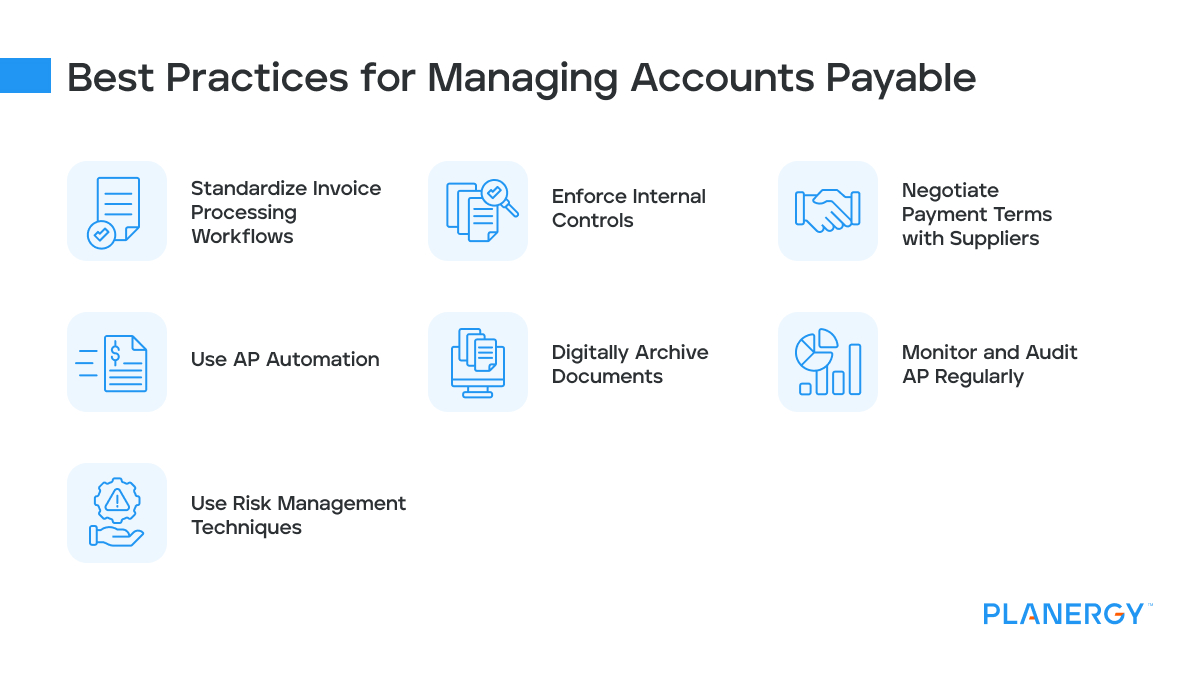

Standardize Invoice Processing

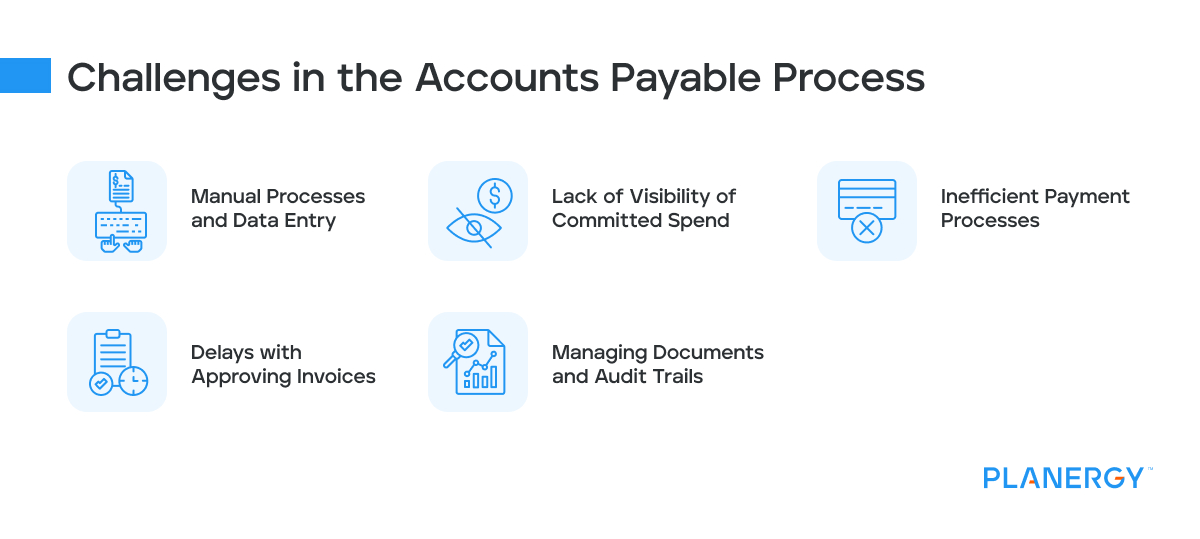

No one is perfect, and there will be occasional mistakes, especially if you still use manual processes and your vendor is the same.

You may be accidentally billed for more office supplies than you received or for a longer period of time than your contract indicates. Duplicate invoices are common. It is often not fraud but just a manual error by the staff at your supplier.

Creating a standard process for how invoices are handled following best practices ensures that information stays consistent across the board. This consistency makes it easier to spot errors during invoice processing, and allows for faster validation.

Enforce Internal Controls

A clear accounts payable policy should be defined with relevant internal controls for accounts payable and invoice processing. Compliance can be enforced more easily with dedicated software.

This should include a set of procedures for invoice approval, incorporating segregation of duties, and a workflow that sends the invoices to the appropriate department, person, or team, such as the CFO, help to streamline the process.

Automation can route invoices to the appropriate team member, and PLANERGY allows “Out of Office” settings that allow another user to temporarily step in with the same user permissions to keep things running smoothly while someone is on vacation or out on leave.

Negotiate Payment Terms with Suppliers

To maximize your cash flow, your procurement team should negotiate more favorable pricing and payment terms with suppliers whenever possible.

If you can take advantage of an early payment discount, that’s great, but the goal is to keep cash flow positive while having all of your bills paid on time to avoid late fees or penalties.

Use AP Automation

Automated processes can reduce the time, effort, and cost associated with manual data entry by streamlining invoice management.

This increases accuracy and reduces errors. Automation also eliminates manual tasks such as matching invoices to orders and purchase orders, which can save significant time and resources.

Automation also improves the efficiency of accounts payable departments by updating payment terms with suppliers quickly and accurately.

This can result in early payment discounts or other incentives that benefit the company’s bottom line.

By reducing the risk of human error, automated accounting processes help ensure compliance with applicable laws and regulations. It can also help ensure you can track and improve on established KPIs.

Digitally Archive Documents

Creating digital copies of your invoices and credit notes is important for accurate accounting. By automatically creating digital copies, you can effortlessly store them in a central repository for easy access.

This reduces the chances of misplacing important documents, so you always have an up-to-date record of your transactions.

Keeping supplier contracts in a central repository also keeps them readily available for review if any issues arise during the relationship.

Having all contracts stored in one place makes it easier to stay on top of legal requirements and ensure compliance.

Monitor and Audit AP Regularly

Keeping an eye on things ensures both you and your vendors comply with all the clauses in the contract. It also helps ensure you comply with reporting requirements, tax regulations, and other relevant industry standards.

Implementing an accounts payable audit program to regularly review your internal processes will ensure compliance and performance does not slip.

Accounts payable audit procedures are often overlooked but are important to maintain any improvements are built on.

Use Risk Management Techniques

To further reduce the issues between you and your vendors, conduct a risk assessment and integrate risk management techniques, like proactive risk management.

This can be done by establishing a threshold of acceptable levels of risk per contract and proactively monitoring those contracts on an ongoing basis.

This can help identify issues early on, with the ability to take action before any major compliance problems arise.

Additionally, integrating digital and automated processes for supplier management will help streamline the process and increase visibility.